Intuit Inc. Stock Performance: Modest Gains in the Early Market

Intuit Inc. (NASDAQ: INTU) is a leader in financial software, offering a range of products designed to assist individuals, small businesses, and accountants with tasks such as tax preparation, accounting, and financial management. Known for its flagship products like TurboTax, QuickBooks, and Mint, Intuit has revolutionized how millions of consumers and businesses manage their finances.

The company operates in a dynamic space, continually evolving its product offerings to adapt to the changing needs of both individuals and enterprises. With a focus on artificial intelligence (AI) and cloud-based solutions, Intuit remains committed to simplifying financial management for its users while expanding its reach through strategic acquisitions and new product development.

Today’s Market Performance: Subtle Gains in Early Trading

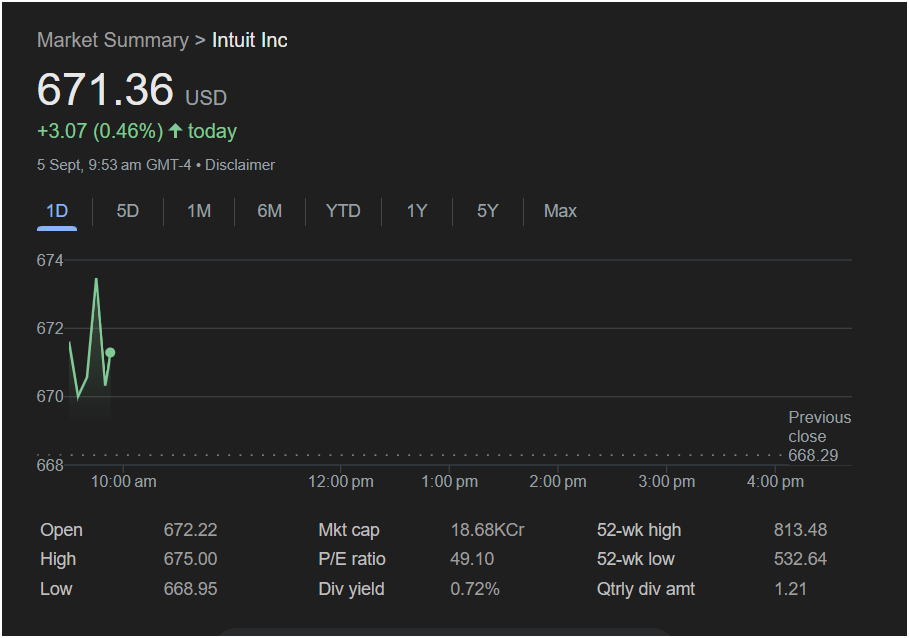

On September 5th, Intuit Inc. opened the market at $672.22, and by 9:53 AM GMT-4, the stock had increased to $671.36, reflecting a +0.46% rise from the previous closing price of $668.29. The gain of $3.07 demonstrates a relatively stable upward movement in the stock price, indicating that investor sentiment remains cautiously positive.

Interestingly, the stock chart shows a notable upward spike shortly after the market opened, with Intuit reaching a high of $675.00 before pulling back slightly to the current price of $671.36. This indicates some early excitement, possibly driven by new product news or investor anticipation about the company’s future financial performance.

Intraday Price Range: A Subtle Fluctuation

Opening Price vs. Intraday Range

- Open: $672.22

- High: $675.00

- Low: $668.95

The stock opened at $672.22, slightly above the previous day’s close. It then surged to a high of $675.00, a modest but notable increase, before pulling back to the current level. This fluctuation suggests a mild volatility in investor sentiment, as the stock briefly moved upwards before stabilizing near the opening price.

Comparison With Previous Close

The stock’s previous close was $668.29, and today’s price of $671.36 represents a +0.46% increase. While this is a smaller percentage gain compared to some other stocks, it is still a positive performance, especially considering that Intuit is known for having relatively steady movements due to its mature business model and consistent performance.

Key Financial Metrics: Intuit’s Market Position

Market Capitalization

Intuit currently holds a market capitalization of 18.68KCr (roughly $186.8 billion), positioning it as one of the dominant players in the financial software industry. This market cap indicates a highly valuable company that benefits from its strong brand presence and customer loyalty, particularly in its core areas of tax preparation and accounting software.

P/E Ratio and Dividend Yield

- P/E Ratio: 49.10

- Dividend Yield: 0.72%

- Quarterly Dividend Amount: $1.21

Intuit’s P/E ratio of 49.10 is on the higher end, suggesting that investors are paying a premium for each dollar of earnings. This elevated ratio reflects strong future growth expectations, especially as Intuit continues to integrate AI-driven features into its software offerings.

The dividend yield of 0.72% is modest, reflecting the company’s strategy of reinvesting profits back into its business rather than paying out substantial dividends. The quarterly dividend amount of $1.21 is a steady payout for investors, aligning with Intuit’s focus on long-term growth.

52-Week Range: A Year of Growth and Opportunity

- 52-Week High: $813.48

- 52-Week Low: $532.64

Intuit’s stock price is currently trading at $671.36, placing it closer to the 52-week low of $532.64 than the 52-week high of $813.48. While the stock is not near its peak, it still demonstrates strong performance within its broader range. The price action suggests that the stock has experienced some volatility in the past year, with significant room for growth should investor sentiment improve or new business developments come to fruition.

Market Sentiment: Why the Gains?

The early gain of 0.46% in Intuit’s stock today could be attributed to multiple factors, including broader market trends or specific news related to the company. Intuit’s position in the financial technology space makes it sensitive to broader economic conditions, particularly tax season dynamics, small business growth, and the increasing adoption of cloud-based solutions.

Intuit’s Role in Financial Software Innovation

One of the key factors driving investor confidence in Intuit is its ability to stay at the forefront of technological advancements, particularly in artificial intelligence (AI) and cloud computing. Intuit’s continued investment in automation, machine learning, and data analytics has positioned it well to capture market share in both the consumer and small business segments.

For instance, QuickBooks Online and TurboTax continue to evolve, with new AI-powered features that allow users to automate tasks and gain better financial insights. These innovations not only enhance user experience but also help businesses and individuals make more informed decisions in real time.

Economic and Sectoral Factors at Play

In the current economic environment, inflation, interest rates, and consumer confidence can all impact software companies like Intuit. As the world recovers from the economic disruptions caused by the pandemic, many small businesses are increasingly turning to digital solutions for accounting, tax management, and financial planning. This provides Intuit with a steady stream of potential customers, fueling growth prospects in the long term.

Moreover, as governments and enterprises push for digital transformation, Intuit is well-positioned to capture an expanding market of cloud-based financial services. However, as the tech sector faces increased regulatory scrutiny and competitive pressures, it remains to be seen how Intuit will navigate these challenges.

Intuit’s Competitive Edge in Financial Technology

Intuit operates in a competitive environment, with major players such as H&R Block, Xero, FreshBooks, and Sage competing for market share in the personal and small business accounting sectors. However, Intuit’s brand recognition, customer loyalty, and product ecosystem give it a considerable edge in the market.

The company’s stronghold in the tax preparation and small business accounting sectors has allowed it to build a solid foundation, but its continued innovation will be key in staying ahead of rivals in the fast-paced world of financial technology.

Institutional Investor Behavior and Analyst Sentiment

The behavior of institutional investors and analysts will be crucial in determining Intuit’s future performance. Large institutional investors typically favor companies with consistent growth, strong fundamentals, and a dominant market position. Intuit’s strong financials, combined with its focus on AI and data-driven services, make it a favorite among institutional investors.

Analysts often look to quarterly earnings reports, customer acquisition metrics, and product updates to gauge the company’s ongoing success. The steady but moderate price movement observed today suggests that analysts and investors are awaiting more concrete signals of future growth before making significant moves.

Looking Ahead: The Path Forward for Intuit

While the stock price today reflects a small uptick, the broader outlook for Intuit remains tied to its ability to continue innovating and adapting to changes in both the tech and financial sectors. As artificial intelligence and cloud-based solutions continue to gain prominence, Intuit’s strategic investments will likely shape its future direction.

Furthermore, the company’s ongoing efforts to expand its offerings through acquisitions and partnerships, particularly in payment solutions and financial automation, could provide substantial growth opportunities in the coming years.

In conclusion, this analysis of Intuit’s stock performance offers a snapshot of how the company is positioned in the broader market, and further developments will continue to shape investor sentiment. If you’re interested in delving deeper into any of the following aspects, feel free to ask for a more detailed exploration:

- Product innovation and AI development

- Intuit’s growth strategies

- Acquisitions and market expansion

- Industry trends and digital transformation

- Quarterly earnings and financial analysis

Let me know if you’d like to continue expanding or shift focus toward another area.