Walmart Stock Slides in Volatile Session—Pre-Market Hints at a Subtle Turnaround

Walmart Inc. (NYSE: WMT) endured a day of volatility on July 10, 2025, as shares of the retail titan fluctuated between gains and losses before closing modestly lower. The day’s price action left investors speculating whether a short-term pullback is merely a pause—or a warning sign.

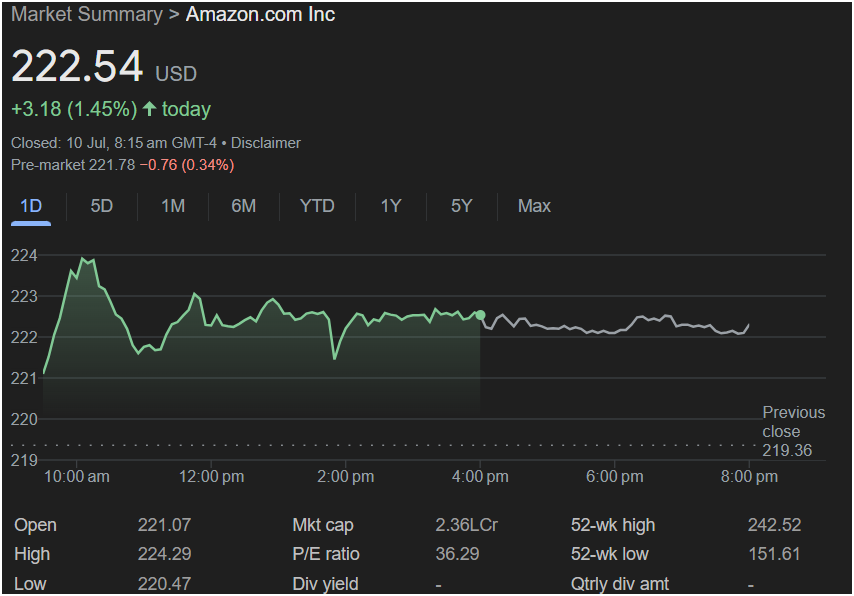

Walmart stock ended the session at $96.81, marking a daily decline of $0.28, or 0.29%, compared to the previous close of $97.09. The dip came after a choppy day of trading marked by both bullish enthusiasm and afternoon sell-offs, reflecting broader market uncertainty and sector rotation.

Choppy Trading Day Sends Mixed Signals

The July 10 trading session was anything but dull for Walmart shareholders. The stock opened at $97.15, showing modest strength in early action. Bulls briefly took control, driving the price to an intraday high of $99.17, supported by optimistic sentiment around consumer spending and early strength in retail stocks. But as midday turned to afternoon, selling pressure mounted.

Walmart shares fell sharply in the second half of the session, hitting a low of $96.38 before stabilizing just above that level into the close. The 1-day intraday chart reflects a textbook “bull trap” pattern: an early surge, a mid-session peak, and a sharp reversal into the red.

Such movement is not uncommon in stocks like Walmart, where heavy institutional trading, high daily volume, and sensitivity to macro headlines can produce exaggerated intraday swings.

52-Week Context: Still Well-Positioned

52-Week Context: Still Well-Positioned

Despite the dip, Walmart’s current share price remains comfortably within its 52-week trading range, which stretches from a low of $66.67 to a high of $105.30. This broader trend highlights the resilience of Walmart stock amid turbulent economic conditions, global supply chain shifts, and rising competition in the retail landscape.

Over the past year, Walmart has consistently held ground as a defensive stock favorite—a position reinforced by its expansive grocery segment, aggressive pricing strategy, and steady dividend policy. In uncertain market environments, these characteristics often make Walmart a go-to choice for long-term investors seeking safety over speculation.

Fundamentals: Valuation and Income Appeal

At current levels, Walmart trades at a P/E ratio of 41.53, indicating that investors are willing to pay a premium for the company’s earnings potential. While high for the retail sector, this valuation suggests market confidence in Walmart’s ability to generate reliable earnings growth, even as inflationary pressures and labor costs continue to weigh on margins.

The company’s dividend yield of 0.97%, with a quarterly dividend payout of $0.23 per share, provides added value for income-seeking investors. While not considered a high-yield dividend stock, Walmart’s payout is viewed as safe and stable, thanks to its robust balance sheet and consistent free cash flow.

Pre-Market Data Offers Glimmer of Optimism

Heading into the next trading day, pre-market indicators are showing signs of a potential rebound. As of early Thursday morning, Walmart shares are quoted at $96.95, up $0.14 or 0.14% from the prior close. While modest, the move suggests that some traders may be stepping in to buy the dip.

Pre-market performance often serves as a window into market sentiment before the bell. With futures pointing to a mixed open for broader indices, Walmart’s slight upward tick could reflect defensive interest or short-covering by traders unwilling to hold bearish positions overnight.

Whether this minor rally holds into the regular session will depend largely on investor response to economic data releases, sector momentum, and broader market risk appetite.

Technical Levels to Watch: Support Near, Resistance Looming

From a technical analysis standpoint, Walmart stock appears to be resting near a minor support zone at $96.30–$96.50. A break below that range could expose the stock to further declines toward the $95 psychological threshold. Conversely, if bulls regain control, upside resistance stands near the $98.75–$99.25 range, with $99.17 marking the high point from July 10’s session.

The stock’s 50-day moving average has recently flattened, while the Relative Strength Index (RSI) remains neutral, suggesting neither overbought nor oversold conditions. This technical setup supports the case for a range-bound move—unless a catalyst pushes the stock decisively in either direction.

Traders will be monitoring whether Thursday’s action confirms a dead cat bounce or a more sustainable reversal.

Retail Sector Under the Microscope

Walmart’s movement is part of a broader trend within the U.S. retail sector. Recent earnings reports and forward guidance from peers such as Target, Costco, and Dollar General have painted a mixed picture of consumer health. While essentials remain in high demand, discretionary spending has cooled—especially among lower-income shoppers impacted by higher borrowing costs and persistent inflation.

Walmart’s strength lies in its ability to offer value across essential categories. The company’s focus on low everyday prices, combined with expansion in digital offerings, positions it favorably relative to more discretionary-focused rivals.

Still, the retail industry faces continued headwinds, including supply chain constraints, changing shopping habits, and labor shortages. Walmart’s ability to adapt and scale is central to investor confidence, particularly as it invests heavily in technology and omnichannel integration.

Strategic Growth Initiatives Remain in Focus

Beyond daily price fluctuations, Walmart’s long-term strategy remains a key focal point for both Wall Street and Main Street. The company has continued expanding its Walmart+ subscription service, growing its third-party marketplace, and modernizing supply chains with automation and AI-driven logistics.

Investments in e-commerce infrastructure, including micro-fulfillment centers and last-mile delivery networks, have significantly boosted Walmart’s competitiveness against Amazon. The retail giant has also shown strength in international markets, including a growing footprint in India via its Flipkart acquisition and presence in Latin America.

In addition, Walmart is exploring healthcare, financial services, and in-house product innovation, all aimed at increasing wallet share and customer loyalty.

Wall Street Sentiment: A Stock to Watch, Not to Ignore

Analyst sentiment around Walmart remains cautiously optimistic. While the stock is not seen as a high-growth name, its reputation for consistency and reliability makes it a top holding in many diversified portfolios.

Recent analyst coverage shows a consensus price target in the $105–$110 range, indicating potential upside from current levels. However, short-term price action will depend on broader economic signals and whether the company can continue executing on margin improvement initiatives amid a tough cost environment.

Earnings on the Horizon: Expectations and Implications

Investors are already looking ahead to Walmart’s next quarterly earnings report, expected in August. Expectations are for steady revenue growth driven by grocery and consumables, with e-commerce and membership revenue also under scrutiny.

Key metrics will include:

- Same-store sales

- Operating margin

- Walmart+ subscription growth

- Inventory turnover

Management’s tone during the earnings call will be particularly important in setting the tone for the stock’s near-term direction.

Macro Factors and Fed Policy Remain Crucial

Walmart’s stock performance continues to be influenced by larger macroeconomic forces. The Federal Reserve’s stance on interest rates, inflation outlook, and consumer confidence data all play vital roles in shaping retail sector performance.

With interest rates still elevated and inflation sticky across core categories, Walmart remains well-positioned to attract cost-conscious consumers. However, the company must also manage internal cost pressures without sacrificing service levels or customer satisfaction.

Would you like a Google News meta description, Twitter/X post, or featured image caption to go along with this article? I can also format this into a ready-to-publish HTML news page or provide schema markup to help it rank better in search engines.