Walt Disney Co. Stock Surges 2.28% in Strong Session, Signaling Robust Investor Confidence

The entertainment giant closes near its daily high, buoyed by a healthy P/E ratio and a remarkable 48% climb from its 52-week low, putting its yearly peak within sight

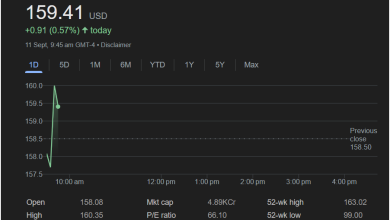

BURBANK, CA – August 25, 2025 – Walt Disney Co. (DIS) demonstrated formidable market strength in its latest trading session, as its stock closed with an impressive gain of 2.28%. The iconic media and entertainment conglomerate finished the day at

2.65, in a move that has captured the attention of investors and signals strong bullish sentiment surrounding the brand.

The day’s trading painted a clear picture of investor optimism from start to finish. After opening at $117.58, the stock experienced a brief, shallow dip to a low of

119.78**. For the remainder of the session, Disney’s stock consolidated its gains, trading consistently in a high range and ultimately closing strong. This ability to hold onto early gains is often seen by market analysts as a sign of underlying strength and institutional support.

Further reinforcing this positive outlook, pre-market data showed the stock continuing to inch upward to $118.88, suggesting that the positive momentum is carrying over into the next session.

A Story of Sustained Growth and Value

This impressive daily performance is not an isolated event but rather the latest highlight in a stellar year for Walt Disney Co. shareholders. The company’s stock has staged a phenomenal comeback, now trading nearly 48% higher than its 52-week low of

124.69, a key psychological level that, if surpassed, could trigger a further wave of buying.

The robust health of the company is further reflected in its core financial metrics. With a massive market capitalization of approximately $213.7 billion (21.37KCr), Disney stands as a blue-chip pillar of the global economy.

Investors are also pointing to the stock’s attractive valuation. Disney’s Price-to-Earnings (P/E) ratio is a healthy 18.63. In today’s market, this figure is widely regarded as reasonable, suggesting that the stock price is well-supported by the company’s actual earnings. It positions Disney as a compelling investment that blends both growth potential and fundamental value, steering clear of the speculative froth seen in other sectors.

Commitment to Shareholders and a Bright Outlook

Disney’s commitment to returning value to its investors is evident in its consistent dividend policy. The company currently offers a dividend yield of 0.84%, paying out a quarterly amount of $0.25 per share. While modest, this reliable dividend is a hallmark of a financially stable and mature company confident in its long-term cash flow from its diverse business segments, including theme parks, streaming services, and blockbuster film studios.

“Today’s performance by Disney is exactly what long-term investors want to see,” noted a senior market analyst. “It’s not just the 2% jump that’s impressive; it’s the context. We’re seeing a stock with a reasonable P/E ratio, that pays a dividend, and is showing incredible momentum from its yearly lows. It’s a textbook case of a healthy, high-quality company reasserting its dominance.”

As Walt Disney Co. continues to innovate and captivate audiences worldwide, its stock performance reflects a deep and growing confidence in its strategic direction. With strong fundamentals and clear market momentum, the House of Mouse is proving once again to be a magical investment for its shareholders.