RGTI Stock Tumbles: What Investors Need to Know Amid Morning Sell-Off

Rigetti Computing, Inc. (ticker: RGTI) is facing significant selling pressure in early trading today, with its stock price taking a steep dive shortly after the market opened. As of 10:31 AM EDT, the quantum computing company’s stock is trading at **0.75, representing a -4.41% loss for the session.

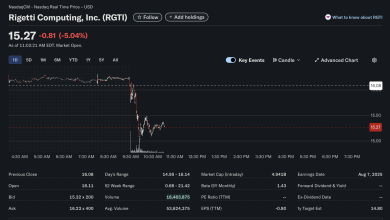

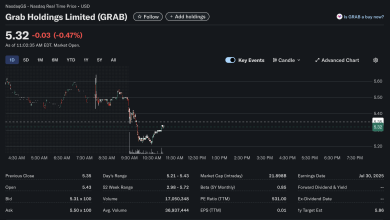

The intraday chart illustrates a dramatic turn for the stock, which gapped down at the open and immediately entered a steep decline. After closing the previous day at $17.14, RGTI opened lower at $16.71 and continued to fall, establishing a day’s low of $16.36. The sustained downward momentum suggests a strong bearish sentiment among investors this morning.

Today’s Stock Performance: A Closer Look

A review of the key financial data paints a challenging picture for Rigetti today:

-

Sharp Decline: The most prominent feature is the stock’s plunge right at the 9:30 AM market open, indicating a wave of sell orders hitting the market.

-

Valuation Concerns: The company’s Earnings Per Share (EPS) over the trailing twelve months (TTM) is negative at -$0.80, and it does not have a Price-to-Earnings (P/E) ratio, which typically indicates the company is not currently profitable.

-

Analyst Outlook: The 1-year analyst target estimate is $14.80. This is notably below the current trading price, suggesting that some analysts believe the stock has further to fall to reach what they consider fair value.

-

Volatility: With a Beta of 1.51, RGTI is inherently more volatile than the broader market, and today’s sharp price movement is a clear example of this higher-risk profile.

Should You Buy or Sell RGTI Stock Today?

Given the current market action, investors are faced with a critical decision. The analysis below weighs the potential risks and opportunities.

The Bearish Case (Why to Sell or Avoid):

The evidence for a bearish stance is strong. The stock is experiencing a significant intraday sell-off on substantial volume. The negative EPS highlights a lack of current profitability, a key concern for many investors. Furthermore, the analyst target price of $14.80 being below the current price is a significant red flag, suggesting potential for further downside.

The Bullish Case (Why to Consider Buying):

A contrarian investor might view this steep drop as a potential “buy the dip” opportunity. Rigetti operates in the high-growth, futuristic field of quantum computing. The stock’s 52-week range of $0.66 – $21.42 shows it is capable of massive price swings. Buyers today would be betting that this is a short-term overreaction and that the company’s long-term potential remains intact.

Our Opinion

Rigetti Computing (RGTI) is clearly in the grip of bearish sentiment today. The combination of a sharp technical breakdown on the chart, weak fundamental metrics like negative profitability, and a bearish analyst price target creates a high-risk environment for potential buyers.

Attempting to “catch a falling knife” is a notoriously risky strategy. The downward momentum is strong, and there is no clear sign of a bottom forming yet. Investors should exercise extreme caution. It may be prudent to wait for the price to show signs of stabilizing or establishing a new support level before considering a position. The current data strongly favors a cautious or bearish approach in the short term.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. You should consult with a professional financial advisor before making any investment decisions.

Frequently Asked Questions (FAQs)

Q1: Why is RGTI stock down so much today?

A: While the specific news catalyst is not shown in the data, the stock chart reveals a significant and immediate sell-off at the market open, indicating strong negative sentiment among investors today.

Q2: Is Rigetti Computing a profitable company?

A: Based on the provided data, Rigetti is not currently profitable. It has a negative EPS of -$0.80 and no P/E ratio.

Q3: What is the 1-year analyst price target for RGTI stock?

A: The 1-year target estimate for RGTI is $14.80, which is below its current trading price, suggesting analysts may see further downside.

Q4: What was the previous closing price for RGTI?

A: The previous closing price for Rigetti Computing stock was $17.14.