Uber Stock at a Critical Juncture: Can Bulls Break the 52-Week High on Monday

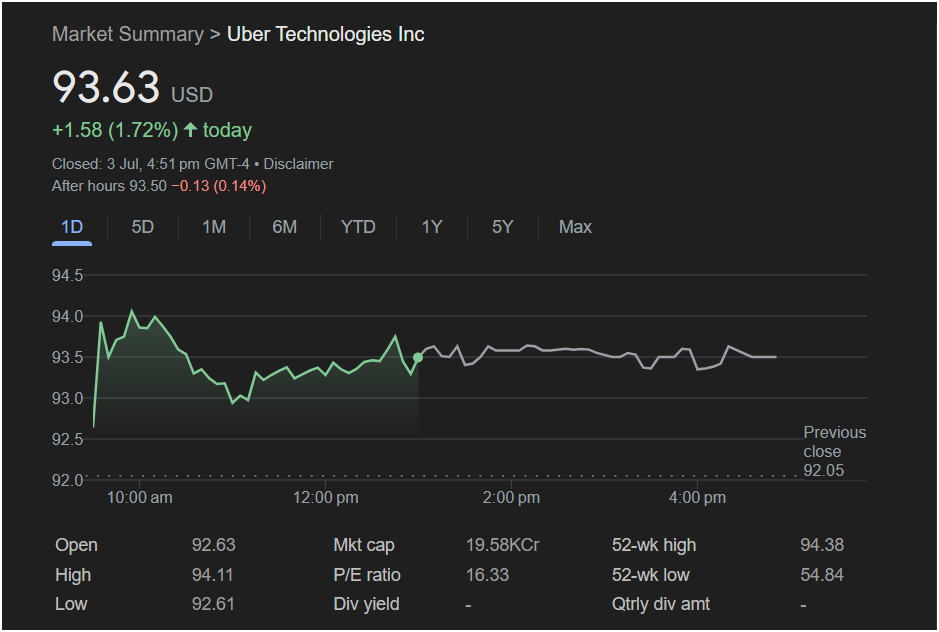

Uber Technologies stock (NYSE: UBER) closed the week with a powerful surge, finishing up over 1.7% and positioning itself directly beneath its 52-week high. This creates a high-stakes scenario for Monday’s open, as traders watch to see if the stock has the momentum for a major breakout or if it will be rejected at this critical resistance level. This analysis will break down the essential data from Friday to help you anticipate the next move.

A Strong Session with Bullish Consolidation

Uber’s trading day on Friday, July 3rd, was a clear victory for the bulls, characterized by an early rally and a healthy consolidation. Here’s a summary of the key performance metrics:

-

Closing Price: 93.63 USD

-

Day’s Gain: +1.58 (+1.72%)

-

After-Hours Trading: A negligible dip of -0.13 (-0.14%) to 93.50.

The stock gapped up at the open from a previous close of 92.05 and immediately rallied to a daily high of 94.11. While it couldn’t sustain this peak, it spent the rest of the day trading sideways in a tight range, holding onto the majority of its gains. This price action is often seen as constructive, indicating that sellers lacked the power to push the price back down.

Key Trading Data at a Glance

Key Trading Data at a Glance

A successful trade requires understanding the full context. Here are the vital statistics from the session that every trader should note:

-

Day’s Range: A low of 92.61 to a high of 94.11.

-

52-Week Range: The stock is knocking on the door of its 52-week high of 94.38.

-

Valuation (P/E Ratio): An exceptionally attractive 16.33. For a major technology and growth company, this low Price-to-Earnings ratio is a standout feature, suggesting the stock may be undervalued relative to its earnings.

-

Market Cap: 19.58KCr.

-

Dividend Yield: None, as is typical for a growth-focused company.

Market Outlook: Will the Stock Go Up or Down on Monday?

The data presents a compelling bullish case, but it’s facing a formidable technical barrier.

The Bullish Case (Potential for an Upward Move):

The argument for a move higher is strong. The combination of a powerful 1.72% gain and the stock’s ability to hold its ground is a sign of strength. The most compelling factor, however, is the low P/E ratio of 16.33. This provides a fundamental cushion, making the stock attractive to value-oriented buyers. If Uber can break through the 52-week high of $94.38 with strong volume, it could trigger a significant rally as the stock enters a new “blue sky” territory.

The Cautious Case (Potential for a Downward Move):

The single biggest risk is the 52-week high itself. This level represents the peak price investors have been willing to pay over the past year and is a natural point for profit-taking. The fact that the stock stalled just below this level and dipped slightly after hours shows that some sellers are present. A failure to break through this resistance on Monday could lead to a quick pullback as short-term traders cash in their gains.

Is It Right to Invest Today?

Your investment strategy should guide your decision.

-

For Momentum Traders: This is a classic breakout setup. The highest-probability trade is to wait for a confirmed move above the 52-week high of $94.38. Entering before that confirmation carries the risk of being caught in a rejection or “false breakout.”

-

For Value and Long-Term Investors: The outlook is very positive. A tech leader like Uber trading at a P/E ratio of 16 is a rare find. Friday’s strength confirms positive sentiment, and the current price could be an excellent entry point for those with a longer time horizon, as the combination of growth and value is compelling.

In summary, Uber stock is coiled for a potentially significant move. The blend of strong upward momentum and an attractive valuation heavily favors the bulls, but the challenge of breaking a 52-week high should not be underestimated. Monday’s trading will be defined by the battle at the $94.38 level.

Disclaimer: This article is for informational purposes only and is based on the provided image data. It does not constitute financial advice. All investing involves risk, and you should conduct your own research or consult with a qualified professional before making any investment decisions.