Advanced Micro Devices (AMD) Stock: Pre-Market Surge Signals Potential Rally for Monday

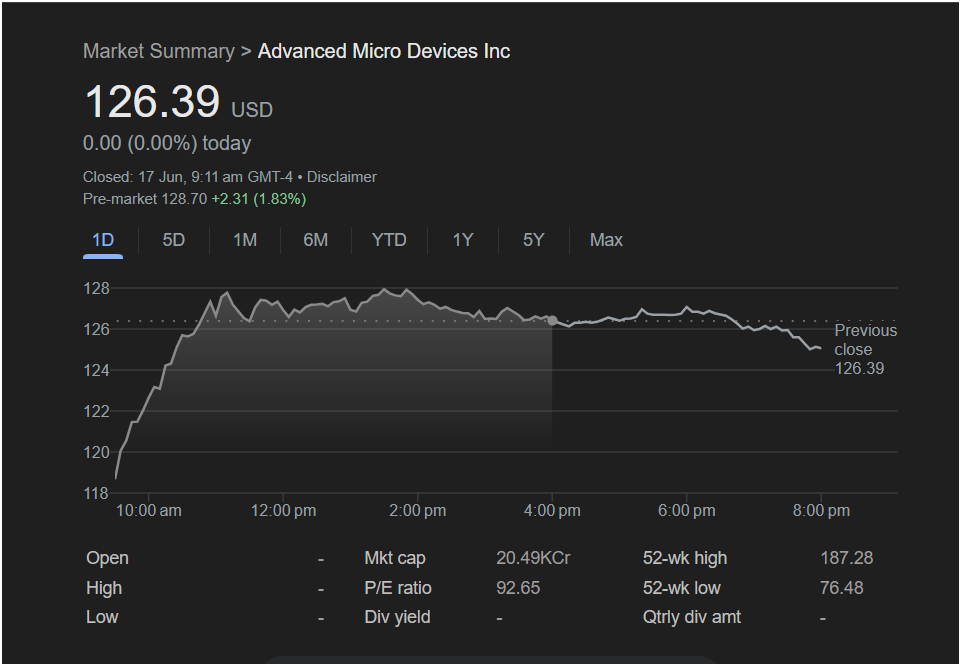

Shares of semiconductor giant Advanced Micro Devices Inc. (AMD) are showing strong signs of a bullish start for the upcoming Monday trading session. After closing the previous session flat, a significant pre-market jump is capturing the attention of traders, suggesting positive momentum is building for the chipmaker’s stock.

Here’s a breakdown of what traders need to know based on the latest data.

Key Takeaways at a Glance:

-

Previous Close: $126.39

-

Pre-Market Price: $128.70

-

Pre-Market Change: +$2.31 (+1.83%)

-

Previous Day’s Action: Showed a strong rally followed by consolidation.

-

Key Indicator: The substantial pre-market gain of nearly 2% is the most critical signal, indicating strong buying interest before the market officially opens.

Analysis of Monday’s Outlook

The most compelling piece of evidence pointing to a positive open on Monday is the pre-market activity. The stock is indicated to open at

2.31 (1.83%)** increase from its last closing price of $126.39. This type of pre-market rally often suggests that overnight news or a shift in investor sentiment is driving demand for the stock, setting a positive tone for the day.

Looking at the intraday chart from the last trading day, we can see a story of strength. The stock experienced a powerful rally in the morning, climbing from a low near $118 to a high around $128. For the remainder of the day, it entered a consolidation phase, trading sideways and successfully holding onto most of its gains before settling at $126.39. This pattern suggests that after a strong upward move, the stock found a stable base of support, which could serve as a launchpad for the next leg up. The pre-market surge appears to confirm this bullish thesis.

Looking at the intraday chart from the last trading day, we can see a story of strength. The stock experienced a powerful rally in the morning, climbing from a low near $118 to a high around $128. For the remainder of the day, it entered a consolidation phase, trading sideways and successfully holding onto most of its gains before settling at $126.39. This pattern suggests that after a strong upward move, the stock found a stable base of support, which could serve as a launchpad for the next leg up. The pre-market surge appears to confirm this bullish thesis.

Should You Invest? What Traders Should Watch

Based on the available indicators, the outlook for AMD stock on Monday appears optimistic.

For traders considering a position, the pre-market strength presents a potential buying opportunity. The key level to watch at the market open will be the previous day’s resistance, which was around the $128 mark.

-

Bullish Scenario: If AMD stock can open strongly and push decisively above the

128.70 resistance zone on good volume, it could signal the start of a continued uptrend.

-

Bearish Scenario: Traders should be cautious if the stock fails to hold its pre-market gains after the open. A retreat back below the $126.39 closing price could indicate that the initial enthusiasm has faded.

Broader Context from Financial Metrics

-

Valuation: With a P/E ratio of 92.65, AMD is priced as a high-growth stock. This means investors have high expectations for future earnings, but it can also lead to higher volatility.

-

52-Week Range: The stock is currently trading between its 52-week low of $76.48 and a high of $187.28. Being significantly off its all-time high suggests there could be substantial room for growth if the semiconductor sector regains broad market favor.

-

Dividend: As a growth-focused company, AMD does not currently pay a dividend, reinvesting its capital back into the business.

In conclusion, all signs from the provided snapshot point towards a likely upward move for AMD stock on Monday. The combination of a strong pre-market surge and a stable consolidation phase from the previous session creates a bullish setup. Traders will be keenly watching the opening minutes of the session to see if this positive momentum can be sustained.

Disclaimer: This article is for informational purposes only and is not financial advice. All trading and investment decisions carry risk. Please conduct your own research before making any financial decisions.