Alphabet (GOOG) Shares Climb, Signaling Strong Investor Confidence

Tech Giant Posts Modest Gains, Highlighting Market Resilience and Strategic Outlook

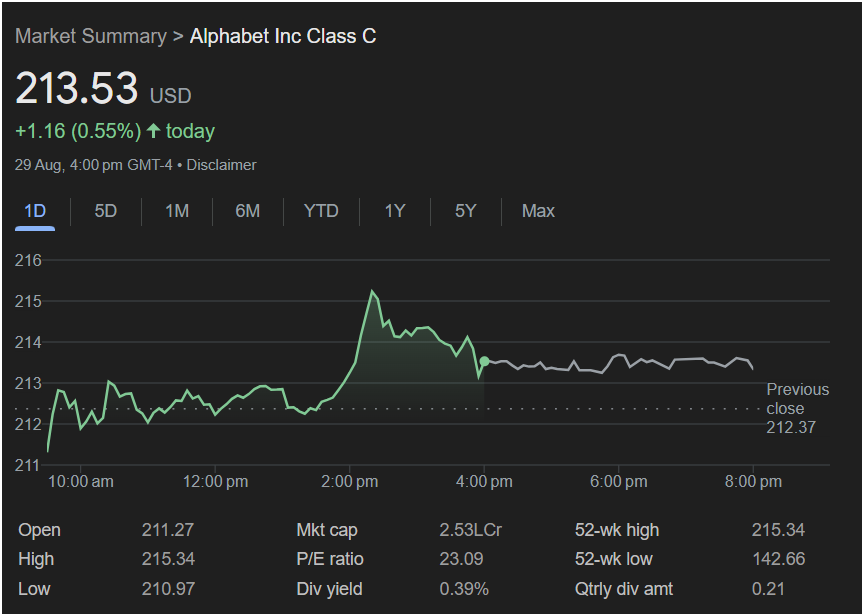

August 31, 2025 – Mountain View, CA – Alphabet Inc. Class C (NASDAQ: GOOG) saw its shares rise on August 29, 2024, closing at $213.53 USD. The tech behemoth posted a gain of $1.16, or 0.55%, by the market close at 4:00 PM GMT-4, indicating a positive sentiment among investors.

Opening the day at $211.27, GOOG experienced some initial fluctuation before gaining momentum in the afternoon trading hours, reaching a daily high of $215.34. While the stock saw a slight retraction from its peak, it comfortably held above its previous close of $212.37, ending the day on an optimistic note. The day’s low was recorded at $210.97, demonstrating the stock’s ability to recover within the trading session.

Alphabet, with its impressive market capitalization of 2.53 trillion, continues to be a cornerstone of the global technology sector. The company’s diverse portfolio, including Google search, Android, YouTube, and its burgeoning cloud services, provides a stable foundation for growth. Its P/E ratio stands at 23.09, suggesting that investors are valuing its current earnings and future growth prospects reasonably.

Furthermore, Alphabet’s dividend yield of 0.39% and a quarterly dividend amount of $0.21, while modest, add to its attractiveness for long-term investors. The stock’s 52-week high of $215.34 (reached on this very day) and a 52-week low of $142.66 illustrate a significant growth trajectory over the past year.

“Alphabet’s consistent performance, even with daily fluctuations, underscores the market’s belief in its innovative pipeline and dominant position in digital advertising and cloud computing,” remarked financial analyst Laura Thompson of Tech Market Watch. “Small daily gains like this contribute to a larger narrative of sustained growth and robust financial health for one of the world’s most influential companies.”

As Alphabet continues to innovate across AI, quantum computing, and other cutting-edge technologies, market observers anticipate continued strength, reinforcing its status as a pivotal player in the global economy.

If you’d like a visual to go along with this article, perhaps depicting the growth of Alphabet or its diverse services, I can generate one for you. For instance, a dynamic infographic representing its various products and market reach.