AMD Stock Analysis: Sharp Reversal Hits AMD, Is More Downside Coming Monday

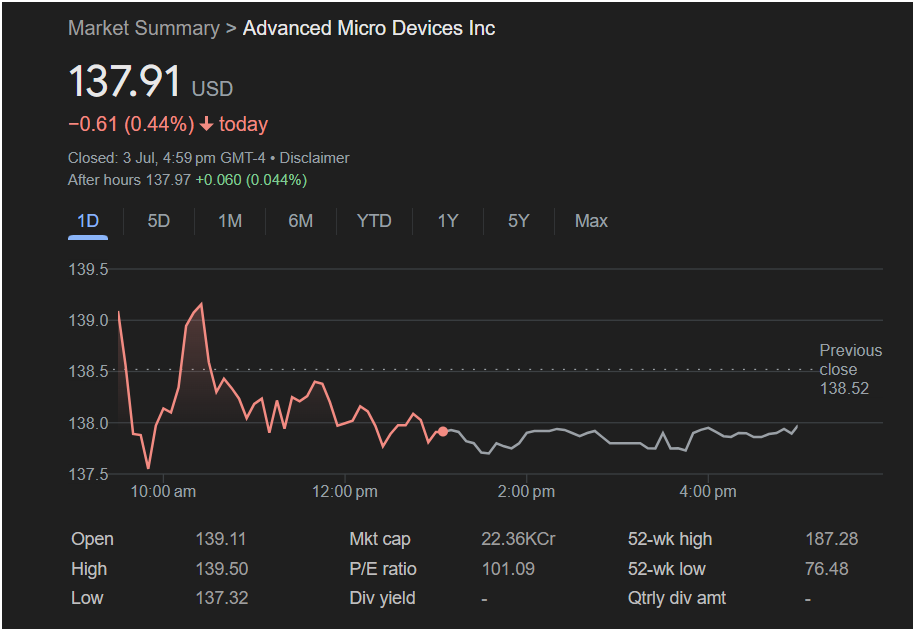

Advanced Micro Devices Inc (AMD) stock experienced a turbulent trading session on Wednesday, ultimately closing in the red after a promising start. The sharp reversal has left traders on edge, closely watching critical support levels to gauge whether the semiconductor giant will continue its slide or find its footing next week.

Today’s Market Performance: A Failed Morning Rally

AMD stock closed the official trading day at

0.61, or 0.44%. While the final numbers seem modest, the intraday price action tells a more dramatic story of a failed rally.

The 1-day chart shows a classic “gap and fade” pattern:

-

Bullish Open: The stock gapped up at the open to $139.11, well above the previous close of

139.50**.

-

Sharp Reversal: This initial strength was short-lived. Sellers stepped in aggressively at the highs, triggering a steep sell-off that sent the stock tumbling to its session low of $137.32 before 10:00 AM.

-

Afternoon Stalemate: For the rest of the day, the stock entered a period of low-volatility consolidation, trading sideways in a narrow range and failing to reclaim any significant ground. It closed near the lower end of its daily range, a sign of weakness.

A negligible gain in after-hours trading to $137.97 does little to change the bearish sentiment of the session.

Key Data for Traders

When planning a trade in AMD, these metrics are crucial:

-

Previous Close: $138.52

-

Day’s Range: $137.32 (Low) to $139.50 (High)

-

P/E Ratio: 101.09

-

52-Week Range: $76.48 – $187.28

The most glaring data point is the sky-high P/E ratio of 101.09. This indicates that the stock is trading at a very high valuation, making it susceptible to sharp pullbacks on any sign of weakness, which is exactly what happened today.

Outlook for the Next Trading Day (Monday)

The technical setup provides a clear line in the sand for traders.

The Bearish Case:

The momentum is decidedly negative. The failure to hold the opening gap up and the subsequent close near the lows are strong bearish signals. The most important level to watch is the day’s low of $137.32. If AMD breaks below this support level on Monday, it could trigger further stop-loss orders and accelerate the move to the downside.

The Bullish Case:

The only silver lining for bulls is that the stock did find support at

138.52** (previous close) level would be the first sign that the sell-off is exhausted.

Is It Right to Invest Today?

Given the sharp reversal and high valuation, extreme caution is advised.

-

For Short-Term Traders: The current outlook is bearish. Buying at this level would be akin to catching a falling knife. A safer strategy would be to wait for a clear signal. A break below $137.32 could be a cue for a short position. A potential long trade would only be viable after the stock shows a definitive reversal by reclaiming a key level like $138.52.

-

For Long-Term Investors: A single-day drop is less of a concern, but the high P/E ratio cannot be ignored. While AMD is a leader in a high-growth sector, its current valuation carries significant risk. This pullback might be a small discount, but investors should be prepared for more volatility.

In conclusion, AMD stock is in a precarious position. Its immediate future hinges on whether it can hold the $137.32 support level. Traders should watch this price point like a hawk at the market open on Monday, as it will likely dictate the stock’s direction for the day.

Disclaimer: This article is for informational purposes only and is based on the analysis of the provided image. It does not constitute financial advice. All trading and investment decisions should be made based on your own research and consultation with a qualified financial advisor.