IBM Stock Jumps Over 1% as Investors Target High-Yield Tech and Stability

The technology giant's solid session is underpinned by a robust 2.78% dividend yield, signaling its appeal as a premier investment for both growth and income

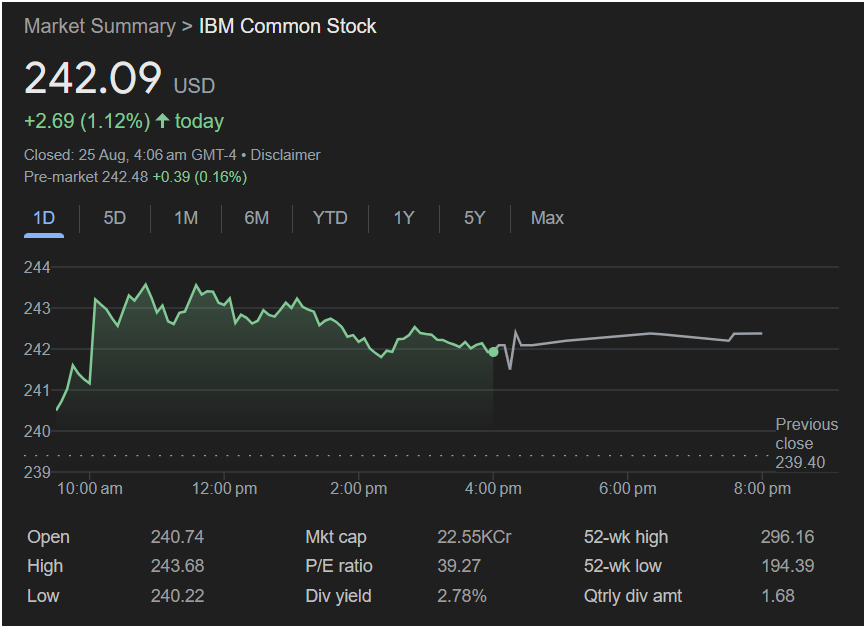

ARMONK, NY – August 25, 2025 – International Business Machines Corp. (IBM) showcased its enduring appeal to investors on Monday, with its stock climbing a solid 1.12% to close at

2.69 reflects a growing market appetite for established technology companies that offer not only a vision for the future but also substantial and reliable shareholder returns.

The trading session demonstrated strong buying interest from the outset. After opening at

243.68**. The stock showed resilience throughout the day, finding solid support at its low of

242.48**, suggesting continued momentum.

A Dividend Powerhouse in the Tech Sector

While the daily gain is impressive, the deeper story behind IBM’s strength lies in its exceptional appeal to income-focused investors. The company boasts a formidable dividend yield of 2.78%, a figure that places it in the top tier of technology blue-chips. This is backed by a very generous quarterly dividend of $1.68 per share. In a sector often known for prioritizing growth over dividends, IBM’s commitment to shareholder payouts makes it a standout choice for those seeking a stable and significant income stream.

This robust dividend is a clear signal of the company’s strong financial health, consistent cash flow, and confident long-term outlook.

A Blend of Growth and Value

IBM’s performance over the past year further solidifies its investment case. The stock has climbed more than 24% from its 52-week low of

296.16, investors see significant room for further appreciation, offering a compelling blend of growth potential alongside its income credentials.

The stock’s Price-to-Earnings (P/E) ratio of 39.27, while elevated, is viewed by many analysts as a vote of confidence in IBM’s ongoing transformation, particularly its leadership in artificial intelligence and hybrid cloud solutions. It suggests the market is willing to pay a premium for the company’s future earnings potential.

“IBM is hitting a sweet spot in the market right now,” noted a technology sector strategist. “Investors are getting the innovation and growth story of a major tech player combined with a dividend yield that rivals many utility or consumer staple companies. Today’s positive price action is a clear reflection of the market’s growing appreciation for this unique and powerful combination.”

With its massive $225.5 billion market cap, proven resilience, and a best-in-class dividend, IBM is reinforcing its position as a cornerstone investment for a balanced and forward-looking portfolio.