Amazon Stock Rises 1.08% to Close at $231.60 as Investors Bet on E-Commerce and Cloud Growth

Amazon shares edge higher on August 28, 2025, supported by strong AWS momentum and resilient retail performance

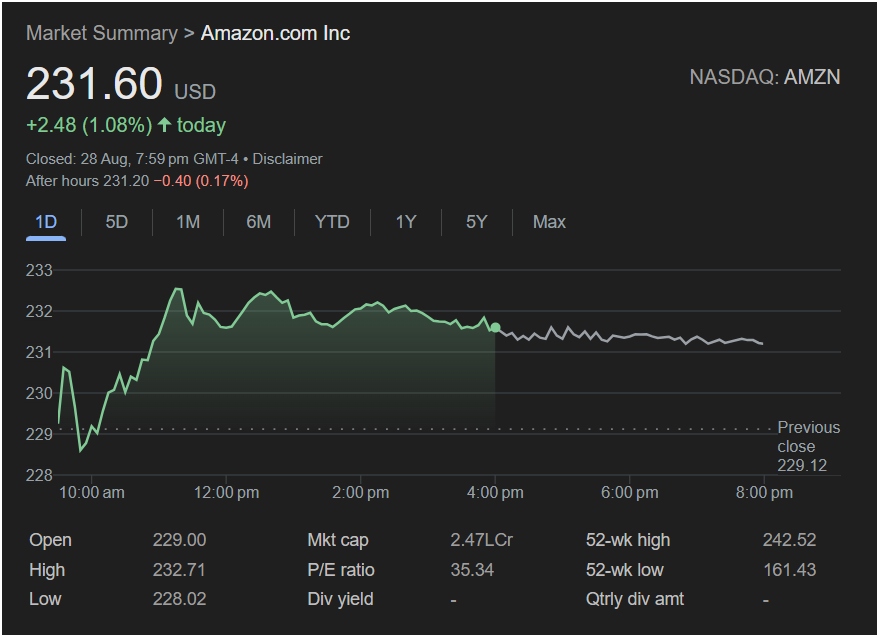

On August 28, 2025, Amazon.com Inc. (NASDAQ: AMZN), the global e-commerce and cloud computing leader, saw its shares climb 1.08%, closing at $231.60. The stock gained $2.48 compared to the previous day’s close of $229.12, reflecting positive investor sentiment as the company continues to strengthen its position across multiple sectors, including retail, logistics, advertising, and cloud services (AWS).

Although shares dipped slightly in after-hours trading to $231.20 (-0.17%), the broader trend highlights Amazon’s resilience in an increasingly competitive technology and retail environment.

Daily Stock Performance

- Opening Price: $229.00

- Day’s High: $232.71

- Day’s Low: $228.02

- Closing Price: $231.60

- After-Hours Price: $231.20 (-0.40)

Amazon stock opened with modest momentum, briefly retreating to $228.02 in morning trading. However, buying pressure soon lifted shares to an intraday high of $232.71, before closing the day in positive territory above $231.

Amazon’s Market Strength

With a market capitalization of $2.47 trillion, Amazon remains one of the most valuable companies in the world, rivaling giants such as Apple, Microsoft, and Alphabet. Its P/E ratio of 35.34 indicates high growth expectations from investors, supported by the company’s consistent revenue expansion and operational scale.

- 52-week high: $242.52

- 52-week low: $161.43

The wide trading range illustrates how Amazon has rebounded strongly from previous market pressures, underscoring confidence in its long-term business model.

E-Commerce and Logistics: Core Business Resilience

Despite global economic challenges, Amazon’s core e-commerce operations continue to thrive, driven by Prime membership growth, fast delivery infrastructure, and expansion into emerging markets.

- Prime Day 2025 saw record-breaking sales, reaffirming Amazon’s dominance in global retail.

- The company has expanded same-day and drone delivery programs, improving customer experience.

- Logistics investments, including warehouse automation and robotics, have helped Amazon reduce costs while scaling operations.

AWS: The Growth Engine

Amazon Web Services (AWS) remains the company’s most profitable division, contributing significantly to earnings.

- Cloud adoption continues to accelerate, with enterprises relying on AWS for AI, machine learning, and data storage.

- In 2025, AWS announced new partnerships in AI infrastructure, solidifying its leadership in cloud computing.

- Analysts expect AWS revenue growth to outpace competitors like Microsoft Azure and Google Cloud in the next two quarters.

Advertising Revenue and New Business Segments

Beyond e-commerce and cloud, Amazon’s advertising business has emerged as a high-margin revenue driver.

- Amazon Ads revenue has been steadily increasing as brands shift spending from traditional advertising to digital retail platforms.

- Amazon’s streaming platform, Prime Video, is expanding its global audience, competing directly with Netflix and Disney+.

These diversification efforts are boosting investor confidence by reducing reliance on traditional retail operations.

Historical Performance: 52-Week Review

Over the past year, Amazon shares have moved between a low of $161.43 and a high of $242.52, reflecting both volatility and recovery.

- The stock saw declines in late 2024 due to inflationary pressures and rising logistics costs.

- However, strategic cost-cutting measures and record earnings in Q2 2025 helped restore market confidence.

Analyst Opinions and Market Sentiment

Wall Street analysts remain largely bullish on Amazon:

- Bullish Case: Analysts cite AWS growth, AI-driven logistics, and advertising strength as key drivers that could push the stock above $250 in the coming months.

- Bearish Case: Some caution that competition in cloud and retail remains intense, while high operational costs could limit profit margins.

Price targets currently range between $240 and $270, suggesting moderate upside potential.

Future Outlook

Looking ahead, Amazon’s growth will depend on:

- Q3 2025 Earnings Report – Investors will focus on AWS margins and international e-commerce growth.

- AI Integration – Amazon’s use of AI in logistics, advertising, and customer service is expected to enhance efficiency.

- Global Expansion – Penetration into emerging markets like India and Southeast Asia remains a priority.

- Regulatory Challenges – Antitrust scrutiny in the U.S. and EU could pose risks to expansion.

Amazon’s stock rise to $231.60 on August 28, 2025, highlights investor optimism in its diversified growth strategy. With strong fundamentals in e-commerce, logistics, advertising, and cloud computing, Amazon remains a cornerstone of the global technology sector.

Although short-term volatility may persist, the company’s ability to innovate and expand across industries positions it for sustained long-term growth.

For investors, Amazon continues to be a stock worth watching closely, balancing near-term challenges with immense long-term potential.