Procter & Gamble (PG) Demonstrates Ironclad Stability in Near-Flat Trading, Reinforcing its Blue-Chip Fortress Appeal

Closing with a negligible 0.038% change, the consumer staples giant showcased its renowned resilience. A strong 2.66% dividend yield and an immediate after-hours recovery underscore its status as a premier safe-haven investment

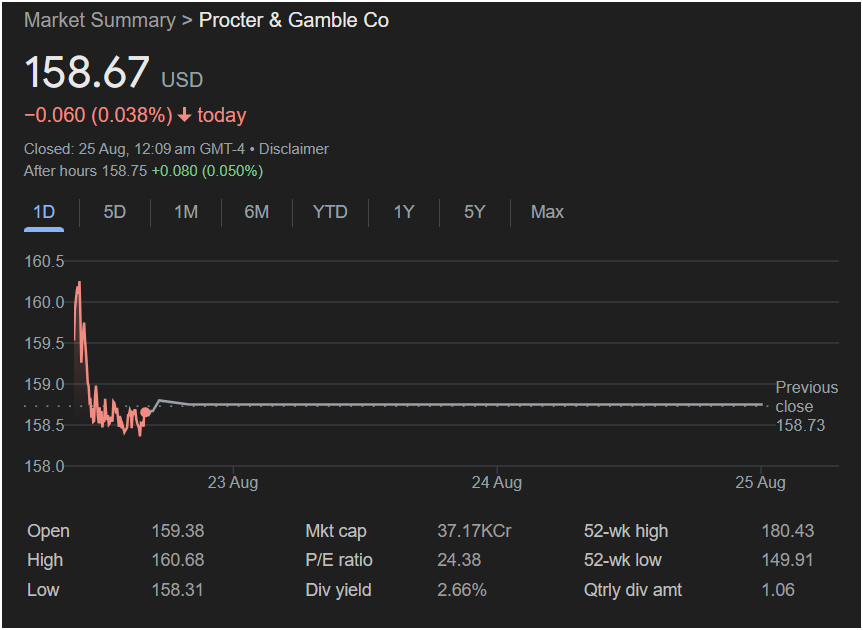

NEW YORK, August 25 – In a market often defined by dramatic swings and volatility, Procter & Gamble Co (PG) delivered what might be the most reassuring performance of the day: a masterclass in stability. The consumer goods behemoth closed the trading session on August 25 at

0.060, or 0.038%.

For savvy investors, this near-zero movement is the ultimate “good news.” It is a powerful testament to the company’s defensive nature and its role as a bedrock of stability in any well-diversified portfolio. While high-flying stocks grabbed headlines with wild price action, P&G stood its ground, proving its mettle as a fortress-like investment.

This incredible resilience, combined with the stock’s robust 2.66% dividend yield and an immediate positive turn in after-hours trading, paints a clear picture. In an uncertain world, the value of predictability and reliability cannot be overstated, and Procter & Gamble has just delivered it in spades.

A Day of Calm Amidst the Storm: Analyzing the Trading Session

To appreciate the significance of today’s performance, one must look at the story told by the intraday chart. The session began with a flurry of activity, as is common. The stock opened at

160.68. This initial move showed that there was clear buying interest at higher levels.

Following this morning peak, the stock experienced a pullback, reaching its intraday low of $158.31. This is where the true story of P&G’s strength begins. At this level, the sellers were met with a wall of buyers. The stock refused to fall further, finding a solid floor of support.

For the remainder of the day—for hours on end—the stock traded in an incredibly tight, sideways channel, oscillating just a few cents around the $158.60 mark before closing. This is not a sign of indecision; it is a sign of perfect equilibrium and profound stability. The final change of -0.038% is effectively a rounding error, showcasing a stock that is immune to the market’s whims.

Even more telling is the after-hours activity. The stock immediately ticked up by

158.75, completely erasing the minuscule daytime loss and putting it firmly in positive territory. This suggests that any shares available at the closing price were quickly snapped up by investors recognizing their value.

The Power of Predictability: Why Flat is the New Up

In financial markets, not all “good news” involves a soaring stock price. For certain types of companies—and P&G is the quintessential example—the best news is the absence of bad news and the demonstration of unshakeable stability.

-

Defensive Stock Champion: Procter & Gamble is a classic “defensive” or “consumer staples” stock. Its vast portfolio of iconic brands—including Tide, Pampers, Crest, Gillette, and Charmin—are products people buy regardless of the economic climate. This creates a highly predictable and non-cyclical revenue stream, which in turn leads to a stable stock price. Today’s performance was a live demonstration of this core investment thesis.

-

A Haven in Volatility: For investors seeking to protect capital and reduce portfolio risk, stocks like P&G are a sanctuary. While other sectors may experience wild fluctuations based on interest rate news or geopolitical events, P&G’s business model provides an insulation that is invaluable. Today’s flat close is precisely the performance that risk-averse investors and retirees cherish.

The Dividend King Reigns Supreme

The quiet strength of the stock price is amplified by the loud and clear message of its dividend. Procter & Gamble offers a very attractive dividend yield of 2.66%, based on a quarterly payout of $1.06 per share.

This is not just any dividend; it is one of the most reliable income streams in the entire market. P&G is a “Dividend King,” an elite designation for companies that have increased their dividend for over 50 consecutive years. P&G’s streak is now over 65 years long.

This legacy is the ultimate signal of financial strength and shareholder commitment. It assures investors that through recessions, market crashes, and periods of high inflation, P&G has not only paid but consistently increased its return to shareholders. Today’s stable price offers an excellent opportunity for income-focused investors to lock in that premium 2.66% yield with a high degree of confidence.

Long-Term Strength and Premium Valuation

Placing today’s price within its annual context further solidifies the positive narrative.

-

52-Week High: $180.43

-

52-Week Low: $149.91

-

Today’s Close: $158.67

The current price is positioned comfortably in the middle of its 52-week range. It represents a solid 5.8% gain from its yearly low while still offering significant upside potential to retest its highs, which are about 12% away. This positioning is healthy, indicating a stock that is in a stable trend, not overbought or oversold.

The company’s Price-to-Earnings (P/E) ratio of 24.38 reflects its premium status. Investors are willing to pay a higher multiple for P&G’s earnings because of their unparalleled quality and predictability. This isn’t a speculative valuation; it is the market’s fair price for certainty, brand dominance, and reliability. This is further backed by its colossal market capitalization of $371.7 billion, placing it among the world’s most valuable and influential corporations.

The Unmistakable Signal of Strength

While a stock chart showing a 5% gain might be more exciting at first glance, the true good news for Procter & Gamble investors today was far more profound. The company delivered a powerful message of stability, resilience, and unwavering reliability.

The day’s virtually unchanged closing price, the immediate after-hours rebound, and the enduring appeal of its “Dividend King” status all combine to tell one clear story: Procter & Gamble is a blue-chip fortress. For anyone looking to build long-term wealth with a foundation of safety and consistent income, today’s performance was not a non-event; it was a ringing endorsement.