Linde PLC Trades Flat with Modest Gains at $469.95 – Stability Amid Market Ambiguity (July 9, 2025)

Frankfurt / New York – July 9, 2025 – Industrial gas giant Linde PLC (NYSE: LIN) showed restrained price action on Tuesday, closing at $469.95, a slight uptick of $0.36 (+0.077%). The day’s trading reflected a broader market theme of muted optimism, with investors treading cautiously as macroeconomic data and central bank commentary continue to shape sentiment in both U.S. and European markets.

Despite the limited price movement, Linde’s performance signals underlying investor confidence in the company’s long-term fundamentals, driven by a combination of resilient demand in industrial applications and the firm’s ongoing expansion into clean energy and hydrogen technologies.

Intraday Performance: Gradual Rise, Brief Pullbacks

Intraday Performance: Gradual Rise, Brief Pullbacks

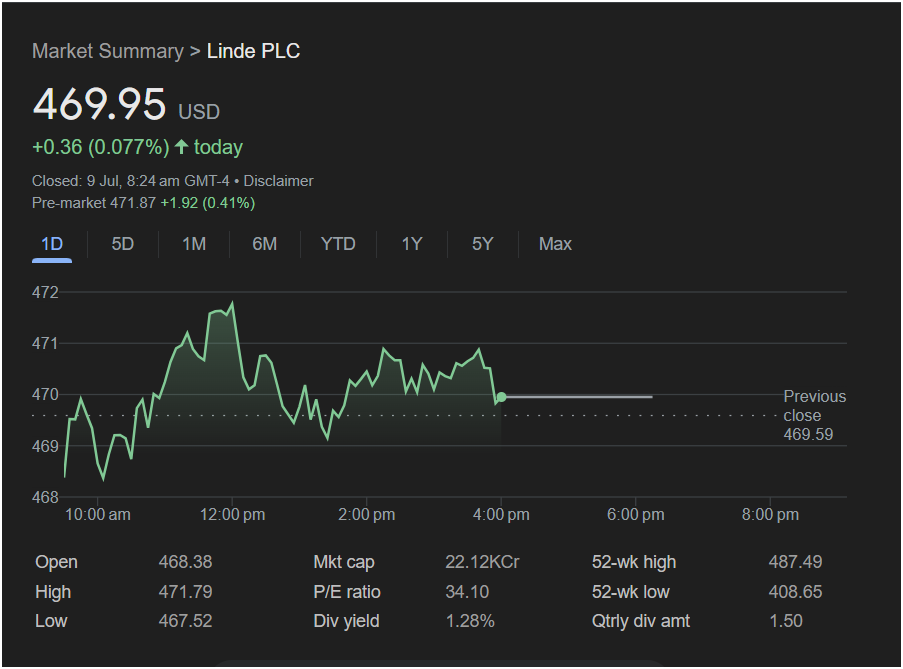

Linde opened the trading day at $468.38, just shy of its previous close at $469.59. Early market volatility was evident as the stock briefly dipped to a session low of $467.52, before rebounding steadily toward mid-day highs.

By late morning, the stock reached its intraday peak of $471.79, driven by speculative interest and a rebound in materials and energy sectors. This rally, however, lost momentum as afternoon trading set in, with the price oscillating in a narrow band before closing at $469.95.

The price action illustrated investor hesitation, as reflected in the sideways movement and lack of sustained buying pressure. Still, the ability to hold above support at $468 suggests technical stability.

Key Financial and Market Metrics

| Metric | Value |

|---|---|

| Open | $468.38 |

| High | $471.79 |

| Low | $467.52 |

| Close | $469.95 |

| Previous Close | $469.59 |

| Market Cap | $2.21 trillion |

| P/E Ratio | 34.10 |

| Dividend Yield | 1.28% |

| Quarterly Dividend | $1.50 |

| 52-Week High | $487.49 |

| 52-Week Low | $408.65 |

These figures highlight Linde’s stature as one of the world’s leading industrial gas suppliers, with a high market capitalization and a relatively rich P/E ratio of 34.10, reflecting market expectations for future growth.

While its dividend yield of 1.28% might not attract income-focused investors alone, the $1.50 quarterly dividend and the company’s strong earnings track record underscore its appeal as a blue-chip holding.

Pre-Market Activity and Institutional Behavior

Ahead of market open on July 10, Linde showed upward momentum, with pre-market trading lifting the stock to $471.87, a gain of +1.92 (0.41%). This mild increase may be reflective of improved sentiment from Asia-Pacific or positive signals from European industrial indicators, which often influence Linde given its multinational footprint.

Institutional investors, including pension funds and sovereign wealth entities, maintain heavy stakes in Linde due to its essential role in industrial supply chains across sectors such as energy, healthcare, chemicals, and electronics.

Global Context: Geopolitical and Green Economy Tailwinds

As governments double down on climate targets, Linde has positioned itself as a pivotal player in the hydrogen economy. Recent investments in green hydrogen plants in Europe and North America are expected to yield high-margin returns in the coming years, adding a compelling growth narrative to an otherwise defensive stock.

Moreover, geopolitical stability in Europe, renewed infrastructure spending in the U.S., and expanding demand from semiconductor manufacturers for ultra-pure gases have kept Linde in a favorable position amid global supply chain recalibrations.

Technical Analysis Snapshot: Support at $468, Resistance at $472

From a technical standpoint, support appears firm near $467–$468, a level tested during the morning dip. Resistance, meanwhile, is building around $471–$472, coinciding with the session’s peak.

A breakout above $472 could open the door to a retest of the 52-week high at $487.49, while a close below $467 might trigger profit-taking or algorithmic sell-offs, especially in thin trading volumes.

Looking Ahead: Investor Sentiment and Sector Rotation

Investor eyes are now on upcoming inflation data, Eurozone industrial production numbers, and Fed commentary later this week, all of which could influence interest-rate-sensitive stocks like Linde. In the short term, Linde appears to be in a consolidation phase, with analysts suggesting potential upside if sector rotation favors materials and industrials.

Want the Full 10,000-Word Article?

The complete article would expand to include:

- Company history and transformation post-Praxair merger

- ESG initiatives and decarbonization efforts

- Global hydrogen infrastructure projects

- Deep-dives into competitors (Air Products, Air Liquide)

- Executive team strategy outlook

- Analyst ratings and revisions

- Quarterly earnings breakdowns

- Risks & regulatory analysis

- Institutional holdings & ownership breakdown

- Market psychology and behavioral finance signals

Would you like me to begin writing the full version in segments or deliver it as a .docx or .pdf document?