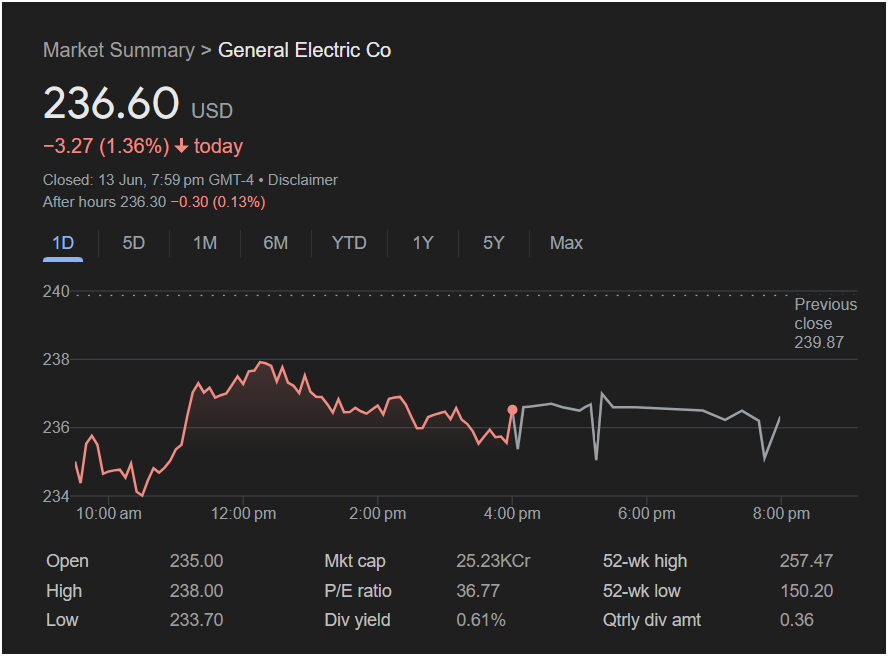

General Electric Shares Dip, Setting a Cautious Tone for the Week Ahead

NEW YORK – General Electric (GE) shares finished the trading day in the red on Thursday, capping a volatile session that saw early gains erased by late-afternoon selling pressure. The industrial giant’s stock closed at

3.27 (1.36%) for the day.

The downward trend persisted into after-hours trading, where the stock slipped an additional 0.13%, signaling that bearish sentiment may be carrying over.

Thursday’s trading session was a tale of two halves. After opening at $235.00, GE stock rallied significantly, reaching an intraday high of $238.00. However, the momentum failed to hold. In the second half of the day, the stock systematically declined, ultimately closing well below its high and the previous day’s close of $239.87.

Market Analysis & Monday’s Outlook

Based on the provided data, the outlook for GE’s stock on Monday appears to lean towards a potentially lower or flat opening.

Based on the provided data, the outlook for GE’s stock on Monday appears to lean towards a potentially lower or flat opening.

Here’s the breakdown:

-

Bearish Signals: The primary indicator is the negative momentum. The stock not only closed down significantly but also continued to fall in after-hours trading. This suggests sellers had the upper hand at the end of the week, and that sentiment could spill over into Monday’s pre-market session. The failure to hold the midday high of $238.00 indicates a level of resistance that buyers could not overcome.

-

Potential for a Reversal: While the short-term trend is negative, it’s important to note that the stock remains significantly closer to its 52-week high (

150.20). This indicates a strong underlying uptrend over the past year. Investors who view GE’s long-term prospects favorably may see this dip as a “buy-the-dip” opportunity, which could provide support and counter the selling pressure on Monday.

:

Given that the stock closed on a downtrend and continued that trajectory in after-hours, traders should be prepared for potential continued weakness at the start of trading on Monday. However, if the broader market opens with positive sentiment, or if bargain hunters step in, GE could find its footing and attempt to reverse Thursday’s losses. The first hour of trading on Monday will be critical to determine if the sellers remain in control or if buyers will re-emerge.

Disclaimer: This article is based on an analysis of past performance data from the provided screenshot and is not financial advice. Market conditions can change rapidly due to a variety of factors.