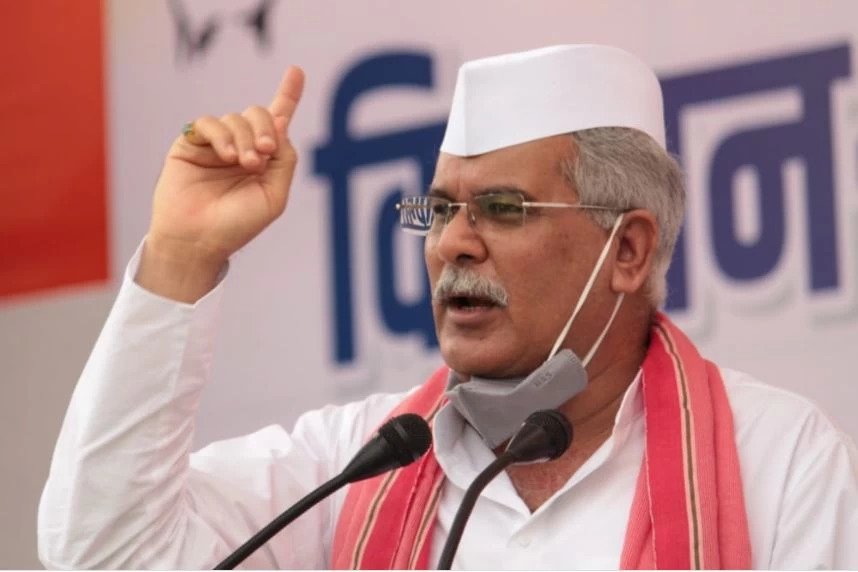

दिल्ली हिंसा पर CM भूपेश बघेल ने केंद्र सरकार को ठहराया जिम्मेदार… किसान आंदोलन को बदनाम करने की साजिश का लगाया आरोप…

रायपुर। CM भूपेश बघेल ने दिल्ली में किसान आंदोलन के दौरान हुई हिंसा के लिए केंद्र सरकार को जिम्मेदार ठहराया है। उन्होंने कहा कि केंद्र सरकार और दिल्ली पुलिस लाल किले जैसी ऐतिहासिक धरोहर की सुरक्षा नहीं कर पाई।

सीएम ने कहा कि किसान लाल किले तक पहुंचे कैसे इसका जवाब केंद्र सरकार दे। उन्होंने केंद्र पर षड्यंत्र पूर्वक किसान आंदोलन को बदनाम की साजिश रचने का आरोप लगाया। केंद्रीय मंत्री प्रकाश जाड़वेकर के राहुल गांधी पर दंगे भड़काने के आरोप पर सीएम ने कहा कि आंदोलन को भटकाने के लिए बीजेपी नेता गलत बयानबाजी कर रहे हैं।

सीएम भूपेश बघेल ने ट्वीट कर भी किसानों के आंदोलन का समर्थन किया। ट्वीट कर कहा है कि किसान का बेटा हूँ। किसान के लिए लडूँगा। किसानों को तोड़ने की कोशिश करने वाले जान लें, छत्तीसगढ़ की एक आवाज है- जय किसान

इससे पहले कांग्रेस महासचिव ने भी किसानों के साथ खड़े रहने का ऐलान किया है। उन्होंने ट्वीट कर लिखा है कि कल आधी रात में लाठी से किसान आंदोलन को ख़त्म करने की कोशिश की। आज गाजीपुरए सिंघू बॉर्डर पर किसानों को धमकाया जा रहा है। यह लोकतंत्र के हर नियम के विपरीत है।

कांग्रेस किसानों के साथ इस संघर्ष में खड़ी रहेगी। किसान देश का हित हैं। जो उन्हें तोड़ना चाहते हैं, वे देशद्रोही हैं। हिंसक तत्वों पर सख़्त कार्यवाही की जाए लेकिन जो किसान शांति से महीनो से संघर्ष कर रहे हैं, उनके साथ देश की जनता की पूरी शक्ति खड़ी है।