Johnson & Johnson Stock: Strong Dividend and Late Rally Signal Opportunity for Monday

NEW BRUNSWICK, NJ – Johnson & Johnson (JNJ) stock closed with a modest gain in its last session, but a powerful late-day rally has caught the attention of traders. As a cornerstone of the healthcare sector known for its stability and strong dividend, any sign of bullish momentum is significant. We’ll analyze the key data to determine the outlook for Monday’s trading.

Friday’s Trading Recap: A Resilient Finish

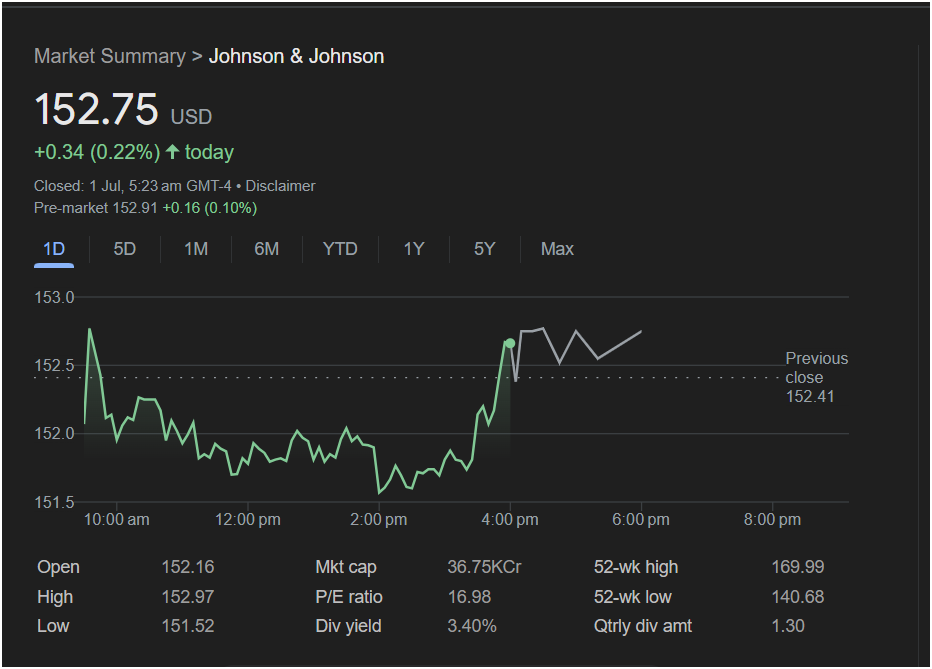

Johnson & Johnson ended the day at

0.34 (0.22%). While the overall gain was small, the intraday chart tells a story of resilience. The stock experienced volatility, dropping to a low of

152.97, allowing it to close near its peak for the day.

This strong finish is a bullish technical signal. Adding to the positive sentiment, pre-market trading for Monday already shows a slight gain, with the stock at $152.91, up another 0.10%.

The Investor’s Edge: Key JNJ Metrics

For any trader or investor considering Johnson & Johnson, its fundamental metrics are a core part of its appeal:

-

Dividend Yield: The standout feature is a very attractive 3.40% dividend yield, supported by a quarterly dividend of $1.30. This makes JNJ a top choice for income-focused investors and provides a cash flow cushion.

-

P/E Ratio: At 16.98, the stock’s price-to-earnings ratio is relatively low, suggesting it is reasonably valued and may be considered a “value stock” in the current market.

-

52-Week Range: The stock is trading closer to its 52-week low of

169.99. This could indicate that there is significant room for upward recovery.

-

Market Capitalization: With a massive market cap of 36.75KCr, JNJ is a blue-chip staple, offering stability and liquidity.

Outlook and Trading Strategy for Monday

The combination of a strong close and solid fundamentals creates a compelling setup for Monday.

Key Levels to Monitor:

-

Crucial Resistance: The high from the previous session at $152.97 is the most important level to watch. The pre-market is already testing this area. A clean break above this price is essential for the bulls.

-

Key Support: The first line of support is the previous close of

151.52.

Potential Scenarios for Monday:

-

The Bullish Scenario: If the stock opens and pushes decisively through the $152.97 resistance, it would confirm the strength of the late-day rally. This could attract more buyers and set the stage for a move towards the

155 range.

-

The Neutral/Bearish Scenario: If JNJ fails to break the $152.97 resistance, it may consolidate or pull back. A drop below $152.41 would suggest the rally has lost steam, potentially leading to a retest of lower support levels.: Is It the Right Time to Invest?

Johnson & Johnson presents a different kind of opportunity than a high-flying tech stock. Its appeal lies in its value, defensive nature, and robust dividend.

The late-day rally is a positive technical sign that suggests momentum is building. For traders, the strategy for Monday is clear:

-

For Value and Income Investors: JNJ’s current valuation and high dividend yield make it attractive for the long term. The recent price action could signal the beginning of a broader recovery, making it a good time to consider a position.

-

For Short-Term Traders: The prudent approach is to watch the $152.97 level. A confirmed break above this resistance would provide a strong entry signal for a momentum trade. Investing before this confirmation carries the risk of a false breakout.

Overall, the sentiment for Johnson & Johnson stock is cautiously optimistic. The strong finish on Friday has put the bulls in a favorable position, but they must prove they can break through resistance to sustain the rally.

Disclaimer: This article is for informational purposes only and is based on the data provided in the image. It does not constitute financial advice. All investment decisions should be made with the guidance of a qualified financial professional.