Merck & Co Stock Analysis: Shares Plunge on Open, Is This a Buying Opportunity or a Warning Sign?

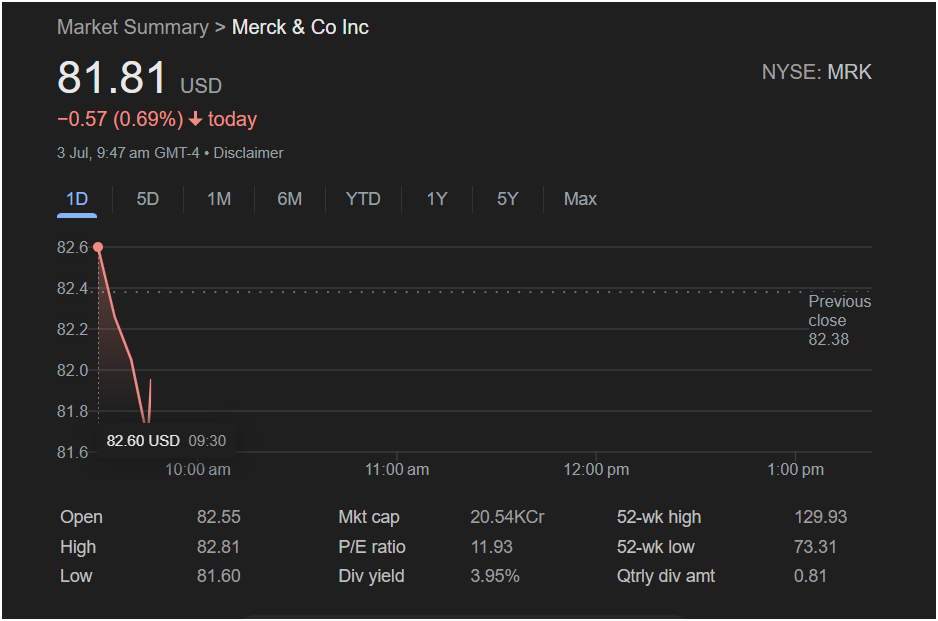

Rahway, NJ – Merck & Co Inc (NYSE: MRK) stock is experiencing heavy selling pressure in early trading, with the price falling sharply immediately after the opening bell. As of 9:47 AM, the stock was trading at

0.57 (-0.69%), after hitting a low of $81.60.

This dramatic opening move has put traders on high alert. The key question now is whether this sharp dip represents a compelling buying opportunity based on strong fundamentals or a serious warning sign of further downside to come. This article breaks down the live data to help investors make sense of the action.

The Bearish Case: The Sellers Are in Control

The immediate technical picture for Merck is overwhelmingly bearish. Here’s what traders are seeing:

-

Aggressive Opening Sell-Off: The stock gapped up briefly at the open to $82.55 before sellers immediately took control, driving the price down more than a dollar. This “gap and crap” pattern is a significant sign of weakness and suggests institutional selling pressure.

-

Breaking Key Levels: The plunge has taken the stock well below its previous day’s close of $82.38, turning a former support level into a new layer of resistance.

-

Strong Downward Momentum: The steepness of the decline on the intraday chart indicates that momentum is firmly in the hands of the sellers.

The Bullish Case: A Fundamental Bargain?

Contrasting with the negative price action is a very compelling fundamental and value-based argument for the bulls:

-

Finding Initial Support: The stock’s decline was halted at $81.60, and it has managed a small bounce from that level. If buyers can defend this low, it could form the base for a recovery.

-

Extremely Attractive Valuation: With a P/E ratio of just 11.93, Merck is fundamentally cheap compared to the broader market. Value investors often look for opportunities like this, where a solid company’s stock is sold off.

-

Massive Dividend Yield: The standout feature is Merck’s dividend yield of 3.95%. This is a very high yield that provides a significant income stream, making the stock highly attractive to long-term income investors who are likely to see this dip as a prime buying opportunity.

Key Data and Levels for Traders to Monitor

The rest of today’s session will be defined by the battle around these key levels:

-

Critical Support Level: The intraday low of $81.60. This is the most important level to watch. A break below this would signal that the downtrend is accelerating.

-

Immediate Resistance: The zone between the current price and $82.00. Buyers need to push through this area to show any real strength.

-

Major Resistance Zone: To reverse the damage, the stock would need to reclaim the previous close of

82.38∗∗andtheopeningpriceof∗∗82.38** and the opening price of **82.55.

-

The Value Floor: The combination of a low P/E and a high dividend yield creates a strong “value floor” that should, in theory, limit how far the stock can fall before long-term buyers step in.

Outlook: How Should You Trade This?

The immediate outlook for Merck stock is bearish, as the selling pressure is undeniable. The critical question is whether the powerful fundamental value can overcome the negative technical momentum.

Is it right to invest today?

-

For short-term momentum traders, this is a classic “falling knife” scenario. Trying to catch the bottom is extremely risky. It is far more prudent to wait for the price to stabilize and show a clear sign of reversal before considering a long position.

-

For long-term value and income investors, this sell-off could be exactly the opportunity they have been waiting for. Buying a high-quality company with a near-4% dividend yield at a low P/E ratio is a classic value investing strategy. Even so, it may be wise to scale into a position rather than buying all at once.

-

Bearish traders will view the small bounce as a potential opportunity to short the stock, targeting a retest and potential break of the $81.60 low.

In conclusion, Merck stock is currently a battlefield between short-term sellers and long-term value buyers. The technicals scream caution, while the fundamentals scream opportunity. The price action around the $81.60 low will be the key to determining which side wins the day.