Microsoft Stock Shows Impressive Resilience, Closing Higher After a Volatile Session

The technology giant (NASDAQ: MSFT) gained 0.59% on Friday, successfully rebounding from intraday lows to underscore strong investor support and a bullish outlook

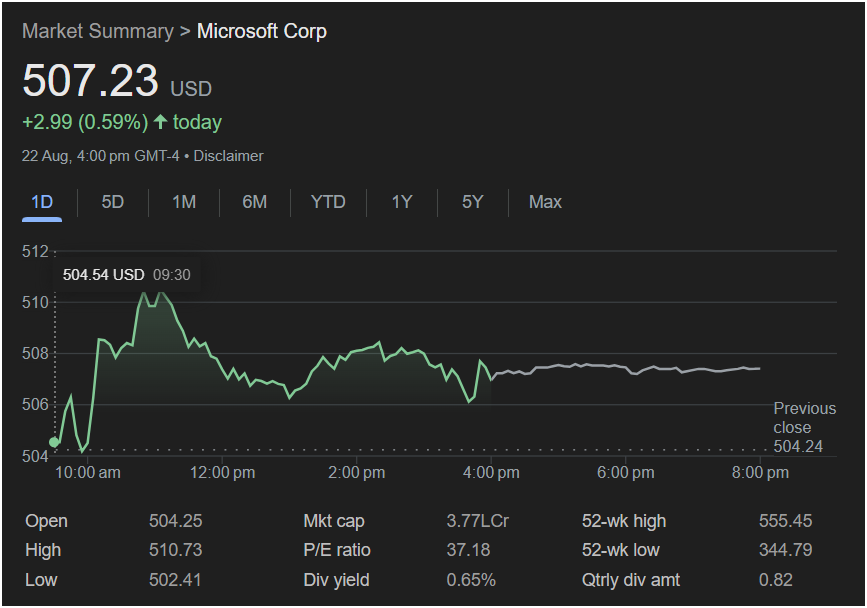

REDMOND, WASHINGTON – August 25, 2025 – Shares of Microsoft Corp. (NASDAQ: MSFT) finished the week on a positive note, closing at

2.99, or 0.59%, in a day that showcased the market’s enduring confidence in the software and cloud computing leader.

While the final gain was modest, the story of the day was one of remarkable resilience. The stock weathered a mid-day sell-off to rally back into the green, a strong technical signal that indicates buyers were eager to step in and support the stock at lower levels.

A Detailed Look at a Dynamic Trading Day

The trading session for Microsoft was a clear demonstration of a bull-bear struggle, with the bulls ultimately emerging victorious. The stock opened for trading at $504.25, almost flat with the previous day’s close of $504.24.

An initial wave of buying pressure in the morning drove the stock up to its session high of

502.41.

This is where the day’s positive story truly unfolded. Instead of continuing to fall, the stock found a solid floor of support just below the previous day’s close. From that low point, a steady stream of buying interest returned in the afternoon, lifting the shares back into positive territory and allowing them to close with a respectable gain. This V-shaped recovery within the day is a powerful sign of market conviction.

Financial Strength and Market Leadership

This resilient performance is underpinned by the rock-solid fundamentals that make Microsoft a core holding for investors worldwide.

-

A Multi-Trillion Dollar Titan: With a market capitalization in the multi-trillions (represented as 3.77LCr in some international data formats), Microsoft is one of the world’s most valuable companies. Its performance is a key bellwether for the entire technology sector and the broader market.

-

Premium Valuation for an AI Leader: The company’s Price-to-Earnings (P/E) ratio of 37.18 reflects the market’s high expectations for future growth, particularly from its leadership position in artificial intelligence and cloud computing through its Azure platform.

-

Impressive Year-Long Performance: The stock is trading comfortably in the upper half of its 52-week range, which spans from a low of

555.45. This highlights the powerful uptrend and significant returns delivered to shareholders over the past year.

-

Commitment to Shareholder Returns: Microsoft continues to reward its investors with a reliable dividend. It offers a dividend yield of 0.65%, with a quarterly payout of $0.82 per share, providing a desirable blend of growth and income.

Outlook: Investor Confidence Affirmed

Friday’s session was more than just a simple gain for Microsoft; it was an affirmation of investor confidence. The stock’s ability to absorb selling pressure and rally to a positive close suggests a deep well of support. As Microsoft continues to innovate and lead in the next generation of technology, this resilient market performance indicates that investors are firmly behind its long-term vision.