JPMorgan Chase Stock Analysis: Early Reversal Signals Bullish Fight Near 52-Week High

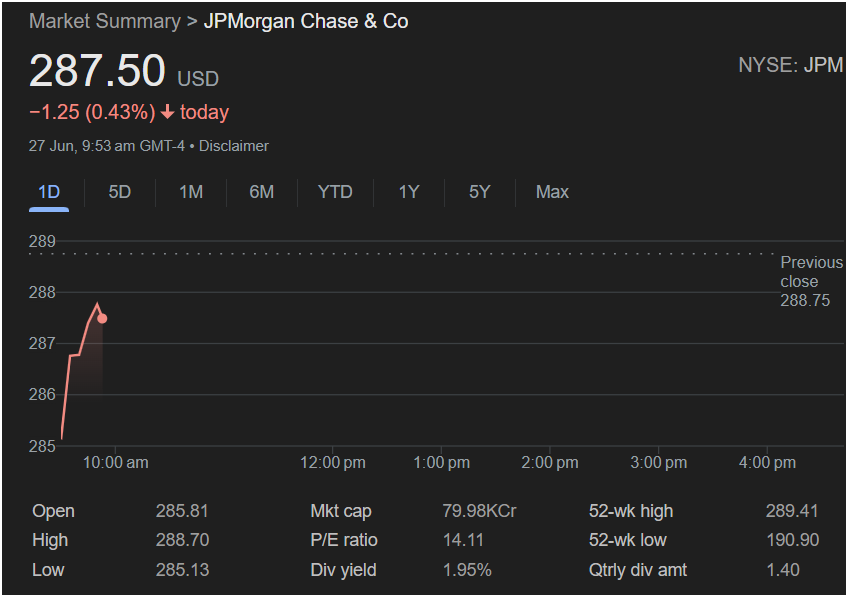

NEW YORK – JPMorgan Chase & Co (NYSE: JPM) stock is exhibiting significant volatility in early trading, presenting a complex but revealing picture for investors eyeing its next move. Despite being down for the day, the stock staged a powerful recovery from its opening lows, positioning it for a critical battle at its 52-week high and setting the stage for a potentially decisive Monday session.

This article provides a comprehensive breakdown of the key data points from the session’s opening moments to help traders determine if now is the right time to invest.

The Morning’s Volatile Action

As of 9:53 AM GMT-4, JPMorgan Chase stock was trading at

1.25 (0.43%) for the day. However, this headline number hides the real story.

The stock opened at $285.81, a notable gap down from the previous close of

285.13**, buyers stepped in with force, driving the price up aggressively to an intraday high of $288.70. This rapid V-shaped recovery off the lows indicates strong underlying demand and that investors are treating any dip as a buying opportunity. The stock is currently consolidating just below its intraday high, suggesting a pause before a potential next move.

Key Levels to Watch for Monday

This price action has established clear and critical technical levels that every trader should be watching heading into Monday:

-

Crucial Resistance (52-Week High): The stock’s 52-week high is $289.41. The morning’s rally stopped just short of this level, confirming it as a major psychological and technical barrier. A sustained break above this price on Monday would be a significant bullish breakout signal, potentially triggering a new leg up.

-

Key Pivot Point (Previous Close): The previous closing price of $288.75 is now a key pivot. Holding above this level would show that bulls are in control.

-

Immediate Support (Morning Low): The day’s low of $285.13 has become the most important short-term support level. A drop below this would negate the morning’s bullish reversal and could signal that sellers are gaining the upper hand.

Fundamental Strength Supports the Bull Case

Beyond the chart, JPMorgan’s fundamentals provide a solid foundation:

-

P/E Ratio: With a Price-to-Earnings ratio of 14.11, the stock appears reasonably valued compared to the broader market, suggesting it may not be overextended despite trading near its highs.

-

Dividend Yield: A healthy dividend yield of 1.95%, supported by a quarterly dividend of $1.40, makes the stock attractive to income-oriented investors, which can help provide price stability.

-

Market Position: As a financial behemoth with a market cap listed at 79.98KCr (a significant global valuation), JPM is a cornerstone of the financial sector.

Outlook for Monday: Is It Time to Invest?

The early trading data presents a classic “unstoppable force meets an immovable object” scenario. The bullish momentum is strong, but the resistance at the 52-week high is formidable.

For Traders:

-

The Bullish Case: The powerful buying pressure off the lows is a very positive sign. An investment could be justified if the stock demonstrates strength by opening on Monday and decisively breaking through the $289.41 resistance level. This would be a clear signal to buy.

-

The Cautious Case: If the stock is rejected at this resistance level again and begins to fall, it would be prudent to wait. A failure to hold above the

285.13 support would be a bearish signal.

: Monday’s opening bell will be critical for JPMorgan Chase stock. While the underlying sentiment appears bullish based on the strong intraday reversal, a confirmation is needed. Traders should watch for a breakout above the 52-week high. If it occurs, it could be an excellent opportunity to invest. If the stock falters at this key level, patience will be the better strategy.

Disclaimer: This article is for informational purposes only and is based on an analysis of the provided image. It does not constitute financial advice. All investment decisions carry risk, and investors should conduct their own research before trading.