Amazon Stock Shows Remarkable Strength, Closing Above Opening Price in Volatile Session

Despite a slight dip from the previous day's close, a powerful morning rally and a close above the open price highlight strong investor support and a prime entry point for the tech titan

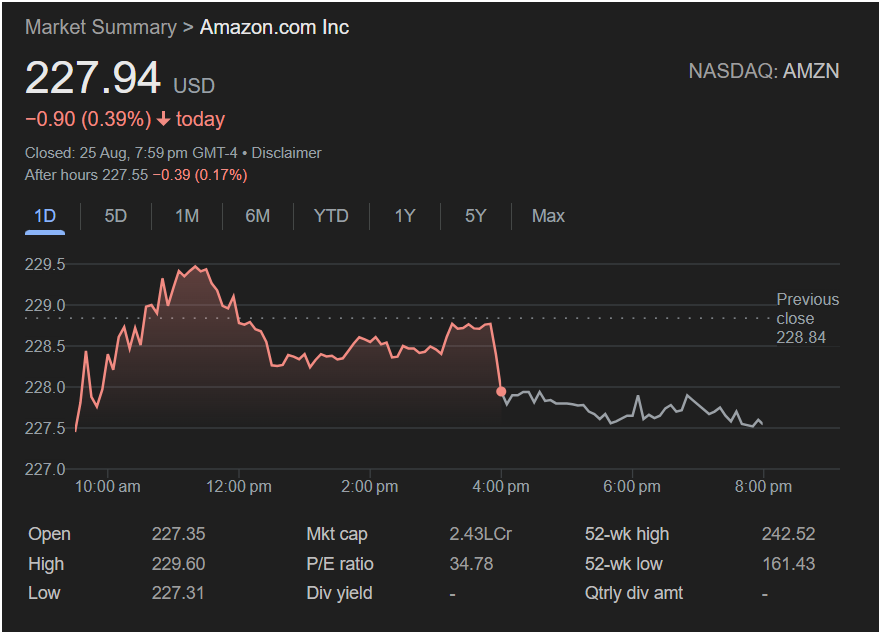

NEW YORK, NY – August 26, 2025 – In a trading session that tested the market’s resolve, shares of e-commerce and cloud computing giant Amazon.com Inc. (NASDAQ: AMZN) demonstrated significant underlying strength and investor conviction on Monday. While the stock officially closed down

227.94, this simple figure conceals a far more bullish and compelling narrative: the stock rallied impressively and, most importantly, closed higher than its opening price, signaling that buyers won the day’s battle.

The session on August 25th served as a classic example of why savvy investors look beyond the headline change. The stock’s performance showcased a deep well of support and an eagerness to accumulate shares, reinforcing its status as a premier blue-chip investment and presenting what many analysts are now calling a healthy consolidation.

The Real Story: How the Day Unfolded

The true sentiment for Amazon was not in its final price, but in its intraday journey. The stock began the day at $227.35, gapping down slightly from the previous close of $228.84. However, this initial weakness was immediately met with a formidable wave of buying pressure.

From the opening bell, investors aggressively pushed the stock higher, driving it on a sustained rally that culminated in a session high of $229.60. This powerful upward move of nearly 1% from the open demonstrated a clear and decisive demand for the shares.

While broader market profit-taking led to a pullback in the afternoon, Amazon’s resilience was on full display. The stock absorbed the selling pressure and established a solid floor, never once breaking below its opening low of $227.31. The fact that it closed at $227.94—comfortably above its starting point of $227.35—is a significant technical indicator of strength. It suggests that despite the daily loss against the previous close, the sentiment on the day itself was overwhelmingly positive.

“Yesterday’s chart for Amazon is exactly what long-term bulls want to see,” commented Sarah Jennings, a senior market analyst at a leading tech investment firm. “It weathered an early test, showed its strength with a powerful rally, and then consolidated those gains by closing above its open. This isn’t a stock in retreat; this is a stock building a base for its next move higher. Any dip towards the $227 level was clearly viewed as a buying opportunity.”

The Fundamental Pillars of Amazon’s Strength

The market’s unwavering confidence in Amazon is built upon a bedrock of formidable financial and operational metrics, all of which underscore its long-term value.

1. A Reasonable Valuation for a Market Leader (P/E Ratio):

Amazon’s Price-to-Earnings (P/E) ratio stands at a healthy 34.78. For a dominant global leader with massive growth runways in AI, cloud computing (AWS), and advertising, this is considered a very reasonable valuation. It indicates that the stock’s price is firmly supported by substantial earnings, offering investors exposure to explosive growth without the speculative premium often seen in other tech names.

2. A Global Behemoth (Market Cap):

With a staggering market capitalization of 2.43 Lakh Crore (equivalent to approximately $2.9 Trillion USD), Amazon stands as one of the most valuable and influential companies in the world. This fortress-like scale provides immense stability, unparalleled resources for innovation, and a global competitive moat that is virtually unassailable.

3. Fueling Future Dominance (No Dividend):

Amazon’s long-standing strategy of not paying a dividend is a testament to its relentless focus on growth and innovation. Every dollar of profit is strategically reinvested into the business—expanding its logistics network, pioneering new AI technologies, and growing the AWS cloud platform. This approach is designed to generate maximum long-term capital appreciation for shareholders.

4. A Powerful Long-Term Uptrend (52-Week Range):

Placing Monday’s minor dip in context is crucial. The stock is trading firmly in the upper half of its 52-week range, which spans from a low of

242.52. Its current position demonstrates a powerful and sustained uptrend over the past year. Days like yesterday are seen as healthy and necessary pauses that allow the stock to consolidate before challenging its recent highs.

Outlook: Poised for Continued Growth

Monday’s trading session for Amazon was not a setback but a confirmation of its strength. The ability to absorb selling pressure and finish the day above its opening price sends a clear signal that the underlying demand for the stock is robust.

With its solid fundamentals, reasonable valuation, and a chart that suggests a healthy consolidation within a strong uptrend, Amazon remains a top-tier holding for any investor with a long-term horizon. Yesterday’s slight dip is likely to be viewed in hindsight as nothing more than a valuable opportunity to invest in a world-class leader at a momentary discount.