Broadcom Rockets to Record Highs as Investors Bet Big on Tech Growth

CUPERTINO, CA — Broadcom Inc. (NASDAQ: AVGO) sent shockwaves through the market on Tuesday, as shares of the semiconductor powerhouse surged to a new 52-week high. With Wall Street sharply focused on the future of AI, cloud infrastructure, and data connectivity, Broadcom’s climb marks a strong signal of investor confidence in the tech sector.

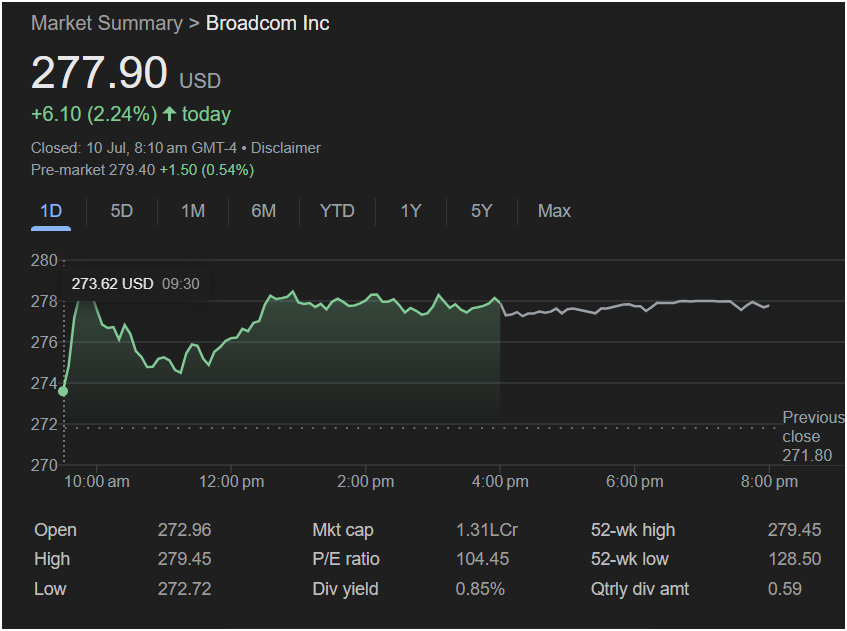

The stock ended the day at $277.90 per share, notching a substantial gain of $6.10 or 2.24%. More importantly, this marks the highest closing price the stock has seen over the past year and solidifies Broadcom’s momentum in an increasingly crowded and competitive chipmaking landscape.

Strong Trading Day Drives Investor Optimism

Broadcom’s rally wasn’t just a lucky bounce. The stock opened the day at $272.96, slightly higher than Monday’s close of $271.80. After briefly dipping to a session low of $272.72, buyers took control, driving steady upward momentum that ultimately peaked at $279.45 — a brand-new 52-week high.

This bullish price action drew the attention of traders, analysts, and institutional investors alike, as Broadcom carved out a clear path of strength amid broader market volatility. The trading session reflected not only strength in the company’s fundamentals but also investor enthusiasm for the broader semiconductor ecosystem.

Pre-Market Action Signals Continuation of Gains

Pre-Market Action Signals Continuation of Gains

Investors waking up to Broadcom news this morning had even more reason to smile. In pre-market trading, the stock ticked up once again — last seen at $279.40, up another $1.50 or 0.54% from the prior close. This positive signal suggests that Broadcom’s rally is more than just a short-term spike; it’s part of a broader trend of sustained investor confidence.

As futures markets show modest gains and the Nasdaq eyes a higher open, Broadcom’s early activity sets the tone for another potentially strong session.

A Look at the Numbers: Strong Valuation and Yield

What’s powering this rally? It’s more than just hype.

Broadcom currently sports a Price-to-Earnings (P/E) ratio of 104.45, a valuation that might seem high at first glance but reflects bullish sentiment around its future earnings growth. With the company deeply embedded in next-gen chip development, AI processing, and 5G infrastructure, investors appear confident that Broadcom’s current valuation is justified — if not still underpriced.

Despite the premium price, Broadcom continues to offer value for dividend investors. The company maintains a dividend yield of 0.85%, a sign of financial stability and long-term strategic planning. In an environment where tech stocks are often laser-focused on reinvestment and growth, Broadcom’s commitment to delivering shareholder income is a key differentiator.

Broadcom’s Position in the Semiconductor Landscape

Broadcom’s dominance in the semiconductor industry has been built over years of innovation, strategic acquisitions, and expansion into high-growth verticals. Its chip technologies are core components in everything from smartphones and data centers to routers and autonomous vehicles.

With Apple, Google, and other tech titans relying on Broadcom’s connectivity solutions, the company is seen as an essential cog in the global tech supply chain. Broadcom’s aggressive positioning in AI-enabling infrastructure — especially through its customized silicon for hyperscale cloud providers — has only added fuel to investor sentiment.

In the past year, Broadcom has aggressively expanded into custom ASIC (Application-Specific Integrated Circuit) production, a niche but growing segment that plays directly into the demands of AI developers and cloud giants. This segment offers higher margins and lower competition compared to general-purpose chips, making it an area of considerable strategic value.

Tech Sector Tailwinds Boost Semiconductor Stocks

Broadcom’s rise isn’t happening in a vacuum. The broader tech sector has been on a tear, particularly companies tied to AI, machine learning, and data processing. As enterprise demand for computing power surges, chipmakers like Broadcom are seeing increasing demand for their products.

Furthermore, investor confidence in tech was recently bolstered by strong earnings reports from peers in the semiconductor industry. Nvidia, AMD, and Intel have all reported better-than-expected revenues, signaling robust growth ahead. Broadcom’s recent stock performance appears to be riding this broader wave of sector optimism.

52-Week Performance: A Story of Strength and Resilience

From a low of $128.50 to its new high of $279.45, Broadcom has more than doubled in value over the past year. This trajectory is emblematic of both company-specific execution and macroeconomic tailwinds, including easing inflation pressures and increased capital expenditure from cloud service providers.

Such price action suggests a long-term trend that may have more room to run. Technical traders point to continued volume increases and bullish momentum indicators, hinting that the stock could break into even higher territory if market conditions remain favorable.

Analysts Weigh In on AVGO’s Future

Wall Street analysts have taken note. Several firms have recently updated their price targets for Broadcom, with some calling for highs in the $300 to $320 range over the next 6 to 12 months.

Analyst sentiment is largely grounded in the belief that Broadcom is uniquely positioned to benefit from two transformative trends — the AI revolution and global 5G deployment. Both markets are expected to grow exponentially over the coming years, and Broadcom’s deep involvement in both areas gives it a potential advantage over competitors.

In addition, the company’s software acquisition strategy — notably its purchase of VMware — is beginning to pay off, diversifying revenue streams and offering recurring income that complements its hardware segment.

Institutional Buyers Signal Confidence

Recent 13F filings show a surge of institutional interest in Broadcom shares. Major funds, including BlackRock, Vanguard, and State Street, have all added to their AVGO positions in recent quarters.

This level of institutional buying typically suggests strong confidence in a company’s fundamentals and long-term outlook. With more hedge funds and pension portfolios adding Broadcom to their holdings, momentum could continue building — particularly in the absence of significant macroeconomic headwinds.

Retail Investors Take Notice Amid Growth Narrative

While institutions have made their moves, retail traders are also jumping on board. On platforms like Reddit, Stocktwits, and X (formerly Twitter), Broadcom has become a buzzword among retail investors looking for strong growth stories with real-world demand drivers.

Retail enthusiasm has also been fueled by bullish options activity, as call volume has surged in recent days. High open interest in calls expiring this month indicates that many are betting on continued upside over the short term.

This growing retail momentum — coupled with institutional support — creates a dual-engine effect that can amplify price movements, particularly in a relatively low-float environment.

Options Activity Points to Bullish Expectations

A dive into Broadcom’s options chain reveals an increasingly bullish sentiment among traders. Call option volume has far outpaced puts, especially at strike prices above $280. This signals that many traders expect the stock to breach new highs in the coming sessions.

Moreover, implied volatility on AVGO options remains elevated, indicating strong demand for exposure to the stock’s upside. This could attract even more short-term traders looking to ride the momentum wave while institutional investors focus on longer-term fundamentals.

Technical Analysis: Support and Resistance Levels in Focus

Chart watchers are paying close attention to several key levels following Broadcom’s breakout. The next psychological milestone is the $280 resistance mark, a level that traders believe could unlock even more upside if surpassed with volume.

On the downside, support appears to be forming around the $272–$274 zone, where buyers consistently stepped in during Tuesday’s session. Technical indicators such as the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) suggest continued strength, with no immediate signs of overbought conditions.

Traders are also eyeing moving averages, with the 50-day and 200-day lines well below the current price, underscoring the strength of the trend and the likelihood of sustained gains.

Market Implications and Broader Outlook

Broadcom’s surge is sending a strong message to the broader market: tech is still king, and semiconductors remain one of the most strategic assets in the global economy. As AI workloads intensify and digital infrastructure grows more complex, demand for Broadcom’s solutions is only set to increase.

This rally also raises expectations for upcoming earnings calls. Investors will be watching closely to see whether the company can maintain its momentum through the second half of the year. Future guidance on margin expansion, software integration (post-VMware), and product pipeline development will be key areas of focus.