Intuit Stock Eyes 52-Week High: Can Bulls Break Through on Monday

Intuit stock (NASDAQ: INTU) closed Friday’s session with a solid gain, positioning the financial software giant just shy of its 52-week high. However, after an early rally, the stock’s momentum stalled, leaving traders to question whether it has the strength for a breakout or if it’s poised for a pullback. This analysis will delve into the critical data from the recent session to provide an outlook on whether the stock will go up or down on Monday.

A Strong Day with a Midday Jolt

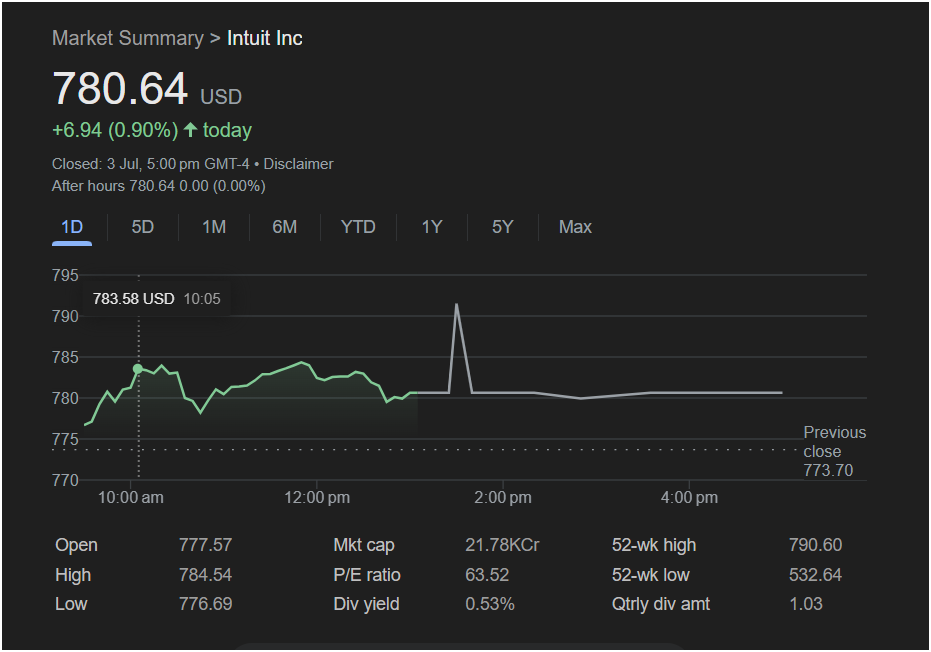

Intuit Inc. had a positive trading day on Friday, July 3rd, but the intraday chart reveals a more complex story than the closing price suggests. Here’s a summary of the day’s performance:

-

Closing Price: 780.64 USD

-

Day’s Gain: +6.94 (+0.90%)

-

After-Hours Trading: Flat at 780.64, indicating a pause in buying or selling pressure.

The stock opened at 777.57, gapping up from the previous close of 773.70. It rallied through the morning to reach its official high for the day at 784.54. The trading day was marked by a peculiar and extremely sharp spike around 1:30 PM, which was immediately erased, suggesting a moment of high volatility or a potential data anomaly. Following this, the stock entered a tight consolidation phase, trading sideways around the $780 level for the entire afternoon before closing.

The stock opened at 777.57, gapping up from the previous close of 773.70. It rallied through the morning to reach its official high for the day at 784.54. The trading day was marked by a peculiar and extremely sharp spike around 1:30 PM, which was immediately erased, suggesting a moment of high volatility or a potential data anomaly. Following this, the stock entered a tight consolidation phase, trading sideways around the $780 level for the entire afternoon before closing.

Key Trading Data at a Glance

To make an informed decision, traders must analyze all the key metrics. Here are the vital statistics from Friday’s session:

-

Day’s Range: A low of 776.69 to a high of 784.54.

-

52-Week Range: The stock is trading at the very top of its 52-week range of 532.64 to 790.60.

-

Valuation (P/E Ratio): A high 63.52. This lofty Price-to-Earnings ratio signifies strong investor expectations for future growth, but also suggests the stock is trading at a premium.

-

Market Cap: 21.78KCr.

-

Dividend Yield: 0.53%, reflecting its status as a growth-focused, rather than income-focused, stock.

Market Outlook: Will the Stock Go Up or Down on Monday?

The data presents a classic battle between bullish momentum and formidable resistance.

The Bullish Case (Potential for an Upward Move):

The primary bullish argument is the stock’s proximity to its 52-week high of 790.60. A strong, high-volume break above this level could trigger stop-loss orders from short-sellers and attract a wave of momentum buyers, potentially leading to a significant new rally. The stock’s ability to hold its gains in the afternoon, even if sideways, shows underlying support.

The Cautious Case (Potential for a Downward Move):

The biggest hurdles are resistance and valuation. The 52-week high is a major psychological and technical barrier where sellers and profit-takers often emerge. The fact that momentum stalled in the afternoon and was flat after hours could indicate that buying power is waning as it approaches this key level. Furthermore, the high P/E ratio of 63.52 makes the stock vulnerable. If it fails to break out, the premium valuation could lead to a sharp pullback.

Is It Right to Invest Today?

Your trading strategy will determine the best course of action.

-

For Momentum Traders: This is a key stock to watch. The situation is binary: a breakout or a rejection. A potential entry would be on a confirmed, high-volume move above the 52-week high of 790.60. Entering before that confirmation is a high-risk proposition.

-

For Cautious or Value Investors: The current price is not an attractive entry point. The high valuation and position at a major resistance level signal significant risk. It would be more prudent to wait for a substantial pullback to a lower support level before considering an investment.

In summary, Intuit stock is at a critical inflection point. It has the momentum to challenge its all-time high, but faces significant resistance and carries a premium valuation. Monday’s opening session will be crucial in revealing whether the bulls have the conviction to push through or if the sellers will defend the peak.

Disclaimer: This article is for informational purposes only and is based on the provided image data. It does not constitute financial advice. All investing involves risk, and you should conduct your own research or consult with a qualified professional before making any investment decisions.