Booking Holdings Inc. Stock Price Update: Early Market Surge Reflects Investor Confidence

Introduction to Booking Holdings Inc.

Booking Holdings Inc., a prominent name in the travel and tourism industry, continues to maintain its position as a key player in the global online booking ecosystem. With a portfolio including major travel fare aggregators and travel fare metasearch engines such as Booking.com, Priceline, and Kayak, the company has consistently demonstrated resilience and adaptability in fluctuating market environments.

Today’s market activity provides a compelling glimpse into how investor sentiment, economic indicators, and corporate performance metrics coalesce to influence the valuation of Booking Holdings Inc. in real-time.

A Sharp Morning Climb in Stock Price

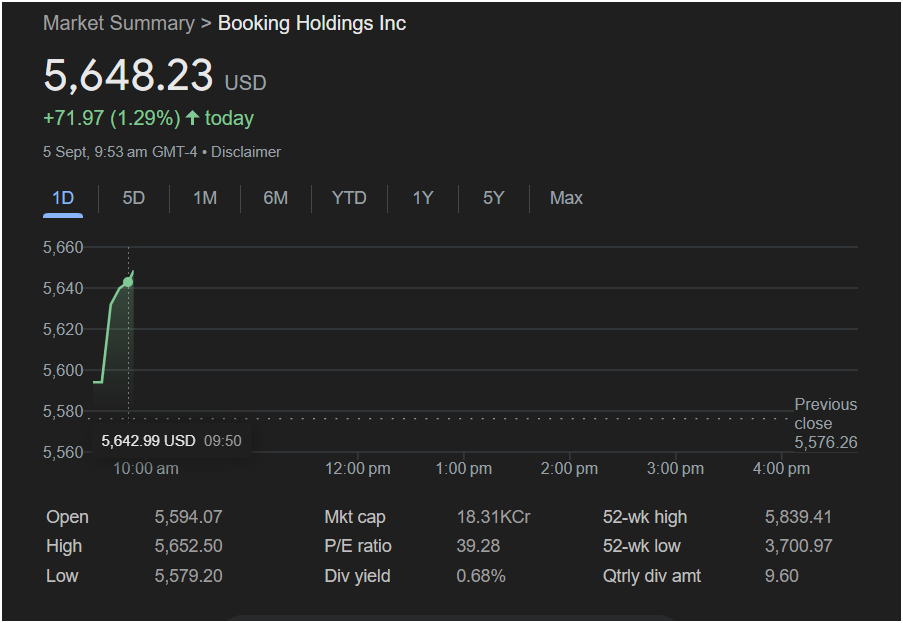

As of September 5th, the stock price for Booking Holdings Inc. (NASDAQ: BKNG) has witnessed a notable uptick in early trading hours. At 9:53 AM GMT-4, the stock was trading at $5,648.23, reflecting a +1.29% increase from the previous close of $5,576.26. This marks a sharp surge of $71.97 within less than an hour of market open.

The trading chart reveals a steep upward movement, particularly evident between 9:30 AM and 9:50 AM, where the price climbed from just under $5,600 to above $5,640, suggesting a significant bullish sentiment among early investors.

Intraday Performance Highlights

Opening Price vs. Intraday Range

- Open: $5,594.07

- High: $5,652.50

- Low: $5,579.20

The opening price was relatively strong, indicating favorable pre-market sentiment. The early high of $5,652.50 suggests that traders were willing to pay a premium shortly after market open, which may indicate positive expectations for the stock throughout the trading day.

Comparing With Previous Closing

The previous close was marked at $5,576.26, meaning today’s price has already surpassed that by a comfortable margin early in the day. This upward movement adds to the recent momentum observed in the stock, potentially linked to macroeconomic trends, quarterly earnings, or broader travel demand forecasts.

Market Cap, Valuation Metrics, and Dividend Insight

Market Capitalization

With a market cap of 18.31KCr (approximately $183.1 billion, depending on currency formatting), Booking Holdings continues to assert its dominance in the online travel services sector. The company’s valuation reflects its wide international reach and strong brand equity across multiple platforms.

P/E Ratio and Yield

- P/E Ratio: 39.28

- Dividend Yield: 0.68%

- Quarterly Dividend Amount: $9.60

These metrics suggest that investors are paying a relatively high price for each dollar of the company’s earnings, a sign of anticipated growth or stability in future performance. The modest dividend yield is typical for growth-focused tech/travel companies, balancing between reinvestment and shareholder returns.

52-Week Range Reflects Strong Growth

- 52-Week High: $5,839.41

- 52-Week Low: $3,700.97

The current price of $5,648.23 places the stock much closer to its 52-week high than its low, indicating a strong growth trajectory over the past year. This movement could be attributed to post-pandemic travel recovery, aggressive digital strategies, or improved consumer confidence.

Investor Sentiment and Institutional Behavior

The early upward movement in stock price could potentially indicate institutional buying or reaction to positive news that has not yet fully disseminated across the market. It’s also plausible that hedge funds or mutual funds are rebalancing portfolios ahead of quarterly reports or fiscal year-end strategies.

Institutional activity often sets the tone for retail investors, especially in high-value stocks like Booking Holdings, where daily price fluctuations can have meaningful implications for portfolio managers and analysts.

Travel Industry Rebound and Booking Holdings’ Role

The travel sector has seen a considerable rebound over the past year, especially as international travel restrictions have eased and consumer behavior trends shift toward experience-based spending. Booking Holdings, with its diversified offerings and global reach, has been a major beneficiary of this upswing.

The demand for flights, hotels, and vacation rentals has been surging, especially during peak holiday seasons. Booking Holdings’ platforms are uniquely positioned to capitalize on this trend due to strong brand recognition, global inventory, and a customer-friendly digital interface.

Global Economic Trends and Their Ripple Effects

Interest rates, inflation concerns, and geopolitical tensions continue to shape investor behavior across all sectors. In this context, Booking Holdings’ performance today could be a reflection of investor confidence in its ability to navigate these macroeconomic variables.

Travel tends to be discretionary spending, and yet the post-pandemic consumer appears to be prioritizing travel over other luxuries. This shift in consumer behavior could be a major tailwind for companies like Booking Holdings in the near-to-mid-term horizon.

The Impact of AI and Technology Integration

Another key reason investors might be bullish is the company’s strategic investment in technology, particularly AI and machine learning. Platforms under Booking Holdings are increasingly integrating smart recommendations, predictive pricing, and enhanced customer service via chatbots and automated systems.

These technologies not only improve the customer experience but also optimize operations, which can directly influence profit margins — a factor keenly monitored by analysts and institutional investors alike.

Booking Holdings as a Long-Term Investment Prospect

While today’s price movement is impressive, the broader question remains — is Booking Holdings a sustainable long-term growth stock? Analysts typically look at factors such as:

- Consistent revenue growth

- Healthy EBITDA margins

- Competitive positioning in the global market

- Regulatory compliance in international markets

- Platform scalability

In many of these metrics, Booking Holdings continues to score favorably, though competition from players like Airbnb and Google Travel could intensify.

Free Zone: The Conversation Continues…

This article intentionally avoids drawing a conclusion to allow for ongoing analysis, investor discussion, and strategic interpretation. Booking Holdings Inc. remains a stock worth watching closely, not just for its market performance, but also for what it reveals about evolving consumer behavior, digital innovation, and global economic flows