रायपुर: मिशन 2023 के लिए लगातार चल रहे बैठकों के दौर के बीच खैरागढ़ में मिली हार ने भाजपा आलाकमान को चिंता में डाल दिया है। भाजपा हाईकमान ने प्रदेश संगठन के बड़े नेताओं को दिल्ली तलब किया है। पूर्व सीएम डॉ. रमन सिंह के साथ चार प्रमुख नेता दिल्ली जा रहा हैं, जहां राष्ट्रीय अध्यक्ष जेपी नड्डा समेत अन्य नेताओं के साथ बैठक हो सकती है।

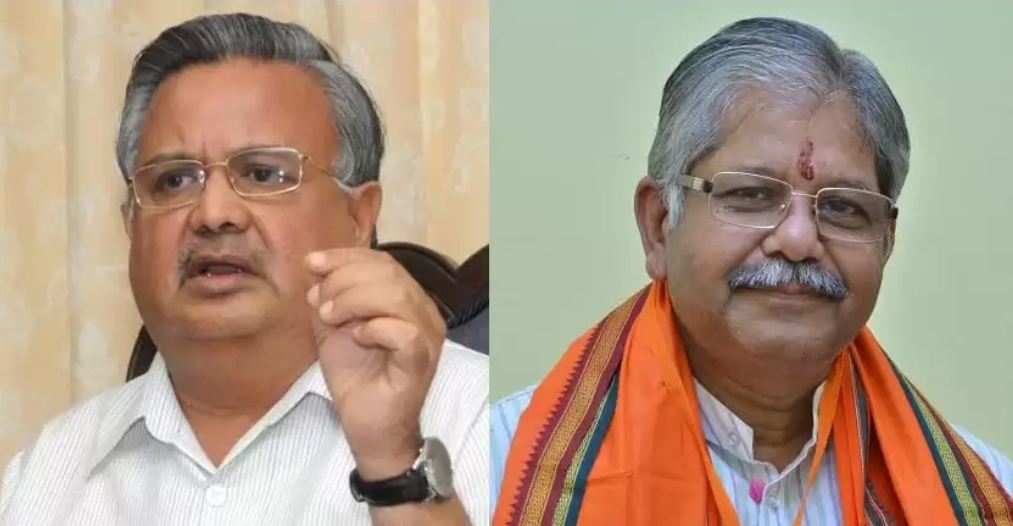

डेढ़ साल बाद होने वाले विधानसभा चुनाव के लिए पार्टी की दशा और दिशा को सुधारने के लिए पूर्व सीएम डॉ. रमन सिंह के साथ नेता प्रतिपक्ष धरमलाल कौशिक, प्रदेश अध्यक्ष विष्णुदेव साय और महामंत्री (संगठन) पवन साय को दिल्ली तलब किया गया है। इन नेताओं की राष्ट्रीय अध्यक्ष जेपी नड्डा और महामंत्री (संगठन) शिवप्रकाश के साथ उनकी बैठक हो सकती है।

कहा जा रहा है कि प्रदेश की प्रभारी डी पुरंदेश्वरी और सह प्रभारी नितिन नबीन ने पहले अपनी रिपोर्ट दी थी, जिसमें संगठन में बड़े पैमाने पर बदलाव की जरूरत पर बल दिया था। उन्होंने बस्तर, सरगुजा संभाग के दौरे के बाद यह पाया था कि ज्यादातर जिलों में कामकाज नहीं के बराबर है। संगठन की गतिविधियां ठप पड़ गई है।

सूत्रों के मुताबिक, राष्ट्रीय महामंत्री (संगठन) शिवप्रकाश ने भी इस पूरे विषय पर चिंता जताई थी। इन सबके चलते पार्टी हाईकमान बैठक बुलाने को मजबूर हो गया है। चर्चा है कि बैठक में आगामी विधानसभा चुनावों को लेकर रोड मैप तैयार किया जा सकता है।

साथ ही संगठन में आमूलचूल परिवर्तन पर भी चर्चा हो सकती है। यही नहीं, कुछ बड़े नेताओं के कार्यक्रम भी तय किए जा सकते हैं। विशेषकर बस्तर और सरगुजा संभाग को फोकस किया जाएगा।