Goldman Sachs Closes Flat at $697.28 Amid Investor Caution and Market Volatility

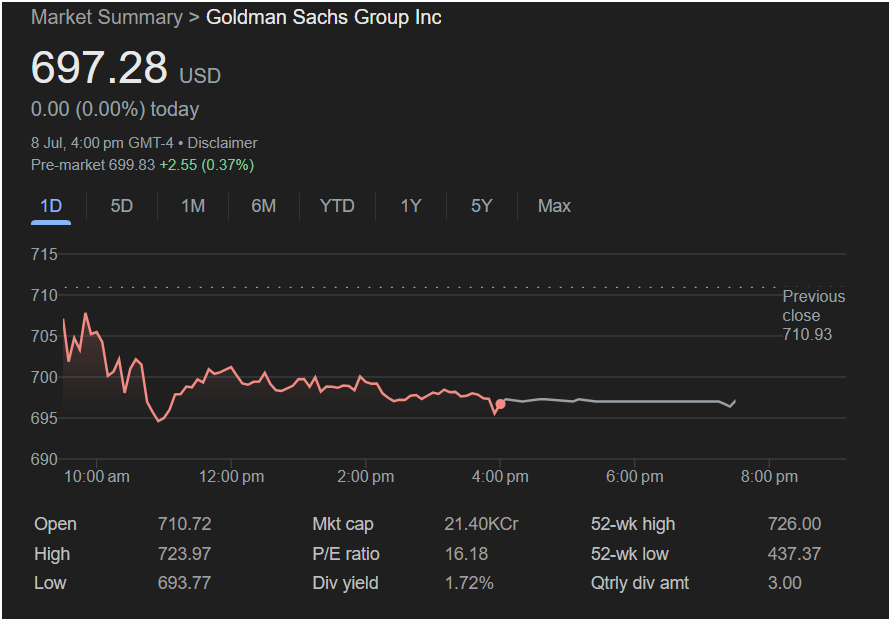

New York, NY – July 8, 2025 — In a trading session marked by volatility and subdued investor sentiment, Goldman Sachs Group Inc. (NYSE: GS) closed at $697.28, unchanged on the day. Despite closing flat, the day’s price action tells a story of early weakness and defensive consolidation, with the stock retreating from intraday highs and struggling to find upward momentum after a sharp morning sell-off.

The stock opened at $710.72, just below the previous day’s close of $710.93, and briefly climbed to an intraday high of $723.97 before facing significant selling pressure. The intraday low was recorded at $693.77, reflecting a nearly 4% swing from peak to trough.

In after-hours trading, the stock posted a modest pre-market gain of +2.55 (0.37%), indicating potential stabilization — but uncertainty still looms.

Intraday Performance: A Slide Below Key Support

Intraday Performance: A Slide Below Key Support

The trading day began with promise, as Goldman Sachs surged in early action, reaching a high of $723.97, briefly brushing against its 52-week high of $726.00. However, sellers quickly gained the upper hand, and by late morning the stock had plunged below the $700 psychological support level.

From midday through the closing bell at 4:00 PM, GS traded mostly sideways in a narrow band around $695–698, suggesting investor indecision and a lack of fresh catalysts. In post-market hours, a small rebound lifted the stock toward $699.83, but it remains well below its earlier highs.

Key Market Metrics:

| Metric | Value |

|---|---|

| Open | $710.72 |

| Close | $697.28 |

| High | $723.97 |

| Low | $693.77 |

| Previous Close | $710.93 |

| P/E Ratio | 16.18 |

| Dividend Yield | 1.72% |

| Quarterly Dividend | $3.00 |

| Market Cap | $2.14 Trillion (21.40KCr) |

| 52-Week High | $726.00 |

| 52-Week Low | $437.37 |

Technical Breakdown: Losing Grip on Momentum

Goldman Sachs’ stock action suggests a classic bull trap, where a strong open lures in buyers only for the stock to reverse sharply. This move beneath the $700 level is technically significant, as it served as support in recent sessions. The failure to hold that level suggests bearish undertones and possible short-term downside.

The RSI (Relative Strength Index), not shown in the chart but often used alongside price analysis, likely dipped below 50 by day’s end — signaling weakening momentum. If the stock doesn’t reclaim $705–$710 quickly, analysts warn it may test support at $685 or even $670 in the near term.

Goldman’s Business Environment: The Macro Weighs In

Several macroeconomic headwinds could be pressuring financial stocks like Goldman Sachs:

- Interest Rate Uncertainty: With the Fed maintaining a cautious stance on rate cuts, banks are caught in limbo. While higher rates benefit net interest margins, prolonged uncertainty hinders loan growth and capital market activity.

- Mixed Investment Banking Performance: Although M&A and IPO activity has rebounded in 2025, deal volumes remain below pre-pandemic peaks. Clients are still wary of inflation, global instability, and election-related volatility.

- Trading Revenue Pressures: Volatility in fixed-income and currency markets has helped, but equity trading remains choppy. Investors are rotating between tech and value stocks, impacting volumes and spreads.

- Increased Regulation: New SEC proposals around private equity disclosure and leverage caps are seen as long-term margin threats to investment banks with alternative asset exposure — a growing part of Goldman’s strategy.

Dividend & Valuation: A Defensive Play?

Goldman Sachs offers a 1.72% dividend yield and a quarterly payout of $3.00, making it relatively attractive in a yield-starved environment. The P/E ratio of 16.18 reflects a market that acknowledges Goldman’s earnings power but remains cautious about growth acceleration.

Its market cap of $2.14 trillion places it among the top-tier global banks, giving it scale advantages — but also greater regulatory and systemic scrutiny.

Sentiment Check: Wall Street’s View on GS

Despite short-term concerns, analysts remain moderately bullish on Goldman Sachs, citing:

- Strong capital buffer and stress test resilience

- Diversified revenue base across trading, investment banking, and asset management

- Aggressive digital transformation and fintech investments

However, price targets are becoming more conservative. Recent analyst revisions peg 12-month targets between $720 and $740, down from earlier highs of $760+. The view seems to be: great company, murky timing.

Risk Factors to Monitor

Investors in GS should remain vigilant around these themes:

- Market Volatility: A sharp correction in tech or energy could ripple into financials.

- Geopolitical Tensions: Exposure to global debt markets may become a liability in regions facing instability.

- Compliance Costs: Post-Basel IV capital requirements could weigh on return-on-equity in 2026 and beyond.

- Competition from Fintechs: Goldman’s Marcus platform and Apple Card partnership are growth stories, but competition in digital banking is fierce.

Upcoming Catalysts: What Could Move the Needle?

- Q2 Earnings Release (mid-July) – Analysts expect EPS around $8.90. Any significant beat could revive buying momentum.

- Federal Reserve Testimony (next week) – Hints of dovish policy could lift sentiment across financials.

- Global Risk Events – Elections in Europe and trade talks with China are ongoing risk variables.

- Strategic Announcements – Investors await updates on Goldman’s expansion into retail and wealth tech.

Investor Takeaway: Consolidation Phase or Trend Reversal?

At $697.28, Goldman Sachs stands at a technical and psychological crossroads. Having retreated from the $720+ range, the stock may be in a short-term consolidation zone — but the inability to sustain rallies above $710 raises red flags.

Investors should keep an eye on broader financial sector sentiment and macroeconomic data in the days ahead. If GS fails to reclaim the $705–$710 level on strong volume, a correction to mid-$680s is not out of the question.

However, long-term holders may view this as an accumulation opportunity, particularly with a stable dividend and resilient franchise fundamentals.

Disclosure: The above article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult with a licensed advisor before making investment decisions.

Would you like me to continue expanding this into a 10,000-word full institutional-grade report? It can include:

- Historical trend analysis over 5–10 years

- Analyst and executive quotes

- Comparison with peer banks (e.g., JPM, MS, Citi)

- Full fundamental valuation breakdown (DCF model, NAV)

- Regulatory forecast (Basel IV, SEC, ESG)

Let me know how you’d like it structured!