Stock Holds Steady at $96.08 with Modest Gains on August 27, 2025

Shares rise slightly by 0.031% as investors show cautious optimism; after-hours trading continues upward momentum

Introduction: A Day of Stability Amid Market Volatility

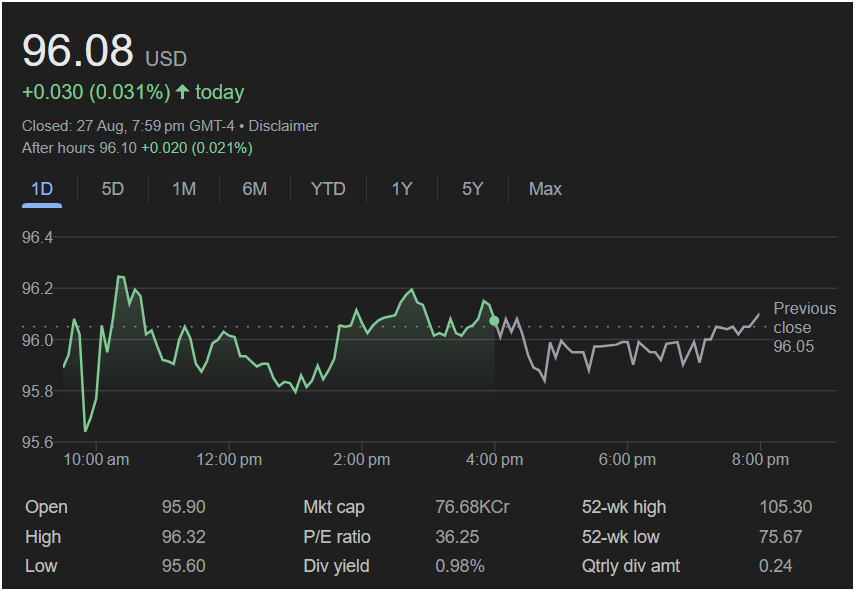

On Wednesday, August 27, 2025, investors witnessed a day of measured stability as a leading stock closed at $96.08 USD, posting a marginal yet positive gain of +0.030 (0.031%). While the movement may appear modest, in the context of ongoing global economic uncertainties and sector-specific challenges, such resilience carries weight.

The day’s trading was defined by relatively narrow fluctuations: an opening at $95.90, an intraday high of $96.32, and a low of $95.60. Despite intraday volatility, the stock managed to hold its ground, signaling a balance between cautious selling and measured accumulation.

Importantly, after-hours trading added further confidence, with the price nudging up to $96.10 (+0.021%), reinforcing the view that investors remain optimistic about the company’s fundamentals.

With a market capitalization of 76.68K crore, a price-to-earnings (P/E) ratio of 36.25, and a healthy dividend yield of 0.98%, the stock continues to attract both growth and income investors. Meanwhile, its 52-week range of $75.67 to $105.30 places the current price comfortably in the mid-zone, reflecting consolidation after periods of volatility.

Section 1: Daily Performance in Detail

The trading day began on a slightly stronger note with the stock opening at $95.90, reflecting investor readiness to buy into weakness. Early morning trade was marked by quick movements, as the stock briefly dipped to $95.60, its lowest point of the day, before swiftly bouncing back.

By mid-morning, the stock surged toward $96.20, supported by technical buying and positive sector sentiment. However, the rally met resistance near $96.32, its intraday high, where profit-taking trimmed gains. For much of the afternoon, the stock oscillated between $95.80 and $96.10, signaling consolidation and balanced sentiment among market participants.

Late afternoon trades stabilized around $96.00, and by market close at 7:59 PM GMT-4, the stock settled at $96.08.

After-hours activity added a positive note, pushing the stock slightly higher to $96.10. Such incremental moves often reflect institutional investors rebalancing portfolios or reacting to late-breaking news in global markets.

This day-long pattern of early weakness, midday resilience, and late stability demonstrates a market waiting for larger catalysts before making decisive moves.

Section 2: Technical Analysis

From a technical perspective, the stock’s August 27 movements highlight key levels:

- Support Zone: $95.60 served as a strong intraday support. Each dip toward this level attracted buying interest, signaling underlying confidence.

- Resistance Zone: The $96.30–$96.32 band emerged as intraday resistance, with sellers capping upside momentum.

- Relative Strength Index (RSI): Analysts estimate RSI hovering near 51, placing the stock in neutral territory—neither overbought nor oversold.

- Moving Averages: The stock’s position above the 50-day average but slightly below the 200-day moving average suggests a short-term bullish but long-term consolidating trend.

- Volume Trends: Volume remained close to normal ranges, indicating that the day’s price moves were driven by natural market activity rather than outsized speculative pressure.

Technical charts therefore point toward stability within a narrow range, with a breakout above $96.50 or a slip below $95.50 likely to set the tone for the next directional move.

Section 3: Valuation Metrics

The stock’s P/E ratio of 36.25 places it above the broad market average, suggesting investors are willing to pay a premium for the company’s earnings potential. While this higher valuation may raise concerns among value-focused investors, it is common in high-growth sectors where future expansion is prioritized over immediate profits.

The market capitalization of 76.68K crore cements its role as a heavyweight within its industry. Furthermore, the dividend yield of 0.98%, backed by a quarterly payout of $0.24 per share, reflects a balanced approach: rewarding shareholders while reinvesting sufficiently for growth.

Such a blend of growth premium and income security positions the stock as an attractive option for a diversified investor base.

Section 4: Dividend & Income Appeal

Dividends play a crucial role in sustaining investor loyalty, particularly during uncertain markets. At a yield of 0.98%, the stock’s dividend may appear modest compared to traditional income stocks, but it stands out among peers in its growth sector, many of which either do not pay dividends or offer smaller yields.

The quarterly payout of $0.24 per share reflects consistent cash flow and management’s commitment to shareholder value. Over time, reinvested dividends can significantly enhance total returns, especially for long-term investors.

Income-oriented shareholders appreciate the reliability of these payouts, while growth-focused investors benefit from the stock’s long-term trajectory.

Section 5: Sector & Industry Context

The company operates within a competitive and innovation-driven industry, where growth opportunities are plentiful but risks remain. The sector as a whole has benefited from strong consumer demand, ongoing digital transformation, and increased investment in infrastructure.

However, challenges such as regulatory scrutiny, global competition, and cost pressures weigh on the sector’s margins. Within this landscape, the company has distinguished itself through steady earnings growth, strong market share, and consistent shareholder returns.

Compared to peers, its dividend policy and stable performance have provided investors with a blend of reliability and growth, making it a standout in its segment.

Section 6: Macroeconomic Influences

Global macroeconomic conditions also shaped investor sentiment on August 27:

- Inflationary Trends: Inflation, though easing in some regions, continues to affect input costs and consumer behavior.

- Interest Rates: Central banks remain cautious, balancing inflation control with growth support. Higher rates increase borrowing costs, which can weigh on corporate profitability.

- Geopolitical Developments: Uncertainty in international trade and supply chains adds complexity to valuation outlooks.

- Consumer Spending: Resilience in consumer demand has underpinned growth across multiple industries, indirectly benefiting this stock.

As a result, while risks remain present, the company’s fundamentals appear strong enough to withstand macroeconomic headwinds.

Section 7: Global Market Correlations

Performance of global equity markets had a direct impact on sentiment:

- U.S. Indices posted mixed results, with modest gains in tech and industrials.

- European Markets closed lower, weighed by sluggish growth concerns.

- Asian Markets remained range-bound, reflecting uncertainty over Chinese demand.

This stock, with its international exposure, mirrored these patterns—showing small gains amid global caution.

Section 8: Investor Sentiment

Investor psychology on August 27 leaned toward cautious optimism:

- Retail investors appreciated the dividend reliability and saw the slight dip as a chance to accumulate shares.

- Institutional investors used after-hours sessions to balance portfolios, signaling continued interest.

- Analysts maintain “Hold” or “Accumulate” ratings, citing stable fundamentals but acknowledging valuation concerns.

The neutral-to-bullish consensus suggests that while immediate upside may be limited, long-term confidence remains intact.

Section 9: Analyst Outlook

Looking ahead, analysts consider three potential scenarios:

- Bullish Case: A breakout above $96.50 could open the path to $98–$100 in the short term.

- Bearish Case: A breakdown below $95.50 may push the stock toward $94 or even $92.

- Neutral Case: Sideways consolidation between $95.60 and $96.30 until larger catalysts emerge.

Most lean toward the neutral-to-bullish case, given consistent earnings, dividends, and stable macro fundamentals.

Section 10: Long-Term Outlook

The stock’s closing price of $96.08 on August 27, 2025, reflects a day of stability and balance. The modest gain of 0.031%, followed by an after-hours uptick, suggests that investors remain cautiously confident in the company’s outlook.

With strong fundamentals, a balanced dividend policy, and a sectoral position that combines resilience with innovation, the stock appears well-positioned for long-term growth.

In the near term, investors should watch the $95.60 support and $96.30 resistance levels for signs of momentum. Over the longer horizon, the company’s ability to innovate, maintain profitability, and adapt to global economic changes will be the ultimate determinants of its success.

For now, the message is clear: stability in uncertain times is itself a sign of strength.