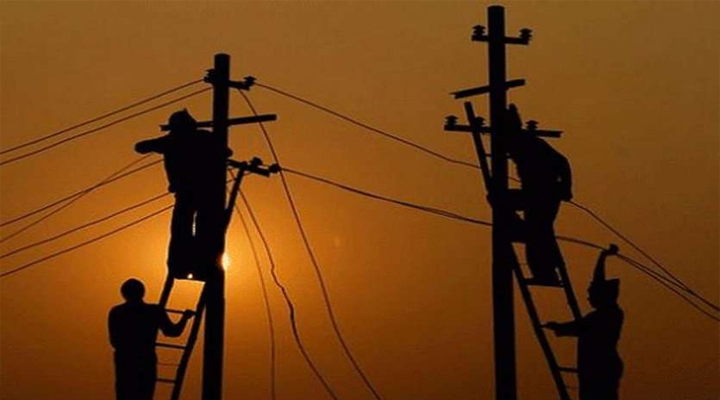

हाई वोल्टेज लाइन पर अचानक आई करंट… खंबे पर काम कर रहे कर्मचारी की दर्दनाक मौत…

लखीमपुर खीरी: उत्तर प्रदेश के लखीमपुर खीरी में हाई वोल्टेज की लाइन को सही कर रहे एक संविदा कर्मचारी की अचानक बिजली आने से तार में ही चिपक कर दर्दनाक मौत हो गई. देखते ही देखते संविदा कर्मचारी हरिशंकर खंबे के ऊपर आग का गोला गोला बन गया और कुछ देर में उसकी दर्दनाक मौत हो गई. इस पूरे वाकये का वीडियो पास खड़े एक शख्स ने बना लिया. अब ये वीडियो सोशल मीडिया पर वायरल हो गया है.

मामला लखीमपुर खीरी के मैगलगंज कोतवाली के मुबारकपुर पावर हाउस के पास गांव का है. जहां पर हरिशंकर नाम का एक संविदा कर्मचारी हाई वोल्टेज की लाइन में आई खराबी को सही कर रहा था. अचानक से उस लाइन में करंट आने के चलते हरिशंकर की तार में चिपक कर दर्दनाक मौत हो गई. देखते ही देखते हरिशंकर का शरीर में आग लग गई और हरिशकर का जला हुआ शरीर नीचे गिर पड़ा. हरिशकर की खम्बे के ऊपर ही दर्दनाक मौत हो गई.

बिजली विभाग की लापरवाही आई सामने

कहीं ना कहीं विद्युत विभाग की एक बड़ी लापरवाही सामने आई है. शट डाउन लेने के बाद संविदा कर्मचारी हरिशंकर हाई वोल्टेज लाइन में आई खराबी को सही करने के लिए खंभे पर चढ़ा था लेकिन उसमें शटडाउन के बावजूद हाई वोल्टेज का करंट लाइन उतारना बिजली विभाग की बड़ी लापरवाही सामने आई है. बिजली विभाग की लापरवाही के चलते कर्मचारी हरिशंकर की दर्दनाक मौत हो गई. मृतक संविदा कर्मचारी हरिशंकर के परिजनों की मांग है कि दोषियों के खिलाफ कड़ी से कड़ी कार्रवाई होनी चाहिए.