Johnson & Johnson Stock Shows Indecision: Is a Monday Move Coming?

Johnson & Johnson stock (NYSE: JNJ) finished Friday’s session with a modest gain, but a day of choppy, volatile trading suggests a market wrestling with indecision. For traders looking ahead to Monday, the healthcare giant’s performance presents a mixed bag of stable fundamentals and uncertain short-term technicals. This analysis will break down the crucial data from Friday’s close to help you anticipate the next potential move.

A Volatile Day Ends in the Green

A Volatile Day Ends in the Green

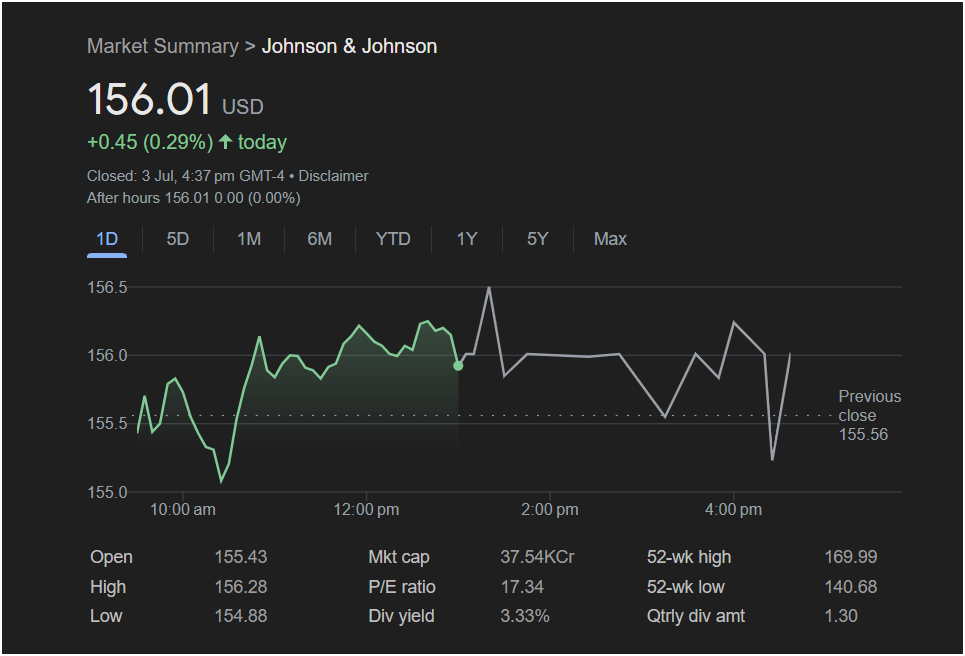

While the closing numbers for Johnson & Johnson look calm, the intraday chart tells a story of conflict between buyers and sellers. Here’s the essential summary of the session:

-

Closing Price: 156.01 USD

-

Day’s Gain: +0.45 (+0.29%)

-

After-Hours Trading: Flat at 156.01, showing no immediate momentum change after the market closed.

The stock opened at 155.43, dipped sharply to a low of 154.88 early in the session, and then rallied to a daily high of 156.28. However, it couldn’t hold those gains and spent the rest of the day in a volatile, sideways pattern, eventually closing slightly above its previous close of 155.56. This price action indicates a lack of a clear directional trend.

Key Trading Data at a Glance

A successful trader must look beyond the closing price. Here are the vital statistics from the trading session:

-

Day’s Range: A wide range from a low of 154.88 to a high of 156.28.

-

52-Week Range: The stock is trading in the lower half of its 52-week range of 140.68 to 169.99, suggesting it is well off its peak valuation.

-

Valuation (P/E Ratio): 17.34. This is a relatively moderate P/E ratio, indicating the stock is not excessively expensive relative to its earnings, a key point for value investors.

-

Market Cap: 37.54KCr.

-

Dividend Yield: A robust 3.33%, with a quarterly dividend of 1.30 per share. This is a significant draw for income-focused investors.

Market Outlook: Will the Stock Go Up or Down on Monday?

The data from Friday’s session points towards market uncertainty rather than a clear bullish or bearish signal.

The Cautious Case (Potential for a Sideways or Downward Move):

The primary argument for caution is the chart itself. The wild swings and failure to hold the day’s high suggest that sellers are active and are capping any upward momentum. The flat after-hours session reinforces this lack of conviction from buyers. If the market opens with bearish sentiment on Monday, the stock could easily re-test its daily low of 154.88.

The Bullish Case (Potential for an Upward Move):

The bullish argument is rooted in the company’s fundamentals rather than Friday’s chart. A P/E ratio of 17.34 and a strong dividend yield of over 3% make J&J a classic “defensive” stock. In a volatile or uncertain broader market, investors often flock to stable, blue-chip companies like Johnson & Johnson for their perceived safety and reliable income. Buyers stepping in to defend the stock at the day’s low shows there is underlying support.

Is It Right to Invest Today?

Your investment strategy should dictate your next move.

-

For Short-Term Traders: The high volatility and lack of a clear trend make this a risky play. A momentum trader might wait for a confirmed break above the day’s high (156.28) or below the low (154.88) before entering a position. The current sideways chop is often a recipe for small losses.

-

For Long-Term and Income Investors: The picture is more appealing. The stock is trading significantly below its 52-week high, has a reasonable valuation, and offers a very attractive dividend yield. For an investor looking to build a long-term position, the current price could be considered a fair entry point, especially if they are willing to weather short-term volatility.

In summary, Johnson & Johnson stock is at a crossroads. While its short-term direction is unclear due to market indecision, its strong fundamentals make it a compelling option for those with a longer time horizon. Monday’s opening price action will be critical in determining whether the bulls or bears will take control for the week ahead.