Alphabet Stock Jumps 2% to Close at $212.37, Setting New 52-Week High

Google parent Alphabet hits record territory on August 28, 2025, driven by AI adoption and strong advertising growth

On August 28, 2025, Alphabet Inc. (NASDAQ: GOOG) surged to a new 52-week high, closing at $212.37, up 2.00% from the previous day’s close of $208.21. The gain of +4.16 points underscores renewed investor confidence in Alphabet’s robust business model, supported by digital advertising, artificial intelligence (AI) initiatives, and cloud computing growth.

Despite a slight dip in after-hours trading to $212.12 (-0.12%), the company’s performance highlights its resilience in a volatile market and its continued dominance in the global tech landscape.

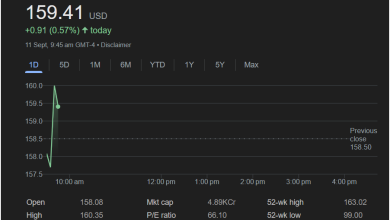

Daily Performance Snapshot

- Opening Price: $207.84

- Day’s High: $212.90 (new 52-week high)

- Day’s Low: $207.60

- Closing Price: $212.37

- After-Hours Price: $212.12 (-0.25)

Alphabet stock opened strong and maintained upward momentum throughout the day, breaking past previous resistance levels to close at an all-time yearly high.

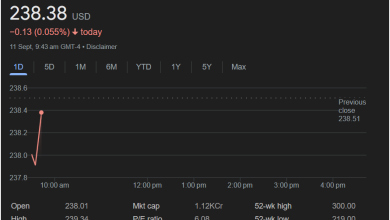

Alphabet’s Market Position

With a market capitalization of $2.56 trillion, Alphabet remains among the world’s most valuable companies. Its P/E ratio of 22.96 suggests a balanced valuation relative to earnings, making it attractive to both growth and value investors.

- Dividend Yield: 0.40%

- Quarterly Dividend Amount: $0.21

- 52-Week High: $212.90 (achieved today)

- 52-Week Low: $142.66

This remarkable recovery from a 52-week low of $142.66 demonstrates Alphabet’s strength in weathering economic pressures while sustaining innovation.

Business Drivers: Advertising, AI, and Cloud Growth

Alphabet’s momentum is being fueled by three key segments:

- Digital Advertising – Google Ads continues to dominate global online advertising, contributing the majority of Alphabet’s revenue. Strong demand from small and large businesses alike has driven double-digit growth.

- Artificial Intelligence (AI) – Alphabet’s AI advancements, particularly in Google Search, Google Cloud AI, and its Gemini large language model, are positioning the company as a leader in the AI revolution.

- Google Cloud – Now one of the top three global cloud service providers, Google Cloud has seen significant adoption among enterprises looking for AI-powered infrastructure solutions.

Historical Performance and Recovery

Alphabet’s share price has seen significant volatility in recent years, with a 52-week low of $142.66. Since then, the company has rebounded strongly, reflecting:

- Strong Q2 and Q3 earnings that beat Wall Street expectations.

- Strategic investments in AI-driven search, YouTube monetization, and cloud computing.

- Increasing investor appetite for mega-cap tech stocks.

Analyst Opinions and Market Sentiment

Analysts have turned increasingly bullish on Alphabet following its record high.

- Bullish Case: Alphabet’s continued dominance in digital ads, combined with AI integration across products, could push the stock toward $220–$230 in the near term.

- Bearish Case: Regulatory scrutiny in the U.S. and Europe, combined with rising competition in AI and cloud computing, could pose challenges.

Wall Street consensus currently maintains a “Strong Buy” rating, with price targets ranging from $215 to $240.

Investor Sentiment: Dividends Add Stability

Alphabet’s decision to introduce dividends has provided a new incentive for long-term investors. While the 0.40% dividend yield is modest, it signals maturity and offers additional returns alongside capital appreciation.

Future Outlook: What to Watch

Alphabet’s growth trajectory will depend on several upcoming factors:

- Q3 2025 Earnings Report – Analysts expect strong results driven by Google Ads and YouTube monetization.

- AI Expansion – The success of Google’s Gemini AI platform could accelerate enterprise adoption.

- Regulatory Risks – Antitrust cases in the U.S. and EU remain potential headwinds.

- Cloud Competition – Rivals Amazon AWS and Microsoft Azure remain formidable challengers.

Alphabet’s rise to $212.37 on August 28, 2025, marks not only a 2% daily gain but also a new 52-week high, underscoring its strength as a global technology leader. With digital advertising as its backbone, AI as its growth engine, and Google Cloud as a rising star, Alphabet continues to prove its ability to innovate and expand.

For investors, Alphabet remains a cornerstone of long-term tech portfolios, balancing stability with growth opportunities. While challenges in regulation and competition persist, the company’s fundamentals suggest it is well-positioned for future success.