Oracle Stock Hits New 52-Week High Then Fades 4%: A Bull Trap or Buying Opportunity

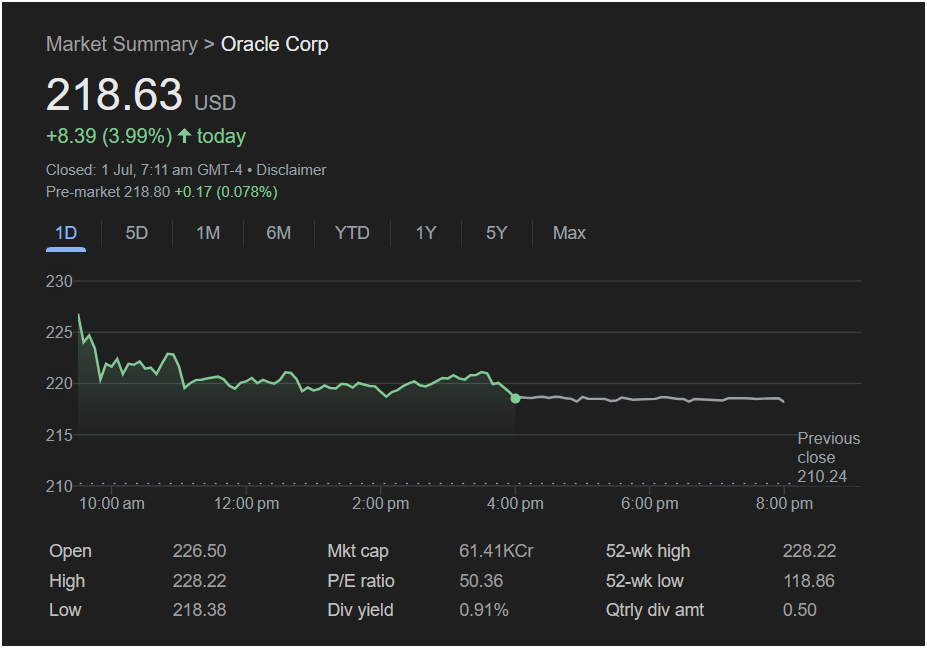

Austin, TX – Oracle Corp (NYSE: ORCL) stock gave investors a wild ride on Monday, July 1st, finishing the day with a headline-grabbing gain of nearly 4%. However, a closer look at the intraday chart reveals a more complex and potentially cautionary tale for traders heading into the next session.

While the stock closed at

8.39 (+3.99%), this number only tells half the story. The price action signals a fierce battle between bulls and bears that could dictate the stock’s direction for the rest of the week.

Monday’s Market Recap: A Day of Extreme Volatility

Oracle stock began the day with tremendous momentum, gapping up to open at $226.50, far above the previous close of $210.24. In the opening minutes of trading, it surged to hit a new 52-week high of $228.22.

This initial euphoria, however, was short-lived. After hitting its peak, the stock entered a sustained sell-off that lasted for the entire trading day. It steadily declined, eventually hitting a low of $218.38 before closing just a few cents above that level. This pattern, known as a bearish reversal or a “fade from the highs,” is a critical warning sign for traders, indicating that sellers took firm control at elevated prices.

Despite the negative intraday trend, pre-market data for Tuesday shows a slight uptick to $218.80, suggesting some stability may be found.

Key Trading Data at a Glance

For any trader analyzing Oracle stock, these are the crucial data points from Monday’s volatile session:

-

Previous Close: $210.24

-

Open: $226.50

-

Day’s High / 52-wk High: $228.22

-

Day’s Low: $218.38

-

Closing Price: $218.63

-

52-Week Low: $118.86

-

Market Cap: 61.41KCr (approximately $614.1 Billion)

-

P/E Ratio: 50.36

-

Dividend Yield: 0.91%

Analysis: Will Oracle Stock Go Up or Down on Tuesday?

The outlook for Oracle stock is mixed, with strong bearish signals from Monday’s price action clashing with the stock’s powerful long-term uptrend.

The Bearish Case (Why it might go down):

The primary argument for a downward move is the stark intraday reversal. When a stock hits a new high and closes near its low, it often traps buyers who bought at the peak and creates significant overhead resistance. This suggests that the stock may need to pull back further to find a solid support level. The next major support could be the top of the price gap, near the previous close of $210.24.

The Bullish Case (Why it might go up):

The fact that Oracle hit a new 52-week high cannot be ignored. It confirms that the company’s long-term growth story, likely driven by its cloud and AI initiatives, is resonating with investors. The stock still closed with a massive 4% gain, and some may see the pullback from the highs as a healthier consolidation before the next move up.

Is It Right to Invest in ORCL Today?

The decision to invest in Oracle stock right now depends heavily on your time horizon and risk tolerance.

For the Long-Term Investor: The long-term uptrend is intact. This pullback could present a more attractive entry point than chasing the stock at its absolute high. The company’s fundamental strength remains the key driver.

For the Short-Term Trader: Extreme caution is advised. The bearish reversal pattern is a classic short-term sell signal.

-

Resistance: The high of $228.22 is now a formidable resistance level. It’s unlikely to be breached without significant buying volume.

-

Support: The critical level to watch is the day’s low of

210 area to fill the gap.:

While the 4% gain in Oracle stock looks impressive on paper, the underlying price action is a red flag for short-term traders. The path of least resistance appears to be downward or sideways in the immediate future. Prudent traders may want to wait for the stock to stabilize and form a new support base before initiating a new long position.