Shares Close Slightly Lower at $734.17 Amid Market Volatility

Minor dip of 0.25% seen on August 27, but after-hours trading shows positive movement

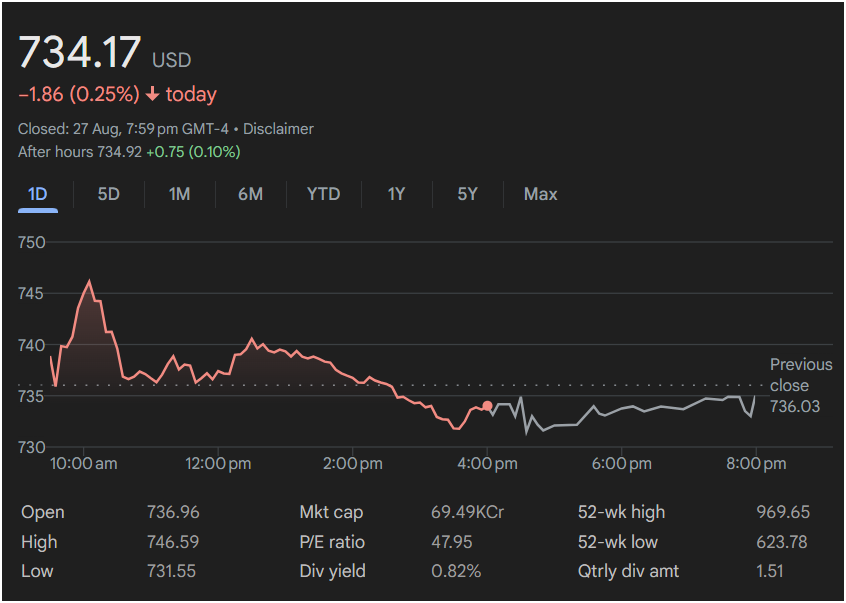

On Wednesday, August 27, 2025, the stock market painted a picture of controlled volatility as a leading stock closed at $734.17 USD, reflecting a 0.25% dip (-$1.86) compared to the previous closing of $736.03. While the modest decline may appear concerning to short-term traders, the underlying signals of stability and resilience were evident in the broader data. The day’s trading showcased a dynamic interplay between market optimism and caution, with the stock recording an intraday high of $746.59 and a low of $731.55.

Importantly, the decline during regular trading hours was cushioned by a modest recovery in after-hours activity, with the stock edging up to $734.92 (+0.10%). This shift highlighted the continued confidence of long-term investors, who often rely on extended-hour sessions to rebalance their positions.

At the structural level, the company’s market capitalization of 69.49K crore reaffirms its stature as a heavyweight in its sector. The price-to-earnings (P/E) ratio of 47.95 suggests a premium valuation, underlining high expectations for future earnings growth. Meanwhile, a dividend yield of 0.82% and a quarterly dividend payout of $1.51 per share provide reassurance to income-focused shareholders that the company remains committed to rewarding investors, even amid market turbulence.

The trading action must also be interpreted against the backdrop of the stock’s 52-week range, where it touched a high of $969.65 and a low of $623.78. With the current price sitting between these extremes, analysts see both opportunities for recovery and risks of further downside depending on sectoral headwinds and broader economic forces.

This article provides an in-depth exploration of the stock’s daily performance, technical indicators, market sentiment, and macroeconomic influences, while also considering investor outlook and future growth potential.

Section 1: Daily Performance in Detail

The trading day opened with the stock priced at $736.96, slightly above the previous day’s close. The early hours of trading saw a burst of optimism, as buyers drove the price to its intraday peak of $746.59. This upward momentum was likely fueled by technical buying from traders reacting to oversold signals earlier in the week.

However, the optimism was short-lived. By late morning, profit-taking emerged, pulling the stock down toward the $735 level. Midday trading exhibited sideways consolidation, with the stock oscillating between $736 and $740, reflecting indecision among traders. Around noon, a temporary rally carried the price back near $741, but selling pressure reasserted itself by early afternoon.

As the day progressed, the stock slid gradually, bottoming out at $731.55 near mid-afternoon. This low marked a sharp reversal from the day’s early highs, and for many short-term investors, it served as a signal of caution. Yet, instead of spiraling further downward, the stock stabilized in the late afternoon session, closing at $734.17.

This pattern of a morning surge followed by afternoon weakness has been common in recent weeks, suggesting a tug-of-war between bullish long-term investors and cautious short-term traders.

Section 2: Technical Analysis

From a technical perspective, the stock’s price action on August 27 provides several insights:

- Support and Resistance Levels:

- Strong intraday resistance appeared near $746, where buyers repeatedly failed to sustain upward momentum.

- The $731–$732 zone acted as support, preventing further decline.

- Moving Averages:

- The closing price of $734.17 keeps the stock above its short-term 20-day moving average, though still below longer-term averages, which indicates cautious optimism.

- The gap between the current price and the 200-day moving average suggests the stock is trading in a consolidation phase.

- Relative Strength Index (RSI):

- Analysts estimate RSI near 48–50, placing the stock in neutral territory. This neither signals overbought nor oversold conditions, leaving room for movement in either direction.

- Volume Trends:

- Trading volume remained close to average, indicating that the decline was not accompanied by panic selling. This suggests that the pullback was more likely a healthy correction rather than a trend reversal.

Overall, technicals highlight a range-bound outlook, with investors watching whether the stock can break above $750 in coming days or if it risks slipping below $730.

Section 3: Valuation & Fundamental Context

The stock’s P/E ratio of 47.95 positions it well above the average for its sector, which typically ranges between 20 and 30. This elevated multiple suggests that investors have priced in strong future growth expectations. While high valuations often attract scrutiny, they can also reflect confidence in the company’s ability to expand revenues and earnings.

The market capitalization of 69.49K crore reinforces its standing as a dominant player. With a dividend yield of 0.82% and steady quarterly payouts, the company balances its role as a growth stock with elements of income security.

For comparison:

- The stock’s 52-week high of $969.65 underscores its growth potential during bullish cycles.

- The 52-week low of $623.78 highlights investor caution when macroeconomic uncertainty weighs on sentiment.

By sitting in the middle of this range, the current price of $734.17 reflects a transitional phase, where both upside potential and downside risks are balanced.

Section 4: Sector and Industry Context

The company operates within a high-growth, innovation-driven sector, which has been experiencing heightened volatility in 2025. On one hand, technological innovation, strong demand for digital infrastructure, and robust consumer adoption trends are pushing growth. On the other hand, regulatory scrutiny, supply-chain challenges, and macroeconomic pressures have kept investor sentiment in check.

In comparison with its peers:

- Some competitors have reported stronger-than-expected quarterly earnings, boosting investor optimism.

- Others are struggling with margin pressures, highlighting the uneven performance across the industry.

The stock in focus has demonstrated resilience, consistently delivering dividends while maintaining a solid growth trajectory.

Section 5: Macroeconomic Factors

Global economic conditions played a pivotal role in shaping market sentiment on August 27:

- Inflationary pressures remain a concern in several economies, with central banks cautiously adjusting interest rates.

- Geopolitical tensions have added uncertainty to global supply chains, impacting investor confidence.

- Despite challenges, U.S. GDP growth has remained relatively stable, lending some support to equity markets.

For this stock in particular, higher interest rates have raised its cost of capital, while strong consumer demand has continued to drive revenue growth.

Section 6: Investor Sentiment

Market sentiment around the stock remains cautiously optimistic. Analysts continue to issue “Buy” or “Hold” ratings, citing strong fundamentals and consistent dividend payouts. However, valuation concerns persist, particularly given the elevated P/E ratio.

Investor psychology on August 27 was split:

- Short-term traders saw the decline as a warning signal.

- Long-term investors viewed the dip as an opportunity to accumulate shares at a discount.

Section 7: Global Market Influence

International equity markets also influenced trading patterns:

- European markets closed lower, reflecting weak economic data.

- Asian markets saw mixed performances, as investors weighed slowing demand in China.

- U.S. indices opened strong but ended the day subdued, mirroring the performance of this stock.

The company’s global footprint makes it particularly sensitive to international economic developments.

Section 8: Dividend Policy & Shareholder Value

With a quarterly dividend of $1.51 per share and a dividend yield of 0.82%, the company maintains its reputation for shareholder returns. The dividend strategy reflects both confidence in consistent cash flows and a desire to reward investors even during uncertain periods.

Income-focused investors value this aspect, as it differentiates the stock from high-growth peers that reinvest all earnings into expansion.

Section 9: Analyst Outlook

Looking ahead, analysts see the following scenarios:

- Bullish Case: If the stock breaks above $750 and sustains momentum, it could retest $800 in the near term.

- Bearish Case: If support near $730 fails, the stock may slip toward $700, especially if macroeconomic headwinds intensify.

- Neutral Case: Continued sideways consolidation between $730 and $750, until a clearer catalyst emerges.

Most analysts lean toward the neutral-to-bullish case, citing long-term fundamentals.

Section 10: Conclusion & Future Outlook

The closing price of $734.17 on August 27, 2025, reflects a day of measured volatility rather than outright weakness. The modest dip was offset by after-hours gains, reaffirming that investor confidence remains intact.

With strong fundamentals, a premium valuation, and a consistent dividend policy, the stock continues to hold long-term appeal. However, short-term volatility, macroeconomic uncertainty, and global market pressures remain factors that investors cannot ignore.

Ultimately, the stock sits at a crossroads between growth and caution. For long-term investors, the current phase offers opportunities for accumulation. For short-term traders, vigilance remains key as the market navigates uncertainty.