Markets

Renaissance Holdings Ltd: Market Performance, Financial Insights, and Broader Perspectives

Possible Subtitles / Sections:

- Introduction to Renaissance Holdings Ltd

- History and business overview

- Role in the global reinsurance and insurance market

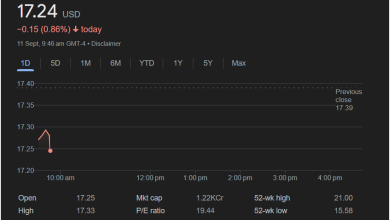

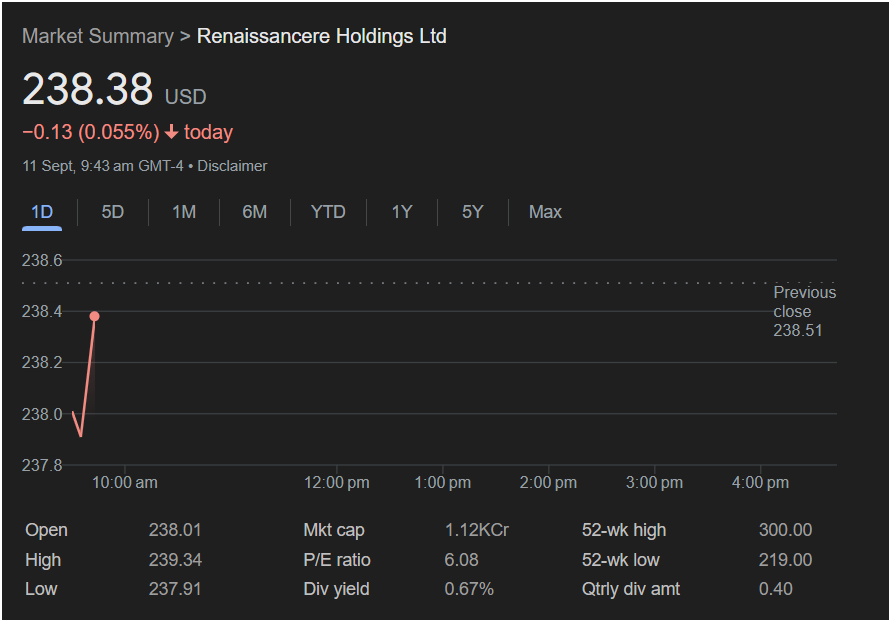

- Stock Market Performance

- Latest price movements (as shown in the screenshot)

- Daily highs, lows, and opening numbers

- Comparison with previous close

- Financial Metrics Overview

- Market capitalization explained

- P/E ratio meaning and significance

- Dividend yield and quarterly dividend insights

- 52-Week Range Analysis

- Highs and lows in the past year

- Investor sentiment across different time frames

- Industry Landscape

- Insurance and reinsurance sector trends

- Global economic pressures affecting the industry

- Regulatory environment

- Investor Behavior and Psychology

- Short-term vs. long-term strategies

- Institutional investors vs. retail investors

- Volatility factors

- Macroeconomic Influences

- Interest rates and their impact

- Inflation trends

- Global risk events and natural disasters affecting reinsurance

- Competitor Analysis

- Other major players in reinsurance

- Comparative valuations

- Strategic advantages of Renaissance Holdings

- Technological Transformation in Insurance

- AI and data analytics in underwriting

- Risk modeling and predictive analysis

- Cybersecurity insurance trends

- Global Outlook

- Emerging markets and growth opportunities

- Climate change and catastrophe modeling

- Future of reinsurance

- Open-Ended Reflection

- Ongoing uncertainties

- Potential directions without concluding definitively