Johnson & Johnson (JNJ) Hits New 52-Week High in a Powerful Display of Intraday Resilience

The healthcare giant erased a steep morning decline to close in positive territory, a powerful reversal that underscores immense investor confidence. The stock's attractive valuation and robust 2.90% dividend yield fueled the strong buying pressure

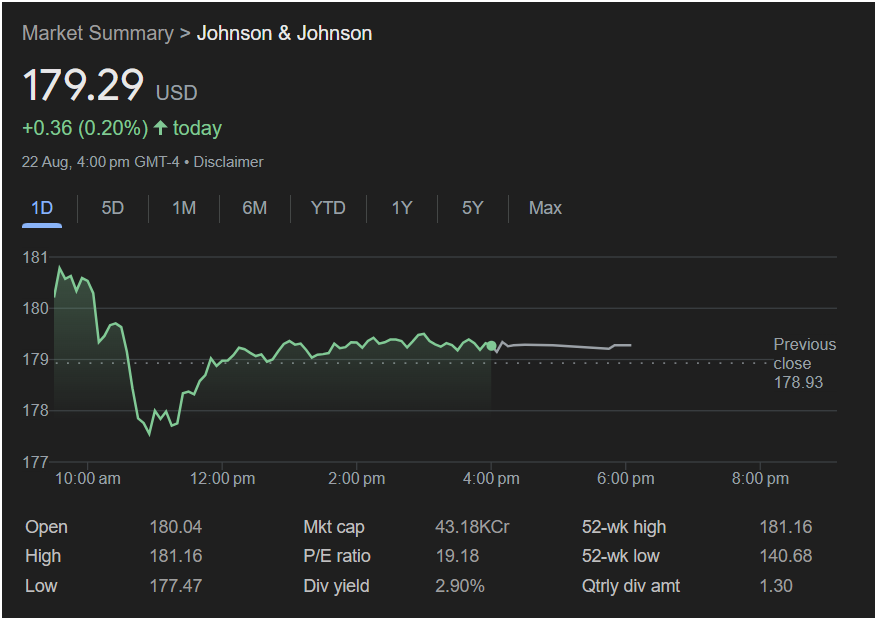

NEW YORK, August 25 – Johnson & Johnson (JNJ), the venerable blue-chip healthcare titan, delivered a masterful performance in the trading session on August 22, showcasing the kind of resilience and underlying strength that has made it a cornerstone of investment portfolios for generations. The stock finished the day at

0.36, or 0.20%.

While the final percentage gain appears modest, the true story of the day—and the most compelling piece of “good news”—lies in the stock’s dramatic intraday journey. In a landmark session, Johnson & Johnson not only touched a new 52-week high of $181.16 but also staged a furious comeback from a sharp sell-off, a technical feat that signals profound and unwavering investor support.

This powerful reversal, backed by an attractive valuation and a best-in-class dividend, sends a clear message to the market: Johnson & Johnson’s bull run is built on a foundation of solid rock, and dip-buyers are aggressively defending the trend.

The Anatomy of a Bullish Reversal: A Day of Two Extremes

The trading session for Johnson & Johnson was a perfect microcosm of a battle between short-term profit-takers and long-term believers—a battle the believers decisively won.

The day began with a surge of optimism. The stock opened at $180.04, a significant gap up from the previous close of

181.16**. This was a major milestone, as it also marked a new high for the past 52 weeks, confirming the strength of the stock’s long-term uptrend.

However, hitting this new peak triggered a wave of automated and manual profit-taking. The stock faced a swift and aggressive sell-off, plunging nearly 2% from its high to hit the session’s low of $177.47. At this point, a less resilient stock might have continued to falter.

But this is where Johnson & Johnson’s blue-chip character shone through. The low point acted as a powerful magnet for value-seeking investors. A “wall of buyers” entered the market, absorbing all the selling pressure and initiating a powerful recovery. For the remainder of the session, the stock ground steadily higher, methodically erasing every penny of its losses and pushing firmly back into positive territory by the close. This V-shaped recovery is one of the most bullish short-term patterns in technical analysis, as it demonstrates that the underlying demand for the stock is overwhelming the supply.

The Milestone Moment: The Power of a New 52-Week High

The most significant event of the day was the stock touching a new 52-week high. This is far more than just a data point; it’s a powerful psychological and technical signal for several reasons:

-

Confirmation of Strength: It is the ultimate confirmation that the stock is in a strong, healthy uptrend. The journey from the 52-week low of $140.68 to today’s peak represents a massive gain of nearly 30%, and hitting that new high proves the momentum is still active.

-

Attracting New Capital: Breakouts to new highs often appear on the screens of momentum investors and large institutional funds. This can attract a new wave of buying interest, potentially fueling the next leg of the rally.

-

Clear Skies Ahead: From a technical perspective, a stock at a 52-week high has no “overhead resistance”—that is, no recent history of bagholders who are waiting to sell as soon as the price gets back to their break-even point. This can create a path of less resistance for the stock to continue to climb.

The Unshakeable Foundation: The ‘Triple-Threat’ Investment Case

The confidence that fueled today’s dramatic recovery is not based on charts alone; it is rooted in Johnson & Johnson’s world-class fundamentals, which present a rare “triple threat” of value, income, and stability.

1. Compelling Value (P/E Ratio: 19.18):

In a market where many leading companies trade at high multiples, Johnson & Johnson’s Price-to-Earnings (P/E) ratio of just 19.18 is exceptionally attractive. This suggests the stock is reasonably priced relative to its substantial and stable earnings. Investors are not paying a speculative premium; they are buying into a profitable global leader at a fair price. This “growth at a reasonable price” (GARP) profile provides a margin of safety and was almost certainly a key reason why buyers stepped in so aggressively at the day’s lows.

2. Elite Income (Dividend Yield: 2.90%):

Johnson & Johnson is not just a growth story; it is an income-generating powerhouse. The stock boasts a robust dividend yield of 2.90%, based on a quarterly payout of $1.30 per share. This is a premium yield that provides investors with a substantial and reliable cash flow stream.

Furthermore, J&J is a “Dividend King,” a member of an elite group of companies that have increased their dividend for over 50 consecutive years. This unparalleled track record of shareholder returns is a testament to the company’s incredible financial strength and its unwavering commitment to its investors through all economic cycles.

3. Unmatched Stability (Market Cap: 43.18KCr / ~

430 billion, Johnson & Johnson is one of the largest and most diversified healthcare companies on the planet. Its three core segments—Pharmaceuticals, MedTech, and Consumer Health—provide a level of stability that is hard to replicate. This massive, diversified business model makes it a quintessential “sleep-at-night” stock and a core holding for prudent, long-term investors.

A Statement of Enduring Strength

Johnson & Johnson’s trading session was a microcosm of its entire investment thesis: a company that can reach new heights of growth while possessing the underlying strength and resilience to weather any short-term storm.

The day’s good news was manifold: the achievement of a new 52-week high, a dramatic and bullish intraday reversal, and a powerful affirmation of its appeal as a fairly-valued, high-yield, blue-chip leader. For investors, the message from the market was crystal clear: Johnson & Johnson’s journey of creating shareholder value is far from over.