The Fluctuation of IBM Common Stock: A Daily Snapshot

The stock market is a dynamic and ever-shifting landscape, a complex interplay of economic indicators, corporate performance, investor sentiment, and global events. Every tick, every rise and fall, tells a story of the forces at play. For a company as iconic and deeply rooted in technological history as IBM, the daily movements of its common stock are observed with keen interest by investors, analysts, and the wider financial community. The provided market summary for IBM Common Stock on September 5th, at 10:18 am GMT-4, offers a singular snapshot of this intricate dance, a moment in time captured within the broader continuum of its market performance.

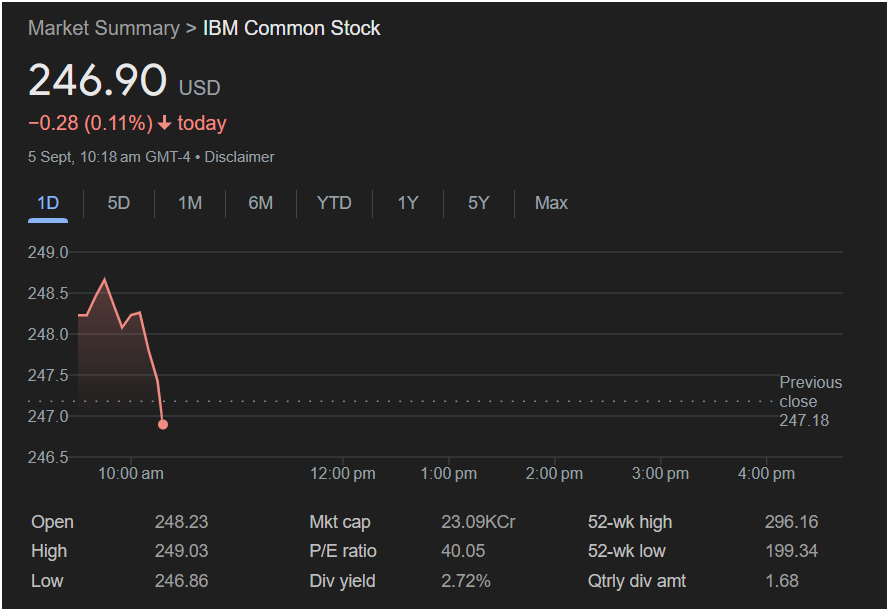

At the time of this particular observation, IBM’s stock stood at 246.90 USD. This figure, however, is not static; it is presented alongside a crucial piece of context: -0.28 (0.11%) today. This immediate indicator reveals that the stock has experienced a slight dip, a marginal decline in its value within the current trading day. While seemingly small, such percentages, when applied to a company of IBM’s scale, can represent significant shifts in market capitalization and investor wealth. The very presence of a “today” metric underscores the real-time nature of stock market analysis, where the most recent movements often heavily influence immediate perceptions and trading decisions.

The provided chart, detailing the “1D” (one-day) performance, visually reinforces this daily trajectory. Beginning around 10:00 am, the stock appears to open at a higher point, only to gradually trend downwards as the morning progresses towards 10:18 am. The line on the graph paints a picture of a gradual, yet consistent, decline during this short period. The visual representation of data is often more impactful than raw numbers, allowing for a quick grasp of trends and patterns that might otherwise be obscured in tables of figures. This immediate visual tells us that the early hours of trading on this specific day have not been entirely favorable for IBM’s stock price.

Beyond the real-time movement, other vital statistics are presented, offering a broader context to the daily snapshot. The Previous close at 247.18 serves as a critical benchmark. It represents the stock’s closing price from the preceding trading day, providing a point of comparison against which the current day’s performance can be measured. The difference between the previous close and the current price further elucidates the extent of the daily change, confirming the observed decline from yesterday’s closing value.

The Open price for the day, 248.23, reveals where trading commenced. Comparing this to the current price of 246.90 USD, it’s evident that the stock opened higher than its current value, further emphasizing the downward trend observed within the early hours of trading. This initial opening price often sets the tone for the day, and subsequent movements can be seen as deviations from this starting point.

The High and Low figures for the day, 249.03 and 246.86 respectively, encapsulate the full range of price fluctuations experienced within this trading session up to the reported time. The high represents the peak price the stock reached, while the low marks its lowest point. The current price of 246.90 USD is very close to the day’s low, suggesting that the stock is currently trading near its minimum value for the observed period, and has fallen significantly from its daily high. These figures are crucial for traders and investors looking to understand volatility and potential price targets or stop-loss levels.

Delving into the more fundamental aspects of the company’s valuation, the Mkt cap (Market Capitalization) is listed as 23.09KCr. This substantial figure represents the total value of all of IBM’s outstanding shares, calculated by multiplying the current share price by the total number of shares in circulation. Market capitalization is a key metric for understanding the size and overall value of a company, and for comparing it against its peers or the broader market. The unit “KCr” likely signifies “thousand Crores,” a unit of measurement common in certain financial markets, highlighting the truly immense scale of IBM’s market presence.

The P/E ratio (Price-to-Earnings ratio) stands at 40.05. This widely used valuation metric compares a company’s current share price to its earnings per share (EPS). A higher P/E ratio can suggest that investors are expecting higher earnings growth in the future, or that the stock is considered overvalued relative to its current earnings. Conversely, a lower P/E ratio might indicate that a stock is undervalued or that investors have lower growth expectations. The interpretation of a P/E ratio is highly dependent on the industry, company-specific factors, and broader market conditions, making it a critical tool for comparative analysis.

Further insights into the company’s financial health and investor appeal are provided by the Div yield (Dividend Yield) of 2.72% and the Qtrly div amt (Quarterly Dividend Amount) of 1.68. The dividend yield indicates the percentage of a company’s share price that is paid out as dividends to shareholders annually. For income-focused investors, a consistent and attractive dividend yield can be a significant draw. The quarterly dividend amount specifies the actual cash payment per share that shareholders receive every three months. For a company like IBM, which has a long history of paying dividends, these figures underscore its commitment to returning value to its shareholders, which can contribute to long-term investor loyalty and stability.

Finally, the 52-wk high of 296.16 and the 52-wk low of 199.34 provide a much broader perspective on IBM’s stock performance over the past year. These figures delineate the highest and lowest prices the stock has traded at within a 52-week period, offering valuable context for assessing the current price. The current price of 246.90 USD sits roughly in the middle of this 52-week range. This longer-term view helps investors understand the stock’s historical volatility and its price extremes, informing decisions about whether the current price represents a good entry point or a high-risk proposition relative to its annual performance.

The various time horizons presented for the chart – 1D, 5D, 1M, 6M, YTD, 1Y, 5Y, and Max – signify the availability of more extensive historical data. While only the “1D” view is actively displayed in the provided image, the presence of these other options highlights the importance of analyzing stock performance across different timeframes. A stock’s daily movement might be a short-term blip, but its long-term trend, observable over months or years, provides a more comprehensive understanding of its underlying strength and market trajectory. Investors often toggle between these views to identify both immediate opportunities and sustained patterns, crucial for both short-term trading and long-term investment strategies.

In essence, this market summary for IBM Common Stock is more than just a collection of numbers; it’s a dynamic data point within the complex ecosystem of global finance. It encapsulates the immediate impact of market forces, offers fundamental valuation metrics, and provides historical context, all within a single, digestible view. For anyone tracking IBM, this snapshot serves as a critical update, informing decisions and shaping perceptions about one of the technology world’s enduring giants. The story of IBM’s stock, like that of any major corporation, is a continuous narrative, with each day adding new chapters of price movements, investor reactions, and evolving market conditions. This particular snapshot, with its slight dip in early trading, represents just one such chapter, leaving the broader story to unfold with each subsequent minute of market activity.

The information presented here is not an isolated event but a consequence of a myriad of factors. For example, the general market sentiment on September 5th could play a significant role. Is the broader market experiencing a downturn, or is this specific to IBM? News related to IBM’s recent product launches, strategic partnerships, quarterly earnings reports, or even executive changes could all contribute to investor confidence or skepticism. A recent analyst downgrade or upgrade could also sway the price. The global economic outlook – concerns about inflation, interest rate hikes, or geopolitical stability – often has a ripple effect across all stock markets, including individual stocks like IBM.

Furthermore, sector-specific trends are crucial. The technology sector, where IBM operates, is constantly evolving. Competition from other tech giants, the emergence of disruptive technologies, or shifts in consumer and enterprise demand can all impact IBM’s perceived value and future prospects. For instance, if a competitor announced a groundbreaking innovation, it might put pressure on IBM’s stock. Conversely, a major contract win or a positive announcement regarding its cloud computing or artificial intelligence initiatives could spur growth.

The trading volume, though not explicitly provided in this summary, is another essential piece of the puzzle. High trading volume accompanying a price drop could indicate strong conviction among sellers, while low volume might suggest a less significant, perhaps temporary, dip. Understanding the volume behind price movements provides a deeper insight into the strength of a trend.

Looking at the P/E ratio of 40.05, it’s worth noting that this is a relatively high multiple. For some investors, a high P/E could signal an overvalued stock, while for others, it might reflect strong expectations for future earnings growth. IBM, being a mature company, typically doesn’t exhibit the explosive growth seen in younger tech firms, so a P/E in this range often warrants closer examination against industry averages and historical trends for the company itself. The nature of its business – a mix of legacy hardware, software, consulting, and burgeoning cloud/AI services – also influences how its P/E is percei