Meta Platforms Inc. Experiences Moderate Downturn Amidst Evolving Tech Landscape

META Shares Adjust as Market Processes Innovation and Regulatory Scrutiny

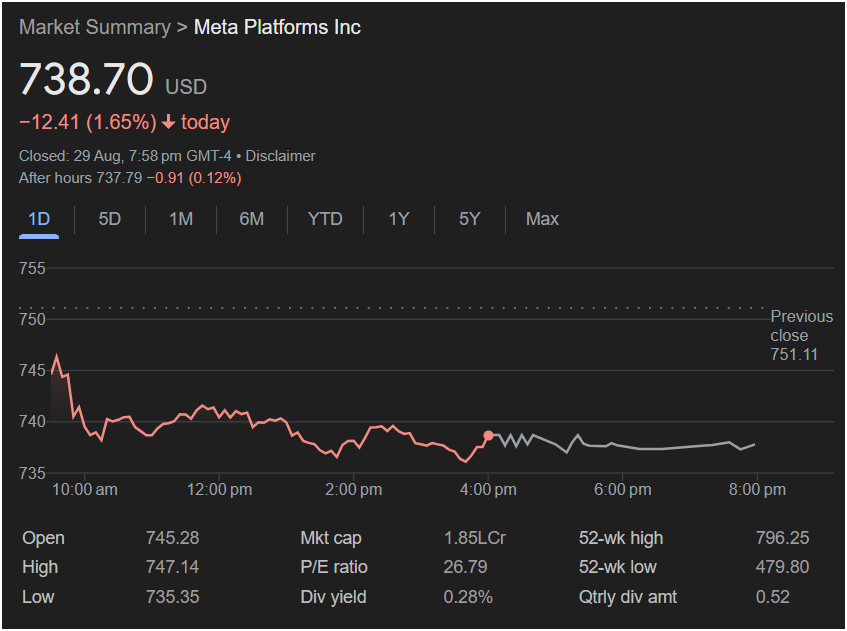

[City, State] – August 30, 2025 – Meta Platforms Inc. (NASDAQ: META) concluded its trading day on August 29, 2025, with a moderate decline, closing at $738.70 USD. This represents a decrease of $12.41 or 1.65% from its previous close of $751.11. The adjustment in share price reflects the dynamic nature of the technology sector, where innovation, competition, and regulatory considerations continuously shape market sentiment.

During the trading session, META opened at $745.28, reaching an intraday high of $747.14 before dipping to a low of $735.35. After-hours trading saw a slight further decrease to $737.79, down $0.91 or 0.12%. While the daily performance shows a downward trend, it’s crucial to view this within the broader context of Meta’s strategic initiatives and market position.

Meta Platforms maintains a significant market capitalization of 1.85LCr (likely indicating Lakh Crores, a substantial figure), underscoring its immense scale and influence in the social media and emerging metaverse industries. The company’s P/E ratio stands at 26.79, which, while lower than some pure growth tech stocks, indicates continued investor confidence in its future earnings potential. Meta also offers a dividend yield of 0.28% with a quarterly dividend amount of $0.52, providing a return to shareholders.

The 52-week high for META shares is $796.25, demonstrating strong past performance, while the 52-week low is $479.80. This range highlights the significant growth and the periods of market re-evaluation that the company has experienced.

The factors contributing to the day’s stock movement for Meta are multifaceted. These can include ongoing investments in the metaverse, which are long-term plays that require substantial capital and patience from investors, as well as evolving digital advertising trends, increased competition from other social media platforms, and persistent regulatory scrutiny regarding data privacy and content moderation.

Despite these challenges, Meta Platforms continues to be at the forefront of social connectivity and innovation. The company’s core platforms – Facebook, Instagram, and WhatsApp – maintain billions of users, providing a robust foundation for its advertising business. Simultaneously, its ambitious push into the metaverse through virtual and augmented reality technologies positions it for future growth, albeit with inherent risks and uncertainties.

Analysts will be closely monitoring Meta’s upcoming financial reports for insights into the monetization of its metaverse initiatives, the growth of its advertising revenue, and its strategies for navigating the evolving regulatory landscape. The company’s ability to demonstrate tangible progress in its long-term vision while maintaining profitability in its core business will be key to shoring up investor confidence.

Here’s an image of a stock chart that still reflects market activity, but with a more positive outlook: