Intuitive Surgical Stock Analysis: Volatility Ends in a Stalemate Setting Up Key Test for Monday

Intuitive Surgical Inc. (ISRG) stock finished the day in positive territory, but the headline gain masks a session of significant volatility and an unusually quiet afternoon, leaving the stock’s next move uncertain. This indecisive price action has created a clear trading range that traders will be watching closely on Monday.

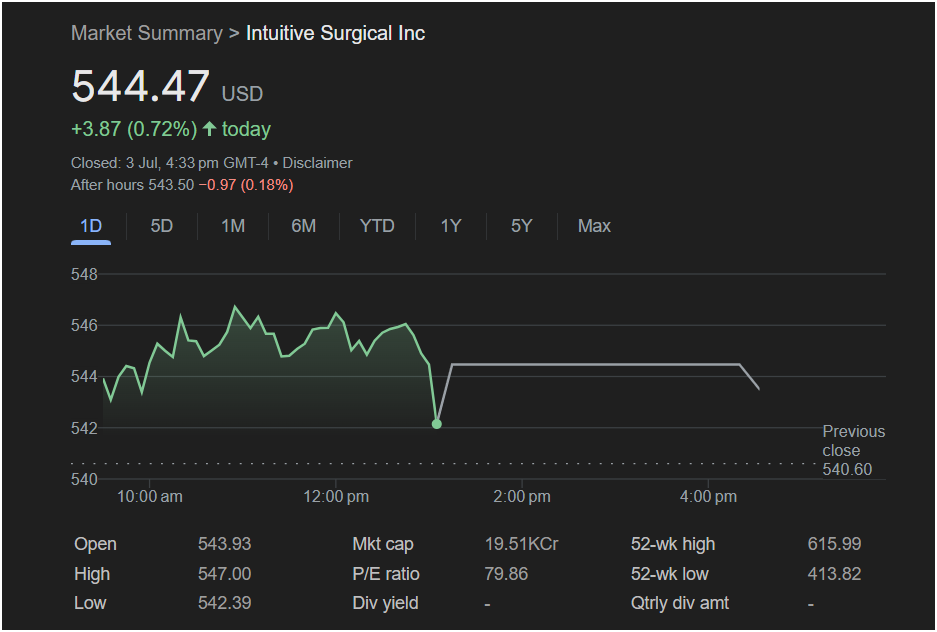

The robotic surgery leader closed at

3.87 (+0.72%) for the day. However, a slight dip in after-hours trading hints at the fragile balance between buyers and sellers.

Today’s Trading Action: A Tale of Two Halves

The intraday chart for Intuitive Surgical reveals a dramatic shift in sentiment midway through the session:

-

Choppy Morning Rally: The stock gapped up at the open and traded in a volatile but upward-trending channel for the entire morning, eventually reaching a session high of $547.00.

-

The Midday Plunge: The most telling feature of today’s chart is the sharp, sudden drop shortly after noon, where the stock quickly gave back a large portion of its morning gains, finding a bottom at $542.39. This indicated a strong pocket of selling pressure at the higher levels.

-

Afternoon Stalemate: Following the dramatic drop and a partial recovery, the stock entered a very tight and quiet consolidation for the rest of the afternoon, flatlining around the $544 mark. This “stalemate” suggests that both bulls and bears are in a temporary truce, waiting for a new catalyst.

Key Metrics for the Trader’s View

Several data points are crucial for understanding the current landscape:

-

High P/E Ratio: At 79.86, Intuitive Surgical’s P/E ratio is high, reflecting its status as a premier growth stock in the medical technology field. This means investors have high expectations for future earnings, which can also lead to higher volatility.

-

52-Week Range: The current price is situated squarely between the 52-week low of $413.82 and the high of $615.99. This means the stock is not at a critical long-term breakout or breakdown point, making short-term technical levels more important.

-

No Dividend: As a growth-focused company, Intuitive Surgical does not pay a dividend. The investment case is purely based on capital appreciation.

Outlook for Monday: Will the Stock Go Up or Down?

Given the sharp rejection from the highs and the subsequent flatline close, the outlook for Monday is neutral to uncertain. The stock is currently coiled in a tight range, and the direction of its next move will be revealed by which side of this range breaks first.

Traders should set alerts for the following key levels:

-

Resistance: The morning high of $547.00 is now the key level of resistance. A strong move and close above this price would suggest the bulls have absorbed the midday selling and are ready to resume the uptrend.

-

Support: The intraday low of $542.39 acts as the crucial support level. A break below this would signal that the sellers are back in control and could lead to a test of lower prices.

The trading action on Monday will likely be dictated by which of these two levels gives way.

Is It Right to Invest Today?

This is a classic “wait for confirmation” scenario for short-term traders.

-

For the Active Trader: Entering a position now would be speculative. The prudent strategy is to wait for the stock to prove its direction. A trade can be initiated on a confirmed breakout above

542.39 (for a short position). Trading within this tight range is not advised.

-

For the Long-Term Investor: The sharp dip that was quickly bought up indicates there are buyers who see value at these prices. For an investor with a multi-year time horizon looking to own a leader in robotic surgery, using days with some weakness to accumulate shares could be a sound strategy, as long-term fundamentals remain the primary focus over single-day volatility.

In short, Intuitive Surgical stock is currently in a state of equilibrium. Monday’s session will be critical for traders looking for the next directional signal.

Disclaimer: This article is an analysis based on the provided image and does not constitute financial advice. All investment decisions should be made after conducting your own thorough research and considering your personal risk tolerance.