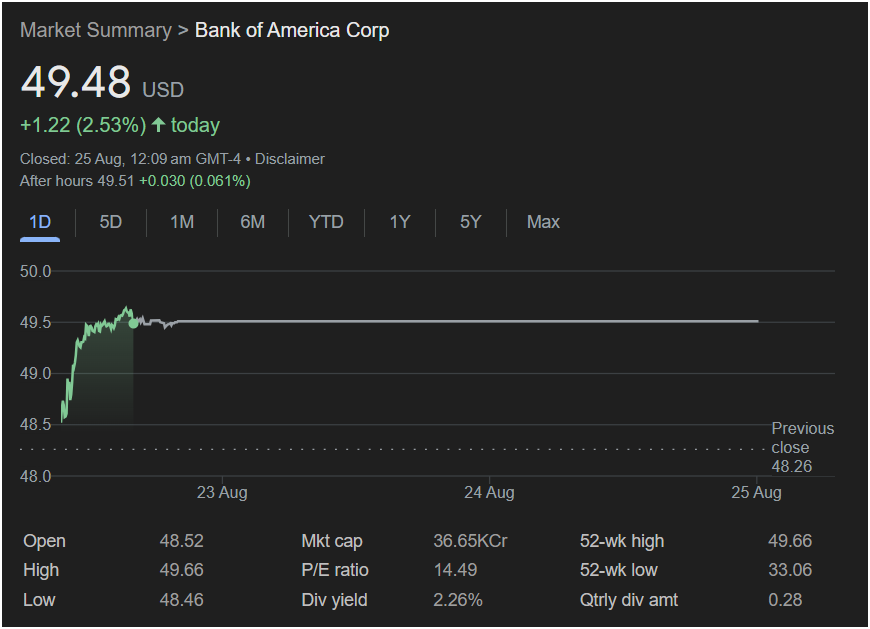

Bank of America (BAC) Shatters 52-Week High in Explosive 2.53% Rally, Signaling Strong Bullish Momentum

Shares of the financial titan soared to close at $49.48 after hitting a new yearly peak, driven by intense investor demand. With an attractive valuation and a solid dividend, the breakout suggests a new phase of growth lies ahead

NEW YORK, August 25 – Bank of America Corp (BAC) delivered a spectacular performance in the latest trading session, sending a clear and powerful signal to the market that its growth trajectory is accelerating. The banking giant’s shares surged by an impressive

49.48.

This was no ordinary rally. In a landmark achievement, the stock not only posted a significant daily gain but also touched a new 52-week high of $49.66, a critical technical milestone that often precedes further upside. The session was characterized by relentless buying pressure from the opening bell, demonstrating profound investor confidence in the bank’s financial health and future prospects.

The breakout performance, supported by a compellingly low valuation and a consistent dividend, has firmly placed Bank of America in the spotlight. For investors, this potent combination of momentum, value, and income presents one of the most compelling large-cap stories in the market today, with even after-hours trading showing a slight positive continuation to $49.51.

A Picture of Dominance: Deconstructing the Day’s Trading

The intraday price action for Bank of America was a masterclass in bullish control. The stock’s journey from open to close tells a story of conviction and strength:

The day began with immediate optimism. Shares opened at $48.52, a notable jump from the previous close of $48.26. While the stock briefly touched a low of $48.46 in the opening moments, this level would serve as a launchpad. From there, a torrent of buying interest flooded the market, propelling the stock on a steep, upward climb throughout the morning.

This powerful rally culminated in the day’s—and the year’s—pinnacle: $49.66. Reaching this new 52-week high is a significant event. It means the stock has overcome every resistance level from the past year and is now entering “blue-sky” territory, where there is no recent history of selling pressure to impede its advance.

Following this peak, the stock did not retreat. Instead, it consolidated its substantial gains, trading in a tight, stable range for the rest of the afternoon. It closed at $49.48, just cents below its high, a clear sign that the bulls remained in complete command into the closing bell. This type of “close near the high” action is highly coveted by technical analysts as it suggests the positive momentum is likely to carry over into the next trading session.

The Milestone Moment: Why the 52-Week High Matters

Today’s most significant piece of good news is the achievement of a new 52-week high. This is more than just a number; it’s a powerful psychological and technical signal for several reasons:

-

Confirmation of a Strong Uptrend: The stock’s journey from its 52-week low of $33.06 to today’s high of $49.66 represents a massive gain of nearly 50%. Hitting the peak of that range confirms that the long-term uptrend is not only intact but accelerating.

-

Attracting Momentum: Breakouts to new highs often act as a magnet for momentum investors and trend-following funds. These market participants see the new high as a sign of strength and are more likely to buy into the stock, potentially fueling the rally even further.

-

No Overhead Resistance: From a technical standpoint, there are no recent sellers who are “stuck” at a higher price and looking to sell as soon as they break even. This lack of overhead supply can make it easier for the stock to continue its upward path.

The Fundamental Powerhouse: Value and Income Justify the Rally

A stock’s price surge is only sustainable if it is backed by strong fundamentals, and Bank of America’s metrics reveal a company that is both a growth engine and a value proposition.

1. A Compelling Valuation (P/E Ratio: 14.49):

Perhaps the most remarkable aspect of this rally is that it is occurring while the stock remains attractively valued. Bank of America’s Price-to-Earnings (P/E) ratio is a very reasonable 14.49. In a market where many leading companies trade at P/E multiples of 25, 30, or higher, a P/E of less than 15 for a dominant financial institution suggests that the stock is far from overvalued. This indicates that the share price is well-supported by the bank’s substantial earnings. Investors are getting in on a stock with powerful momentum without having to pay a speculative premium. This is the hallmark of a “growth at a reasonable price” (GARP) investment.

2. A Reliable Income Stream (Dividend Yield: 2.26%):

Bank of America complements its growth story with a solid dividend, making it a “total return” investment. The stock offers a dividend yield of 2.26%, based on a quarterly payout of $0.28 per share. This provides shareholders with a steady and reliable income stream, rewarding them for their long-term ownership. For investors, this is the best of both worlds: they can enjoy the significant potential for capital gains, as seen in today’s rally, while also collecting regular cash payments.

3. Unquestioned Market Leadership (Market Cap: 36.65KCr / ~

366 billion, Bank of America is one of the pillars of the global financial system. Its immense scale, diversified business lines—from consumer banking to wealth management to investment banking—and entrenched position in the U.S. economy provide a level of stability and resilience that is hard to match. This blue-chip status gives investors the confidence to buy into the stock, knowing it is a well-managed institution built to thrive across economic cycles.

A Breakout with Room to Run

Bank of America’s stunning 2.53% rally was far more than a one-day wonder. It was a decisive breakout that confirmed a powerful year-long uptrend, setting a new 52-week high and signaling the potential for a new chapter of growth.

The good news is multi-faceted: investors today witnessed powerful technical momentum, a validation of a strong underlying business, and a reminder of the company’s attractive valuation and shareholder-friendly dividend policy. With the stock now challenging the key psychological level of $50, the path of least resistance appears to be upward. Today’s performance has firmly established Bank of America as a must-watch stock for any investor seeking growth, value, and income in a single, world-class package.