Tesla Stock Faces Headwinds as After-Hours Drop Signals a Bearish Start to the Week

NEW YORK – Tesla Inc. (TSLA) stock finished the trading day on July 3rd with a slight decline, but a more pronounced drop in after-hours activity is signaling potential trouble for investors and traders heading into the next session on Monday. While the market may be looking for direction, the latest data suggests a cautious approach is warranted.

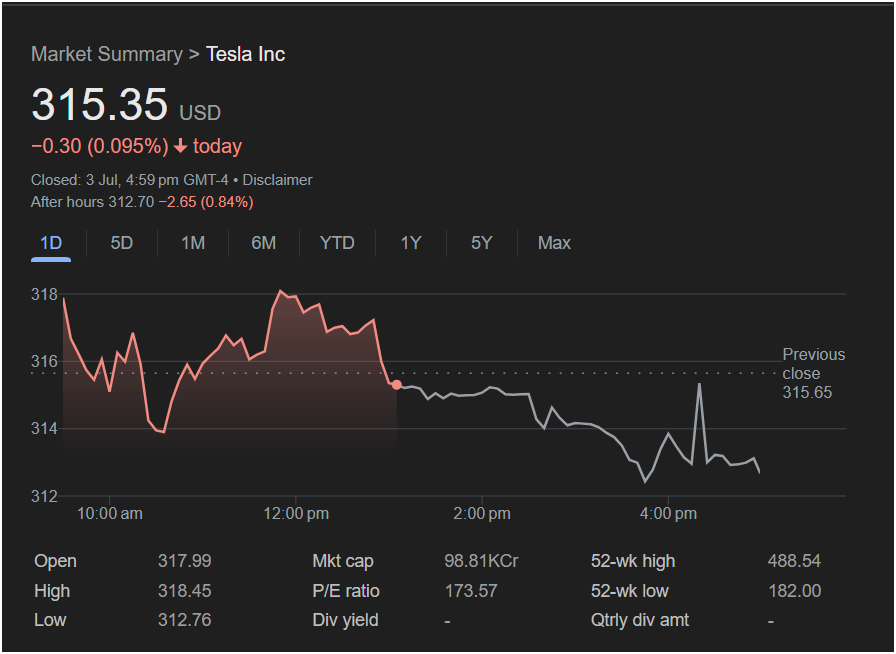

The electric vehicle giant closed the official trading day at

0.30 (0.095%). However, this figure doesn’t tell the whole story of a volatile day. The stock opened higher at $317.99 and reached an intraday high of $318.45, but sellers took control in the afternoon, pushing the price well below the previous day’s close of $315.65.

The most critical piece of information for traders to consider happened after the closing bell. In after-hours trading, Tesla stock fell significantly, dropping

2.65(0.842.65 (0.84%)** to **

312.70. This downward momentum after the market’s close is often a strong indicator of negative sentiment that could carry over into the next trading day’s opening.

Today’s Key Trading Data for Tesla (TSLA):

-

Closing Price: $315.35

-

Day’s Change: -$0.30 (0.095%)

-

After-Hours Price: $312.70 (down 0.84%)

-

Day’s High: $318.45

-

Day’s Low: $312.76

-

Previous Close: $315.65

Analysis for Monday: Should You Invest?

Based purely on the technical picture from July 3rd, the outlook for Monday appears bearish. Here’s what traders should be watching:

-

The After-Hours Gap: The drop to $312.70 in post-market trading is the most significant red flag. This suggests a potential “gap down” opening on Monday, where the stock could begin trading well below its Friday closing price.

-

Support Levels: The intraday low of $312.76 and the after-hours low of $312.70 now act as critical support levels. If the stock opens below this area and fails to reclaim it, it could signal a further move to the downside.

-

Failed Rally: The intraday chart shows that the stock attempted to rally in the morning but was firmly rejected. The subsequent sell-off in the afternoon shows that bears were in control by the end of the day.

While Tesla’s fundamentals, like its high P/E ratio of 173.57, point to a company with high growth expectations, the short-term technicals are pointing downward. The stock is trading significantly off its 52-week high of $488.54, indicating it is in a broader corrective phase.

For traders considering an investment on Monday, exercising caution is paramount. The weak close combined with a substantial after-hours sell-off suggests that sellers currently have the upper hand. Waiting to see if the stock can find solid ground and reverse the negative momentum after the market opens would be a prudent strategy. An immediate investment at the opening bell carries a high risk of catching a falling stock.

Disclaimer: This article is for informational purposes only and is based on an analysis of past stock performance. It should not be considered financial advice. All investing involves risk, and you should conduct your own research before making any investment decisions.