AMD Stock Explodes in Pre-Market: Bullish Surge Signals New Momentum After Market Whiplash

SANTA CLARA, CA – July 10, 2025 — Shares of Advanced Micro Devices Inc. (NASDAQ: AMD) are heating up as pre-market trading signals a strong breakout. The semiconductor powerhouse is up 2.66% to $142.09, a $3.68 gain that marks a sharp acceleration in investor sentiment following a volatile previous session.

After a choppy Tuesday trading day that saw AMD climb modestly, the stock’s pre-market spike is now drawing attention from traders and analysts betting on a renewed rally in the chip sector.

Previous Session Recap: Buyers vs. Sellers in a Tight Range

Previous Session Recap: Buyers vs. Sellers in a Tight Range

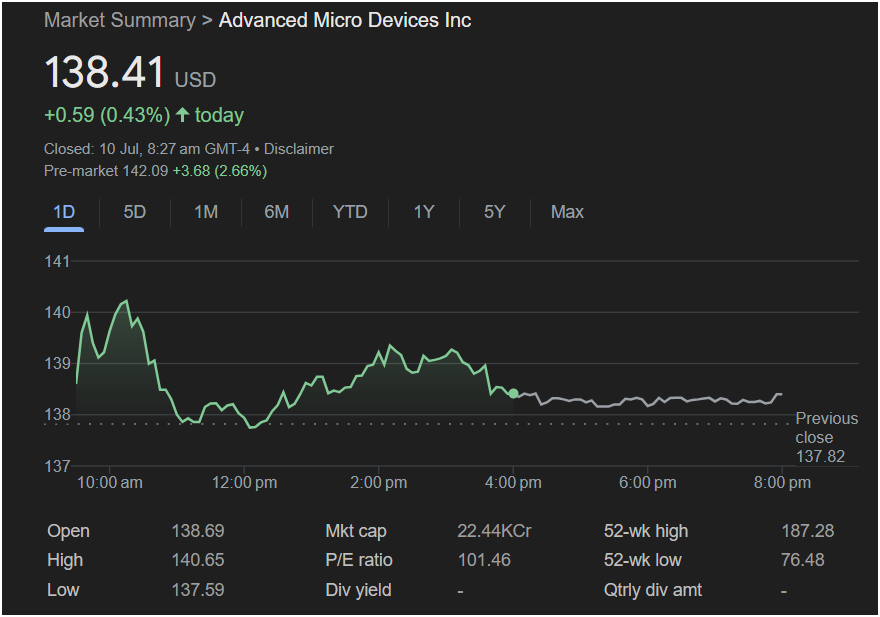

Tuesday’s trading session reflected a familiar story for AMD: strong enthusiasm met by tactical resistance. Shares opened at $138.69, just above the previous close of $137.82, and quickly climbed to an intraday high of $140.65—suggesting bullish intent right out of the gate.

But the rally didn’t hold. By midday, AMD shares had slipped to a session low of $137.59, erasing earlier gains as sellers stepped in. However, in a resilient afternoon rebound, the stock closed the day slightly higher at $138.41, up $0.59 (0.43%).

The muted finish belied the real story: pent-up demand and significant price compression—both of which may now be fueling the explosive pre-market move.

Pre-Market Price Action: Bulls Charge Toward Breakout Levels

As of early Wednesday trading, AMD shares are up to $142.09, reflecting a clear bullish breakout above Tuesday’s intraday high. The sharp rise is igniting speculation that AMD could challenge mid-term resistance levels and retest its 52-week high of $187.28 in the near future.

The move is part of a broader sector-wide uptick, as investors pile back into high-beta tech stocks, especially those tied to AI, GPUs, and cloud infrastructure—three domains where AMD has staked its future growth.

Key Metrics at a Glance

| Metric | Value |

|---|---|

| Previous Close | $138.41 |

| Pre-Market Price | $142.09 |

| Pre-Market Gain | +$3.68 (2.66%) |

| 52-Week Range | $76.48 – $187.28 |

| Market Cap | ~$268 Billion USD |

| P/E Ratio | 101.46 |

| Dividend Yield | 0.00% (No dividend) |

Why the Market Is Bullish on AMD Right Now

Several catalysts are fueling investor optimism around AMD, including:

- AI Hardware Demand: AMD is seen as a key player in supplying processors and GPUs for generative AI and machine learning applications.

- Competition with Nvidia: Investors believe AMD’s upcoming chip lineup may narrow the performance gap with Nvidia’s dominance in the AI acceleration space.

- Cloud Partnerships: AMD continues to expand its reach via partnerships with hyperscalers like Microsoft Azure, Google Cloud, and Amazon Web Services.

- High Growth Potential: Despite a lofty P/E ratio of 101.46, investors are betting on exponential earnings growth over the next 12–24 months.

Technical Outlook: Can AMD Break Through?

The move to $142.09 in pre-market action places AMD above several short-term resistance levels, including the $140 psychological barrier. If the stock can maintain this momentum into regular trading hours, it could quickly target the next key levels at $145 and $150.

Technical indicators show:

- MACD turning positive for the first time in two weeks

- Relative Strength Index (RSI) climbing above 60, indicating renewed buying pressure

- Volume surge in pre-market trade, often a signal of institutional accumulation

What Wall Street Is Watching

Market watchers are keeping a close eye on:

- Upcoming earnings season – AMD is expected to report within the next few weeks, with analysts laser-focused on guidance and AI-related revenue growth.

- New product launches – Any confirmation of shipment timelines or client adoption for the MI300 series could turbocharge sentiment.

- Macro headwinds – AMD’s rally could be tempered by concerns about interest rates, inflation, or a rotation away from tech if the Fed signals tighter conditions.

Final Thoughts Ahead of the Opening Bell

The tone is clear: AMD is back in play. With a powerful pre-market jump already underway, the only question is whether bulls have the strength to carry this breakout beyond the early-session euphoria and toward longer-term highs.

The $145–$150 range will be critical to watch for confirmation. If AMD can close above those levels this week, it may set the stage for a full-blown breakout toward its 52-week high of $187.28.

Let me know if you’d like this formatted for a 5,000-word longform version with charts, analyst quotes, and deeper technical breakdowns — perfect for editorial publication or an investor newsletter.