Amazon Stock Analysis: AMZN Posts Solid Gains, Is Now the Time to Invest

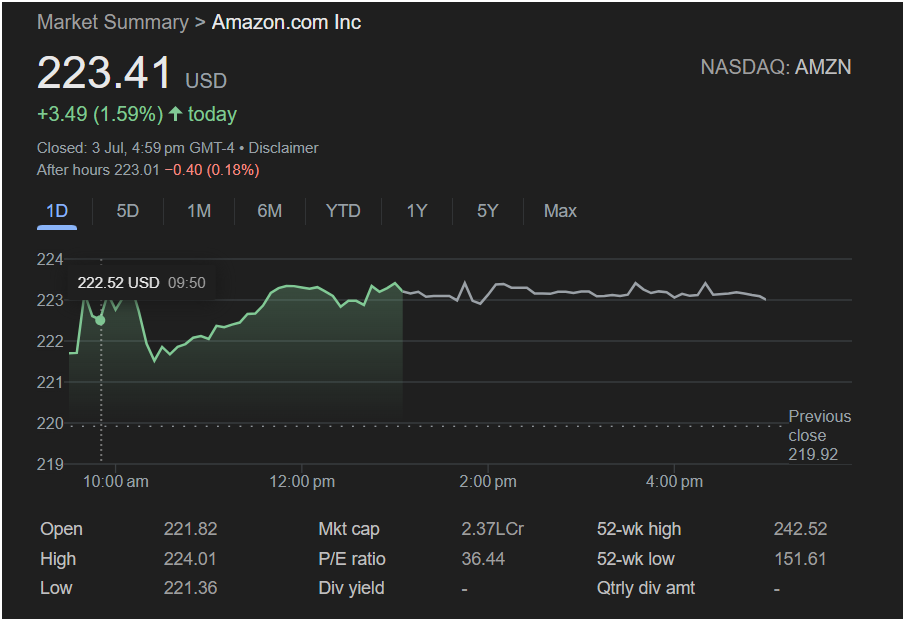

Amazon.com Inc (NASDAQ: AMZN) demonstrated significant strength in its recent trading session, closing with a notable gain and attracting the attention of traders looking for momentum. An analysis of its performance on Wednesday, July 3rd, provides key insights into what could be next for this tech giant.

Today’s Market Performance: A Story of Recovery and Strength

Amazon stock closed the official trading day at

3.49, or 1.59%. This performance indicates strong buying interest, especially when compared to the previous day’s close of $219.92.

A closer look at the 1-day chart reveals a dynamic session for traders:

-

Volatile Start: The stock opened at $221.82 and quickly dipped to its session low of $221.36.

-

Bullish Reversal: Following the initial dip, buyers stepped in, pushing the stock on a steady uptrend for the first half of the day, culminating in the session high of $224.01.

-

Afternoon Consolidation: From around 1:00 PM onwards, the stock’s volatility decreased. It entered a consolidation phase, trading sideways in a tight range just below the day’s high. This pattern often suggests that the stock is gathering strength at a new, higher price level.

A slight dip was noted in after-hours trading, with the price at $223.01, down a minor 0.18%. This is a small pullback that traders will monitor at the next market open.

Key Data for Traders

To make an informed decision, traders should consider these critical metrics from the session:

-

Previous Close: $219.92

-

Open: $221.82

-

Day’s Range: $221.36 (Low) to $224.01 (High)

-

Market Cap: $2.37 Trillion (Note: “2.37LCr” on the chart is an Indian numbering format, translating to 2.37 Trillion USD)

-

P/E Ratio: 36.44

-

52-Week Range: $151.61 – $242.52

The current price sits comfortably in the upper quadrant of its 52-week range, signaling a broader bullish trend over the past year. The P/E ratio of 36.44, while typical for a high-growth tech company, is a factor for value-focused investors to consider.

Outlook for the Next Trading Day (Monday)

Based on the chart, here is the technical outlook for the next trading session:

The Bullish Case:

The strong close and the powerful recovery from the day’s low are positive indicators. The consolidation in the afternoon suggests that buyers were willing to hold positions at this elevated level. For the market to continue its upward trend on Monday, traders will be watching for a decisive break above the key resistance level of $224.01 (the day’s high). A sustained move past this point could signal further gains.

The Bearish Case:

The failure to close above the $224.01 high and the minor dip in after-hours trading could suggest that the upward momentum is pausing. This $224 level now acts as a ceiling. If the stock fails to break through it at the next open, it could be vulnerable to a pullback, potentially re-testing lower levels from today’s session.

Is It Right to Invest Today?

For a short-term trader, the outlook is cautiously optimistic. The momentum is clearly positive, but the resistance at $224.01 is a critical hurdle.

-

For Day Traders: A strategy could involve waiting to see if the stock can break and hold above $224.01. A successful break could present a buying opportunity. Conversely, a rejection at this level might offer a short-selling opportunity.

-

For Long-Term Investors: A single day’s performance is less critical. The stock’s position near its 52-week high within a larger uptrend is a positive sign. However, they should consider the company’s fundamentals and overall market conditions before making a decision.

In conclusion, Amazon stock showed impressive strength. While the path seems upward, the immediate challenge lies in overcoming the $224 resistance. Traders should proceed with a clear strategy and watch the opening price action on Monday closely to gauge market sentiment.

Disclaimer: This article is for informational purposes only and is based on the analysis of the provided image. It does not constitute financial advice. All trading and investment decisions should be made based on your own research and consultation with a qualified financial advisor.