Meta Stock Outlook: Analyzing META’s Volatility Ahead of Next Week’s Trading

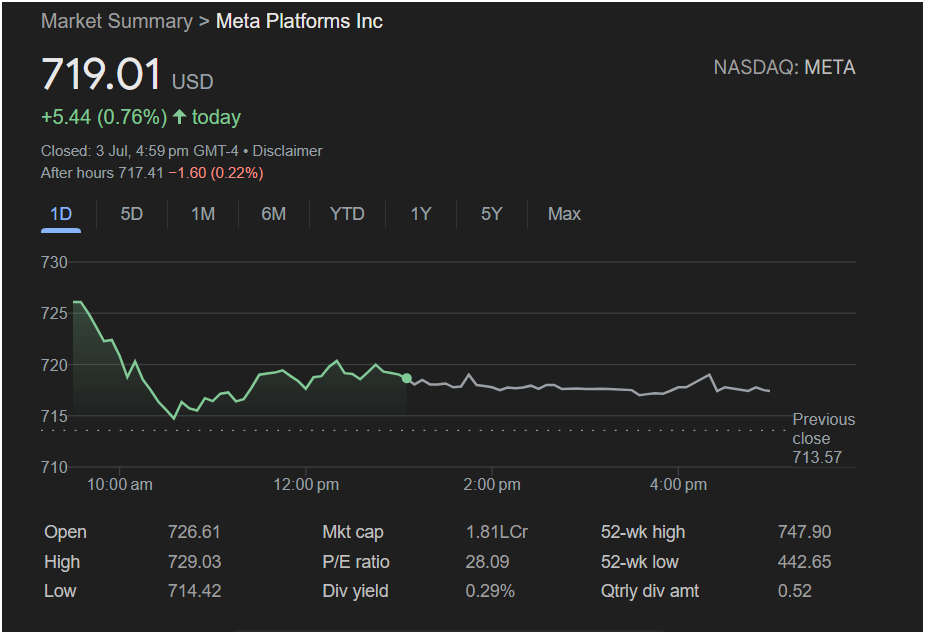

Meta Platforms Inc. (NASDAQ: META) closed the trading day on a positive note, but a closer look at the session’s data reveals a more complex picture that traders should carefully consider heading into the next market open on Monday. While the stock finished in the green, underlying weakness during the day and a dip in after-hours trading suggest potential volatility ahead.

Here’s a comprehensive breakdown of what every trader needs to know based on the latest data.

Wednesday’s Trading Session Recap

Meta stock closed the day at

5.44 (+0.76%). This green close, however, doesn’t tell the whole story. The stock’s performance on Wednesday, July 3rd, was a battle between buyers and sellers:

-

Open: $726.61

-

High: $729.03

-

Low: $714.42

-

Previous Close: $713.57

The stock gapped up at the open, starting strong above its previous close. However, it immediately met with significant selling pressure, falling sharply in the first hour to its session low of $714.42. While it found support there and managed to climb back, it spent the rest of the day trading in a relatively tight range, struggling to reclaim its opening levels.

Crucially, the closing price of

717.41**, a decline of -$1.60 (0.22%), signaling that negative sentiment may be carrying over.

Key Financial Metrics for Traders

To get a fuller picture of Meta’s position, let’s look at the fundamental data provided:

-

Market Cap: 1.81L Cr (Note: This appears to be a regional display format, likely representing approximately $1.81 Trillion USD). This confirms Meta’s status as a mega-cap technology leader.

-

P/E Ratio: 28.09. This price-to-earnings ratio suggests that investors have healthy expectations for future growth, though it is not in the extremely high territory of some growth stocks.

-

52-Week Range: The stock has traded between

747.90 over the past year. The current price is firmly in the upper end of this range, reflecting strong long-term momentum.

-

Dividend Yield: 0.29%, with a quarterly dividend of $0.52. The modest yield is typical for a tech giant that is also heavily reinvesting in growth.

Will Meta Stock Go Up or Down on Monday?

Based on the provided chart and data, here is the analysis for the upcoming trading session.

The Bearish Case (Potential for a Downturn):

The most significant warning sign is the stock’s inability to hold its opening gains. A stock that opens high and sells off throughout the day (a “fading” pattern) often indicates institutional selling or widespread profit-taking. The negative after-hours performance, although slight, reinforces this cautious sentiment and could lead to a lower open on Monday. Traders will be watching to see if the stock breaks below the recent low of $714.42. A move below this level could trigger further selling.

The Bullish Case (Potential for an Upturn):

On the positive side, the stock successfully defended its previous day’s close of

747.90**.

for Investors:

Investing today requires careful consideration of these mixed signals. While Meta stock finished Wednesday with a gain, the intraday price action was weak. The after-hours dip suggests caution is warranted for Monday’s open.

Key levels for traders to watch on Monday will be:

-

Support: The intraday low of $714.42.

-

Resistance: The midday resistance around

721, and more significantly, the opening price of $726.61.

A decisive break above resistance could signal renewed strength, while a fall below support may indicate the start of a short-term pullback. Given the volatility, investors may want to wait for a clear trend to emerge early in Monday’s session before making a move.

Disclaimer: This article is an analysis based on the provided image and is for informational purposes only. It is not financial advice. All stock market trading and investment activities involve risk. You should conduct your own research and consult with a qualified financial professional before making any investment decisions.