Linde Stock Falters in Choppy Trading: A Warning Sign for Monday

Linde PLC (LIN) finished the last trading session in the red after a day of significant volatility and a clear lack of bullish conviction. The stock’s inability to find a clear direction, coupled with a drift lower in after-hours trading, has put traders on high alert. The upcoming market open will be crucial in determining whether this weakness is a temporary blip or the start of a more significant pullback.

Friday’s Trading Session: A Detailed Breakdown

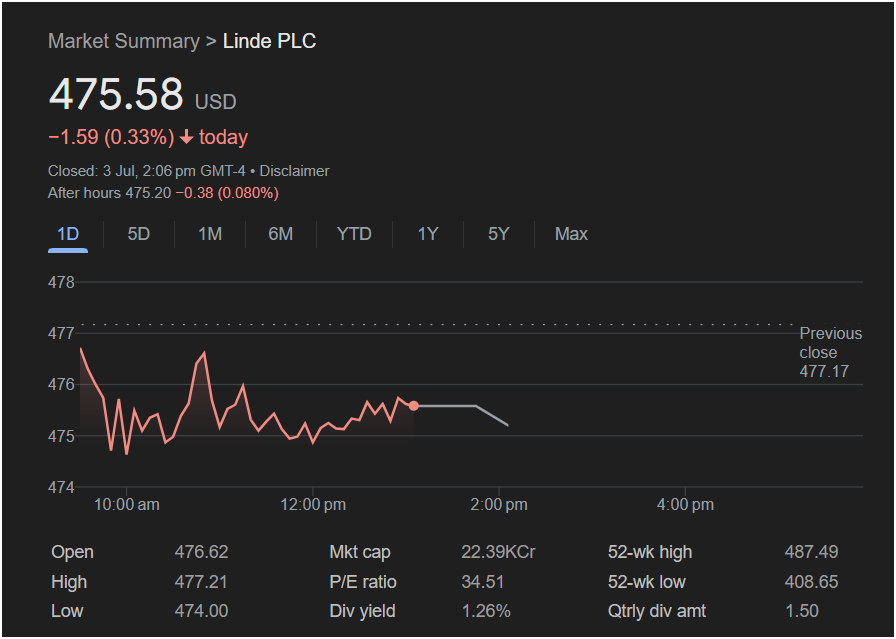

Linde’s stock performance on Friday, July 3rd, was characterized by erratic price swings within a defined range, ultimately resolving to the downside. Here’s a look at the key data:

-

Closing Price:

1.59 (-0.33%).

-

After-Hours Trading: The stock continued its slide, falling to $475.20, reinforcing the bearish sentiment.

-

Day’s Range: After opening at

474.00** and a high of $477.21.

The intraday chart tells a story of struggle. The stock opened below the previous close of $477.17 and, after a brief attempt to rally, failed to hold any gains. It quickly fell to the day’s low of $474.00. The remainder of the session was a choppy, back-and-forth battle with no clear winner, though the stock remained under pressure and was trending down at the early 2:06 PM close. This type of price action often suggests distribution (selling) and a lack of buying interest at current levels.

Key Takeaways for Traders

1. The Defined Trading Range is Key:

Friday’s session has clearly defined the critical levels for the short term.

-

Firm Resistance: The area around $477.20 (the day’s high and previous close) has been established as a solid ceiling. The stock’s failure to reclaim this level is a significant sign of weakness.

-

Critical Support: The day’s low of $474.00 is now the most important support level. A break below this floor would signal that sellers have taken firm control.

2. Premium Valuation Under Scrutiny:

-

P/E Ratio: At 34.51, Linde trades at a relatively high P/E ratio for an industrial gas company. This premium valuation suggests investors have high expectations for growth. When the price action turns negative, a high P/E can make a stock more vulnerable to a sharper sell-off as investors reassess those growth prospects.

-

52-Week High: The stock is trading below its 52-week high of $487.49, indicating it is not in a strong breakout mode.

Market Outlook: Will Linde Stock Go Up or Down on Monday?

Given the negative close, bearish after-hours drift, and choppy price action, the immediate outlook for Linde stock leans bearish.

The Bearish Case (Likely Scenario):

The path of least resistance appears to be downward. The primary signal to watch for is a break of the $474.00 support level. If the stock opens weak and moves below this price, it could trigger further selling and accelerate the decline. The lack of buying pressure on Friday suggests there may be few buyers ready to step in and defend the price.

The Bullish Case:

For the bulls to turn the tide, they would need to mount a powerful rally and reclaim the resistance level at $477.20. A decisive move above this area on strong volume would be necessary to negate Friday’s weakness and suggest that the selling was just temporary profit-taking. This appears to be the less likely scenario based on the current chart.

Is It Right to Invest Today?

The volatile and bearish price action calls for a cautious approach.

-

For the Day Trader: The range between

477 (resistance) is the immediate sandbox. Given the choppiness, trading within this range is risky. A clearer opportunity would be to trade a confirmed break below $474 or a strong reclaim of $477.

-

For the Swing Trader: The current chart is flashing warning signs. It would be prudent to wait for a clearer trend to emerge. Entering a long position here is fighting the immediate momentum.

-

For the Long-Term Investor: Linde is a high-quality, blue-chip industrial leader. A short-term pullback is of less concern and could even offer a more attractive entry point for those with a long-term bullish outlook on the company’s role in the global economy.

In conclusion, Linde stock is in a precarious position. The inability to hold support and the volatile trading on Friday are red flags for the short term. The market’s reaction to the $474.00 support level at Monday’s open will be the most critical indicator of the stock’s direction for the week ahead.

Disclaimer: This article is for informational purposes only and is not financial advice. All trading and investment decisions should be made with the consultation of a qualified financial professional and after conducting your own research.