Meta Platforms Inc. Experiences Modest Gains, Signaling Stability in Dynamic Market

Stock Price Climbs 0.11% Today, Reaching $754.10, with Steady After-Hours Performance Reflecting Investor Confidence

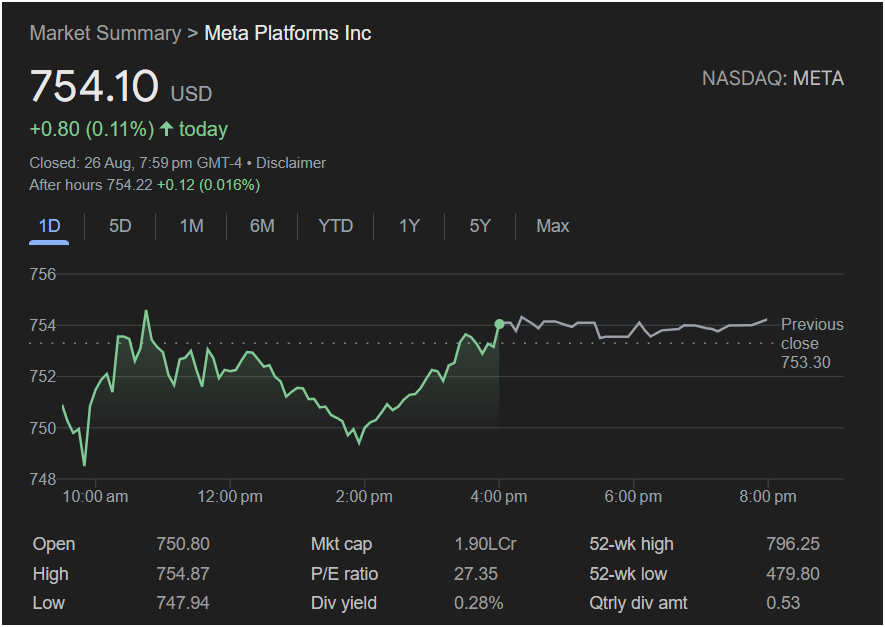

27 August 2025, Menlo Park, California – Meta Platforms Inc. (NASDAQ: META) concluded today’s trading session with a slight but positive uptick, closing at $754.10 USD. The social media and technology giant saw its stock price increase by $0.80, a modest gain of 0.11% for the day. This performance indicates a period of relative stability for the company amidst a bustling technology sector. The slight rise, while not dramatic, contributes to the overall positive sentiment surrounding the stock.

The movement continued into after-hours trading, where Meta added another $0.12, or 0.016%, to reach $754.22. This consistent, albeit small, upward trend after the market close suggests that investors are maintaining their positions and potentially anticipating further, more significant movements in the near future. Such slight after-hours gains often reflect a steady underlying demand and a lack of immediate negative catalysts.

Intraday Performance: A Picture of Resilience

Throughout the day, Meta’s stock chart illustrated a resilient performance. Opening at $750.80, the stock experienced some volatility in the morning, dipping to an intraday low of $747.94. However, it swiftly recovered, demonstrating the market’s support for the company. By the afternoon, the stock had climbed to its daily high of $754.87, before settling slightly lower at its close. This recovery from an early dip to a positive close is often seen as a sign of underlying strength and investor buying interest, especially after potential initial profit-taking or minor market adjustments.

The previous day’s close stood at $753.30, making today’s gain, though small, a continuation of positive movement. The consistency in holding above the opening price for much of the latter half of the day suggests that buying pressure outweighed selling pressure for a significant portion of the trading session.

Robust Market Capitalization and Attractive Valuation Metrics

Meta Platforms Inc. continues to boast an impressive market capitalization (Mkt Cap) of 1.90 LCr (likely denoting 1.90 Lakh Crore or a similar large denomination), underscoring its immense scale and significant presence in the global technology landscape. This colossal valuation reinforces its position as one of the world’s most influential companies, with a vast ecosystem of platforms and technologies.

The company’s Price-to-Earnings (P/E) ratio is reported at 27.35. This figure is generally considered reasonable for a large-cap technology company, especially one with significant growth prospects and a dominant position in its various markets. A P/E ratio in this range suggests that the market has a balanced view of the company’s current earnings and its potential for future growth, without appearing excessively overvalued. For many investors, this P/E ratio offers an attractive entry point, balancing growth potential with a sensible valuation.

Meta also provides a Dividend Yield (Div yield) of 0.28%, with a quarterly dividend amount (Qtrly div amt) of $0.53. While the yield is modest, it signifies the company’s commitment to returning capital to its shareholders. The consistent payment of dividends, even while investing heavily in future technologies like the metaverse, is a positive signal to long-term investors seeking both growth and a steady income stream.

Navigating the 52-Week Range

Looking at the broader context of the past year, Meta’s stock has traded within a significant range. The 52-week high stands at $796.25, while the 52-week low was $479.80. Today’s closing price of $754.10 places the stock comfortably within the upper half of this range, nearing its annual peak. This position suggests a strong recovery and consistent upward momentum since its lows, reflecting the market’s positive re-evaluation of the company’s strategic direction and financial performance.

The ability of Meta to trade near its 52-week high indicates that the market is increasingly confident in its business model, its investments in artificial intelligence and the metaverse, and its ability to continue generating substantial revenue from its core advertising platforms. Investors often interpret movement towards the 52-week high as a sign of strong and sustained performance, making it an important psychological benchmark.

Strategic Vision and Market Influence

Meta Platforms Inc. remains at the forefront of digital innovation, with its extensive portfolio of social media applications (Facebook, Instagram, WhatsApp) continuing to command billions of users worldwide. Concurrently, its ambitious investments in the metaverse, virtual reality (VR), and artificial intelligence (AI) are shaping the future of digital interaction and computing. While these forward-looking initiatives require substantial capital, the market’s current valuation and the stock’s stability suggest a belief in the long-term potential of these ventures.

Today’s relatively stable performance, despite the often-volatile tech market, underscores Meta’s foundational strength. It suggests that despite ongoing debates surrounding digital privacy, regulatory scrutiny, and competitive pressures, the company’s core business remains incredibly robust, and its future-oriented projects are increasingly being factored into its market valuation.

As Meta continues to execute its vision for an interconnected digital future, market participants will be keenly observing its progress in the metaverse, the efficacy of its AI integrations, and the continued monetization of its vast user base. The consistent, albeit modest, gains observed today are indicative of a company that is maintaining its footing and building for future expansion, providing a sense of reassurance to its broad investor base. The subtle upward trend reflects a market that sees underlying value and ongoing potential in the technology powerhouse.