Alphabet (GOOG) Ends Trading Week on a High Note, Analysts Optimistic

Tech Giant Posts Modest Gains as Market Awaits Future Innovations and Q3 Projections

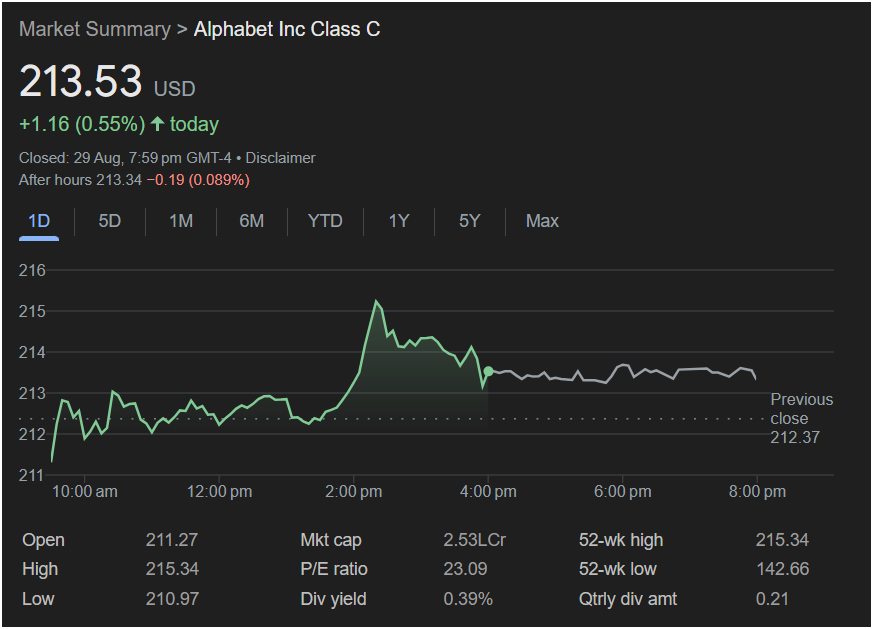

New York, NY – August 30, 2025 – Alphabet Inc. (NASDAQ: GOOG), the parent company of Google, demonstrated a steady performance at the close of trading on August 29th, setting a positive tone for investors as the market heads into the weekend. The Class C shares, trading under the ticker GOOG, finished the session at a solid $213.53, marking a healthy increase of $1.16, or 0.55%, by the market’s close at 7:59 PM GMT-4.

The day’s trading saw Alphabet’s stock fluctuate, opening at $211.27 and reaching a high of $215.34. The low for the day was recorded at $210.97, indicating a dynamic yet ultimately upward trajectory. This movement highlights continued investor confidence in the tech behemoth, even amidst broader market discussions. The stock’s previous close was $212.37, making the day’s gain a notable positive shift. After-hours trading saw a slight dip of $0.19 (-0.089%), bringing the price to $213.34, which is typical for post-market adjustments and doesn’t significantly detract from the day’s overall positive sentiment.

With a substantial market capitalization of 2.53 trillion USD, Alphabet continues to be a dominant force in the global economy. Its P/E ratio stands at 23.09, suggesting that investors are willing to pay a premium for its earnings, a common indicator of strong growth expectations. The company also offers a dividend yield of 0.39% with a quarterly dividend amount of $0.21, providing some return for long-term shareholders.

Looking at the broader context, Alphabet’s 52-week high currently sits at $215.34, which it touched during yesterday’s trading, demonstrating that the stock is performing at the upper end of its annual range. The 52-week low of $142.66 provides a stark contrast, underscoring the significant appreciation the stock has experienced over the past year.

Analysts are closely watching Alphabet for upcoming announcements, particularly regarding its advancements in artificial intelligence, cloud computing (Google Cloud), and ongoing regulatory discussions impacting its advertising business. The company’s consistent investment in research and development, coupled with its expansive ecosystem of products and services, positions it strongly for sustained growth.

As we move further into the third quarter of 2025, attention will turn to Alphabet’s next earnings report, where stakeholders will be keen to assess revenue streams, profit margins, and guidance for the remainder of the fiscal year. The recent positive close of GOOG shares suggests a resilient company that continues to adapt and innovate in a rapidly evolving technological landscape, maintaining its appeal to both institutional and individual investors alike.