Broadcom Stock Analysis: Strong Friday Finish Puts 52-Week High in Focus for Monday

Broadcom stock (NASDAQ: AVGO) capped the week with a powerful performance, leaving traders and investors keenly watching for Monday’s market open. The semiconductor giant closed the trading day with significant gains, but key technical levels and valuation metrics present a complex picture for the immediate future. This article breaks down the essential data from the recent trading session to help you understand the potential scenarios ahead.

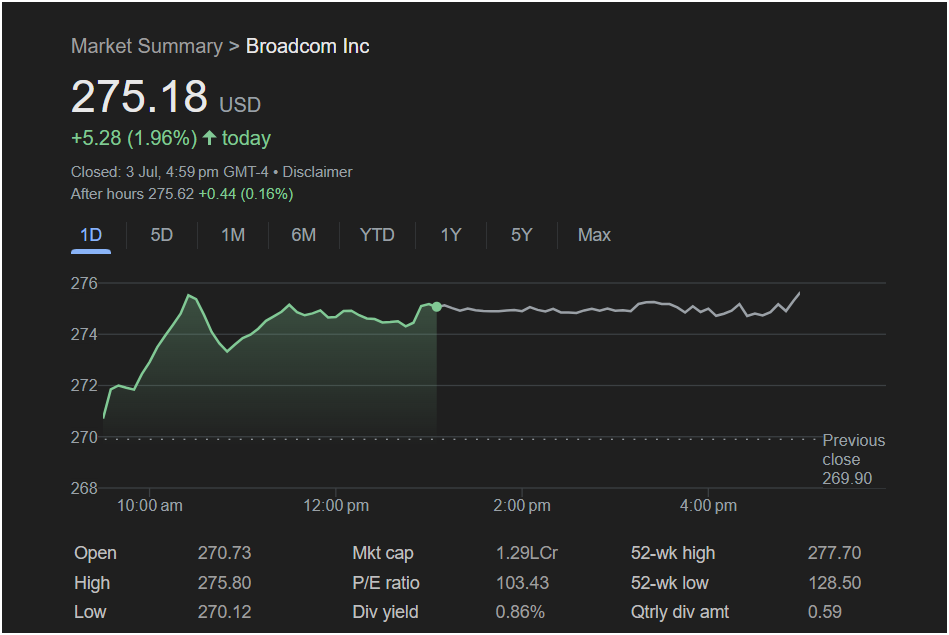

A Strong Bullish Close

Based on the market data from Friday, July 3rd, Broadcom Inc. demonstrated considerable strength. Here’s a summary of the key performance indicators:

-

Closing Price: 275.18 USD

-

Day’s Gain: +5.28 (+1.96%)

-

After-Hours Trading: Further gains of +0.44 (+0.16%), reaching 275.62 USD.

The stock began the day at 270.73, gapping up slightly from the previous close of 269.90. It experienced a strong rally in the morning, hitting the day’s high of 275.80. After some consolidation, it maintained its gains and closed near the peak of its daily range. The positive momentum continued into after-hours trading, signaling sustained buying interest even after the market closed.

The stock began the day at 270.73, gapping up slightly from the previous close of 269.90. It experienced a strong rally in the morning, hitting the day’s high of 275.80. After some consolidation, it maintained its gains and closed near the peak of its daily range. The positive momentum continued into after-hours trading, signaling sustained buying interest even after the market closed.

Key Trading Data at a Glance

For any trader, understanding the numbers behind the movement is crucial. Here are the vital statistics from the session:

-

Day’s Range: The stock traded between a low of 270.12 and a high of 275.80.

-

52-Week Range: The stock is trading very close to its 52-week high of 277.70, having come a long way from its 52-week low of 128.50.

-

Valuation (P/E Ratio): At 103.43, the Price-to-Earnings ratio is notably high. This suggests that investors have lofty expectations for future earnings growth, but it can also indicate that the stock is expensive compared to its current earnings.

-

Market Cap: Listed as 1.29LCr.

-

Dividend Yield: 0.86%, with a quarterly dividend amount of 0.59.

Market Outlook: Will the Stock Go Up or Down on Monday?

The data presents compelling arguments for both bullish and cautious traders.

The Bullish Case (Potential for an Upward Move):

The primary driver for optimism is momentum. Closing up nearly 2% and continuing to rise in after-hours trading shows strong positive sentiment. The most significant factor is the stock’s proximity to its 52-week high of 277.70. For momentum traders, a decisive break above this critical resistance level could trigger a new wave of buying, potentially leading to a significant upward move as the stock enters a new price discovery phase.

The Cautious Case (Potential for a Downward Move):

Conversely, the 52-week high represents a major psychological and technical barrier. Stocks often face selling pressure and profit-taking at these levels. If Broadcom fails to break through 277.70, it could be rejected and pull back. Furthermore, the high P/E ratio of 103.43 is a point of concern for value-focused investors. It implies the stock is priced for perfection, making it vulnerable to a correction if there is any negative news or a broader market downturn.

Is It Right to Invest Today?

The decision to invest hinges on your individual trading strategy and risk tolerance.

-

For Momentum Traders: The situation is a classic “wait and see.” An entry might be considered if the stock shows strong volume and breaks convincingly above the 277.70 resistance level.

-

For Cautious or Value Investors: The high valuation and position at a key resistance level may signal a time for patience. It might be prudent to wait for a potential pullback to a more attractive entry point or for confirmation that the breakout is sustainable.

In conclusion, Broadcom stock closed the week on a high note, poised to challenge a key technical milestone. Monday’s trading session will be critical. Traders should watch closely to see if the bullish momentum has the strength to push the stock to new highs or if resistance and valuation concerns will lead to a reversal.

Disclaimer: This article is for informational purposes only and is based on the provided image data. It does not constitute financial advice. All investing involves risk, and you should conduct your own research or consult with a qualified professional before making any investment decisions.