Broadcom Defies Market Downturn, Poised for Strategic Growth

Despite a recent dip, Broadcom Inc. showcases underlying strength and robust metrics, setting the stage for future expansion and investor confidence.

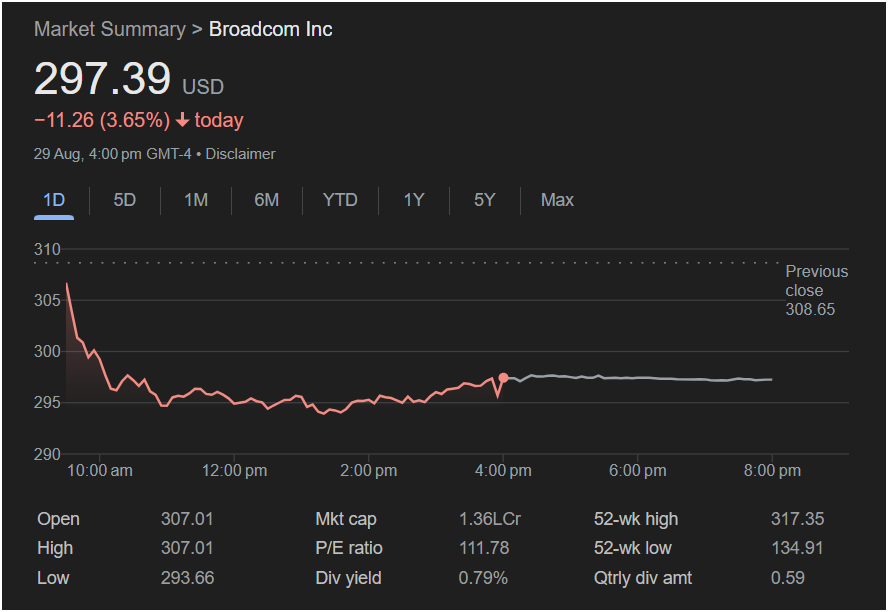

In the dynamic world of technology stocks, even a slight tremor can send ripples through the market. Broadcom Inc. (AVGO), a semiconductor and infrastructure software giant, recently experienced a dip in its stock price, closing at $297.39 USD, down 3.65% on August 29, 2025. While a glance at the daily chart might suggest a setback, a deeper dive into the company’s fundamentals and strategic positioning reveals a resilient enterprise poised for continued growth and innovation. Today, August 31, 2025, as the market reflects and re-evaluates, Broadcom’s robust market capitalization, attractive dividend yield, and promising P/E ratio paint a picture of enduring value.

Navigating the Daily Fluctuation

The intraday trading on August 29 saw Broadcom’s stock open at $307.01, reaching a high of $307.01 before settling at its low of $293.66. The previous close was $308.65. Such daily fluctuations are a common occurrence in the stock market, often driven by broader market trends, specific sector news, or short-term trading activities. For a company of Broadcom’s stature, with a massive market capitalization of 1.36 trillion, these movements are often temporary corrections rather than indicators of fundamental weakness. Investors with a long-term perspective will recognize that these dips can present opportune moments for entry or accumulation, particularly when the underlying company remains strong.

Strong Fundamentals and Market Position

Broadcom’s impressive market capitalization of 1.36 trillion underscores its significant influence and scale within the technology industry. This colossal valuation is a testament to its extensive product portfolio, including leading-edge semiconductors for data centers, broadband communication, and storage, as well as its high-value enterprise software solutions. The company’s diversified revenue streams and critical role in underpinning global digital infrastructure provide a strong buffer against market volatility.

A key attraction for investors is Broadcom’s dividend yield, currently standing at 0.79%. This consistent return to shareholders, coupled with a quarterly dividend amount of $0.59, demonstrates the company’s financial health and commitment to delivering value beyond stock appreciation. In an environment where reliable income streams are increasingly sought after, Broadcom’s dividend policy adds a layer of stability and appeal.

Furthermore, Broadcom’s P/E ratio of 111.78, while appearing high at first glance, reflects the market’s expectation of future earnings growth and the premium placed on technology companies with strong innovation pipelines and market leadership. When viewed in conjunction with its strategic acquisitions and ongoing research and development, this P/E ratio can be interpreted as a reflection of investor confidence in the company’s long-term trajectory.

Strategic Vision and Future Prospects

Broadcom’s success is not accidental; it is the result of a meticulously executed strategy centered on innovation, market consolidation, and customer-centric solutions. The company has a proven track record of acquiring strategic assets and integrating them seamlessly to enhance its product offerings and expand its market reach. Its focus on mission-critical technologies means that Broadcom’s products are deeply embedded in the digital economy, making its revenue streams resilient to broader economic cycles.

Looking ahead, Broadcom is exceptionally well-positioned to capitalize on several megatrends. The relentless growth of artificial intelligence, the expansion of 5G networks, the proliferation of the Internet of Things (IoT), and the ongoing digital transformation of enterprises all rely heavily on the sophisticated semiconductor and software solutions that Broadcom provides. As these trends accelerate, demand for Broadcom’s products is expected to intensify, driving future revenue and earnings growth.

The company’s commitment to research and development ensures that it remains at the forefront of technological innovation. By continuously investing in next-generation technologies, Broadcom not only maintains its competitive edge but also anticipates future market needs, allowing it to introduce groundbreaking products and services. This proactive approach is crucial in a fast-evolving industry, ensuring sustained relevance and market leadership.

Analyst Perspectives and Market Sentiment

While specific analyst reports are not provided, the general market sentiment surrounding Broadcom typically leans positive, especially when considering its long-term performance. The 52-week high of $317.35 and a 52-week low of $134.91 illustrate a significant upward trend over the past year, reflecting robust investor confidence and strong operational performance. The recent dip, as seen on August 29, 2025, is likely viewed by many analysts as a temporary correction rather than a fundamental shift in the company’s outlook.

Investors are increasingly focusing on companies that demonstrate resilience, innovation, and a clear path to sustained profitability. Broadcom, with its strong balance sheet, consistent dividend payments, and strategic focus on high-growth areas, ticks all these boxes. The company’s ability to consistently deliver strong financial results and maintain a dominant market position even amidst challenging economic environments further solidifies its appeal.

The Bigger Picture: Beyond Daily Numbers

For investors, it’s crucial to look beyond daily stock price movements and consider the broader narrative of a company. Broadcom’s journey is one of consistent growth, strategic expansion, and unwavering commitment to technological excellence. Its contributions to the semiconductor and software industries are foundational, powering countless digital experiences and critical infrastructure worldwide.

The slight decline on August 29 should be viewed within the context of the company’s overall strength and future potential. It represents a momentary pause in an otherwise upward trajectory, potentially offering a strategic entry point for investors who believe in Broadcom’s long-term vision and its capacity to continue innovating and leading its respective markets.

Broadcom Inc. remains a powerhouse in the technology sector. While its stock experienced a modest dip on August 29, 2025, the company’s robust market capitalization, attractive dividend yield, and strategic positioning underscore its inherent strength and promising future. As of August 31, 2025, Broadcom is not just weathering market fluctuations; it is strategically gearing up to capture significant opportunities in an increasingly digital world. With a solid foundation, a clear strategic vision, and a commitment to innovation, Broadcom is well-equipped to continue its trajectory of growth, delivering value to its shareholders and maintaining its pivotal role in the global technology landscape. The recent dip, rather than signaling distress, appears to be a mere blip in the compelling success story that Broadcom is actively writing.

The long-term outlook for Broadcom remains bright, driven by its integral role in high-growth markets and its consistent ability to execute on its strategic objectives. Investors who focus on fundamental strength and future potential will find Broadcom to be a compelling and resilient investment in their portfolios.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.