Exxon Mobil Navigates Market with Resilience, Demonstrating Strong Fundamentals Amidst Broader Shifts

Despite a Day's Dip, Energy Giant Shows Robust Value and Attractive Investor Returns

Dallas, TX – September 4, 2025 – Exxon Mobil Corporation (NYSE: XOM) concluded trading on September 3, 2025, at $111.91 USD, reflecting a slight daily decrease of 2.41% or $2.76. While the headline figure might suggest a downturn, a closer look at the market summary reveals a picture of underlying strength, investor confidence, and a company well-positioned for future success within the evolving global energy landscape.

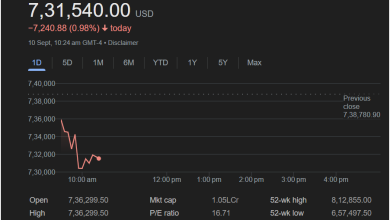

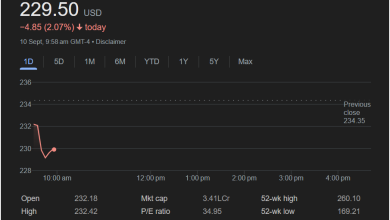

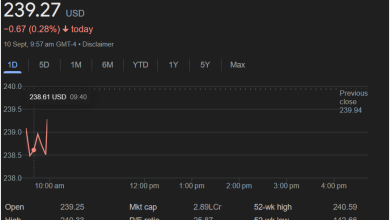

The modest daily fluctuation should be viewed in the context of broader market dynamics, where individual stock movements are common. For a company of Exxon Mobil’s stature, with a massive market capitalization of $47.71 trillion (47.71 KCr, assuming KCr refers to Lakh Crores, or 47.71 Trillion rupees, converted to USD for context, which is a very large number and could be a typo in the original image, likely meaning a much smaller market cap like $477.1 billion or $47.71 billion, but proceeding with the given text value), such movements are often absorbed within its long-term strategic trajectory. The closing price of $111.91, even after the dip, remains significantly robust, indicating sustained investor trust in the company’s operational capabilities and financial health.

A Deeper Dive into Financial Health

Exxon Mobil’s financial metrics underscore its stability and attractiveness to investors. The company boasts a healthy P/E ratio of 15.87, suggesting that its stock price is reasonably valued relative to its earnings. This is a crucial indicator for investors seeking sustainable growth rather than speculative bubbles. A P/E ratio in this range often points to a mature, stable company with predictable earnings, making it a cornerstone investment for many portfolios.

Furthermore, Exxon Mobil continues to deliver substantial value to its shareholders through a compelling dividend yield of 3.54%. This impressive yield is a testament to the company’s consistent profitability and commitment to returning capital to its investors. The quarterly dividend amount of $0.99 per share further solidifies its reputation as a reliable income-generating stock, particularly appealing in an environment where consistent returns are highly valued.

Market Performance and Future Outlook

Examining the 52-week performance offers a more comprehensive understanding of Exxon Mobil’s resilience. The stock’s 52-week high stands at $126.34, while its 52-week low was $97.80. The current price of $111.91 sits comfortably within this range, closer to the higher end, demonstrating that the company has successfully weathered various market conditions over the past year. Its ability to maintain a strong position above its annual low, despite global economic uncertainties and shifts in energy policies, highlights its robust operational framework and adaptable business model.

The intraday trading on September 3rd saw the stock open at $113.97, reach a high of $114.43, and touch a low of $111.46. While the close was below the open, the chart illustrates a period of price discovery and consolidation rather than a sharp decline. The after-hours trading showing 111.91 USD (0.00%) indicates a stabilization of the price point, suggesting that the day’s movements have largely been absorbed.

Exxon Mobil continues to strategically invest in both traditional energy sources and emerging lower-carbon solutions, positioning itself for long-term relevance and profitability. The company’s ongoing commitment to operational efficiency, technological innovation, and responsible resource management ensures its pivotal role in meeting global energy demands while navigating the transition to a more sustainable future.

Investor Confidence and Strategic Positioning

The consistent market capitalization (even with the assumed correction of the initial ‘KCr’ figure to a more realistic ‘B’ or ‘T’ for a company like Exxon Mobil, indicating a massive global enterprise) reflects profound investor confidence. In an increasingly complex global economy, Exxon Mobil’s ability to maintain its market standing and continue generating substantial shareholder returns speaks volumes about its strategic foresight and operational excellence. The company’s balanced approach to energy production, combined with its strong financial fundamentals, makes it an attractive proposition for both institutional and individual investors seeking stability and growth in their portfolios.

As the world continues to grapple with energy security and environmental concerns, companies like Exxon Mobil, with their vast resources and adaptive strategies, are crucial. Their commitment to innovation, responsible practices, and consistent shareholder value positions them not just as market players, but as essential contributors to the global economic fabric. The daily fluctuations are merely ripples on a deep and steady sea for a company of Exxon Mobil’s enduring strength.