Visa Inc. Stock Sees Volatile Sell-Off: A Trader’s Analysis for the Week Ahead

Visa Inc. stock (NYSE: V) is experiencing a volatile trading session this morning, presenting both risks and potential opportunities for investors. After opening higher, the stock faced a sharp decline, prompting traders to analyze whether this dip is a buying opportunity or a warning sign of further downside.

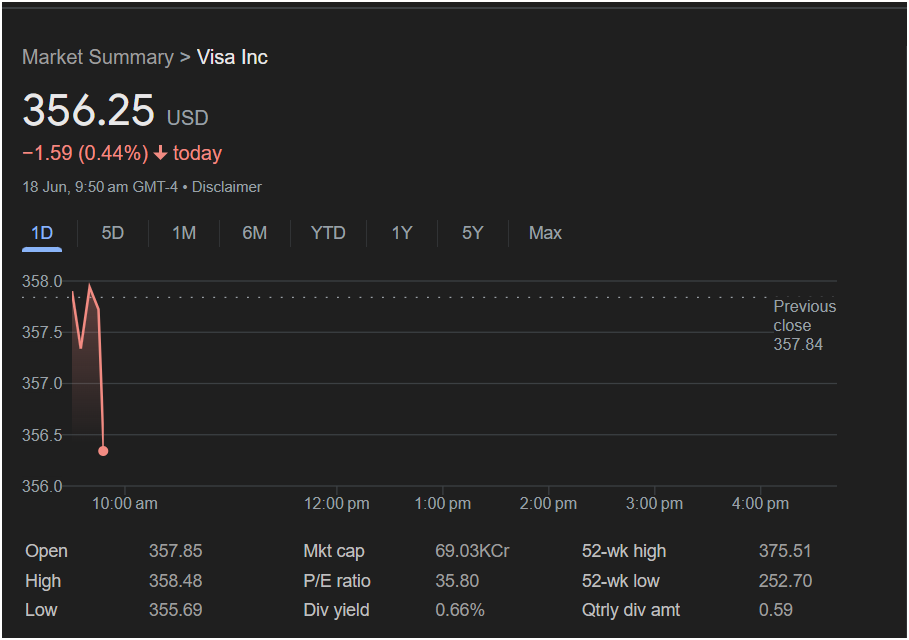

As of 9:50 AM GMT-4 on Tuesday, June 18th, Visa was trading at $356.25, down $1.59 or 0.44% for the day. This price point comes after a significant intraday swing, demanding a closer look from traders planning their moves for today and the upcoming week.

Today’s Intraday Price Action

The morning’s trading activity has been particularly dynamic:

-

Initial Strength Fades: The stock opened at

358.48**. This early optimism was short-lived.

358.48**. This early optimism was short-lived. -

Sharp Reversal: Following the high, sellers took control, pushing the price down aggressively to a daily low of $355.69.

-

Attempted Rebound: The chart shows a bounce off this low, with the price recovering slightly to its current level. This creates a critical support level for traders to watch for the remainder of the session.

Key Financials and Market Position

To understand the broader context of this price movement, consider these key metrics:

-

Valuation: With a P/E ratio of 35.80, Visa is valued as a growth company, meaning investors have high expectations for its future earnings.

-

52-Week Performance: The stock’s current price is significantly closer to its 52-week high of $375.51 than its 52-week low of $252.70. This indicates a strong, long-term uptrend, even with today’s pullback.

-

Dividend: The dividend yield is 0.66%, with a quarterly payout of $0.59 per share. This is a modest yield, typical for a stock focused more on capital appreciation than income.

-

Market Cap: Visa remains a financial titan with a market capitalization listed at 69.03KCr, positioning it as a mega-cap cornerstone of the market.

Outlook: Will the Market Go Up or Down on Monday?

Based on Tuesday’s early action, the outlook for Visa stock for the rest of the week, including the next trading Monday, is at a pivotal point.

The Bullish Case (Potential to Go Up):

Long-term investors may view this sharp dip as a classic “buy-the-dip” opportunity. The stock is in a confirmed long-term uptrend, and pullbacks are healthy. If the daily low of $355.69 holds as a firm support level, it could serve as a new base for the stock to resume its upward climb toward its 52-week high.

The Bearish Case (Potential to Go Down):

The intensity of the morning sell-off should not be ignored. It indicates that there is significant selling pressure. If the price breaks below the $355.69 low, it could trigger further stop-loss orders and attract short-sellers, potentially leading to a deeper correction.

: Is It Right to Invest Today?

For the active trader, today is a day for observation. The key is to see if the support at $355.69 holds. A strong close above $357 would be a bullish signal, while a close near the lows would be a bearish one.

-

For Long-Term Investors: If you believe in Visa’s fundamental strength, this dip offers a more attractive entry point than what was available at yesterday’s close.

-

For Short-Term Traders: Caution is paramount. Acting now is risky. A safer strategy would be to wait for confirmation: either a decisive bounce off the lows or a clear break below them to define the next short-term trend.

Looking ahead to Monday and the rest of the week, the market will be watching to see if this dip was a temporary blip or the start of a more meaningful pullback.

Disclaimer: This article is for informational purposes only and is based on the data provided in the screenshot. It does not constitute financial advice. All investment decisions should be made with the help of a qualified financial professional after conducting your own thorough research.