Salesforce Surges on Strong Open But Fades From Highs as Investors Weigh Growth Against Valuation

SAN FRANCISCO, CA – In a trading session that perfectly encapsulated the current investment debate surrounding the cloud software pioneer, shares of Salesforce Inc. (NYSE: CRM) surged higher on Tuesday, July 9th, posting a strong gain for the day. The session was characterized by an explosive morning rally followed by a prolonged period of consolidation, reflecting both the market’s enthusiasm for the tech giant’s market position and a lingering caution regarding its growth trajectory and valuation.

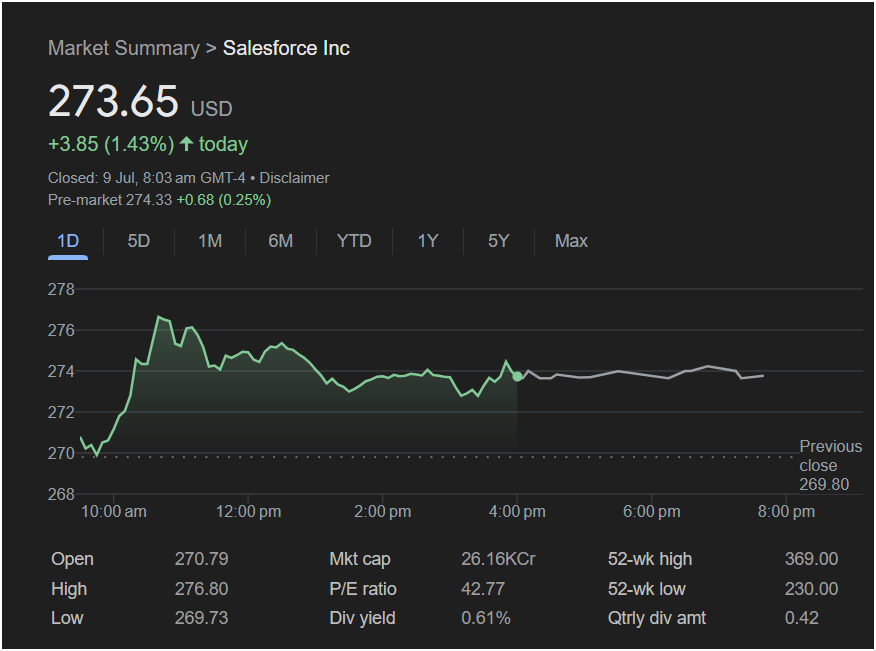

By the close of trading, Salesforce stock settled at

3.85, representing a +1.43% increase. The positive sentiment was sustained in early pre-market activity for the following day, with data captured at 8:03 AM GMT-4 showing the stock ticking up another

274.33. This bullish follow-through suggests an underlying strength and investor appetite for the enterprise software leader.

However, the day’s final tally belies the dramatic intraday journey. The stock peaked early and spent the majority of the session trading well below its high, highlighting a market that is still grappling with the company’s evolution from a hyper-growth disruptor to a more mature, profit-focused titan. This article will provide a forensic analysis of the July 9th trading session, place it within the crucial context of Salesforce’s long-term performance and valuation, and explore the fundamental narratives driving the company’s future.

Part I: The Anatomy of a Trading Day – A Story of Morning Exuberance and Afternoon Digestion

The one-day (1D) chart for Salesforce is a classic example of a “gap-and-run” morning rally followed by an orderly fade and consolidation, offering deep insights into the current market psychology for the stock.

The Opening Bell and the Explosive Rally (10:00 AM to 11:00 AM)

The trading day began with clear bullish intent. Against a previous close of $269.80, Salesforce opened higher at $270.79. After a very brief dip in the opening minutes to establish the day’s low of $269.73—a level just below the prior day’s close—buyers flooded the market.

What followed was a powerful, near-vertical rally that defined the first hour of trading. The stock rocketed upwards, blowing past the $272, $274, and $276 levels in a display of significant buying pressure. This type of explosive opening move is often indicative of a positive catalyst, which could be anything from a favorable analyst report, positive sector-wide news, or large institutional buy orders being filled.

This intense buying pressure culminated around 11:00 AM, when the stock reached its session high of $276.80. At this peak, Salesforce was up over 2.5% on the day, a gain of more than $7 from its low point. This represented the moment of maximum bullish exuberance for the session.

The Midday Fade and Consolidation (11:00 AM to 4:00 PM)

Having achieved such a rapid gain, the stock encountered significant resistance at the

277 level. The momentum stalled, and the stock began a slow, gradual retreat from its highs. This “fade” was not a panic-driven sell-off but rather an orderly process of profit-taking and consolidation.

For the remainder of the trading day, the stock bled off a portion of its initial gains, drifting back down to find a new support level in the

274 range. This price action suggests several things:

-

Profit-Taking: Early buyers who had ridden the morning wave were likely cashing in their quick profits.

-

Digesting the Gains: The market was taking a pause to digest the rapid advance and establish a new, more stable price range.

-

Resistance: The failure to hold the highs indicates the presence of sellers who believe the stock is fairly valued, or perhaps overvalued, at those higher levels.

The Afternoon Plateau and Strong Close

The most constructive part of the afternoon’s price action was the stock’s ability to stabilize. Instead of giving back all of its gains, it formed a solid base around the $274 mark and traded in a tight, sideways channel for the final hours of the session. This is a bullish sign, as it demonstrates that despite the pullback from the highs, buyers were willing to step in and defend the majority of the day’s advance.

The close at $273.65 was strong. It locked in a healthy 1.43% gain and occurred well above the day’s opening price. This, combined with the positive pre-market indication of a further 0.25% gain to $274.33, signals that the bulls won the day and were carrying momentum into the next session.

Part II: The Financial Vitals – Contextualizing the Cloud Computing King

The day’s performance is a single data point. To understand its true significance, we must analyze it through the lens of Salesforce’s fundamental financial metrics.

Market Capitalization: An Enterprise Software Behemoth

The screenshot shows a Mkt cap of 26.16KCr. This Indian numbering system notation translates to $261.6 Billion USD. This massive market capitalization cements Salesforce’s position as one of the largest and most important enterprise software companies in the world. Its software is the mission-critical backbone for sales, service, and marketing departments in hundreds of thousands of businesses, from small startups to the largest global corporations.

52-Week Perspective: A Stock in Recovery Mode

The provided 52-week high is $369.00 and the 52-week low is $230.00. This context is absolutely critical. The closing price of $273.65 is much closer to the 52-week low than the high.

-

It is approximately $95 (or 25.8%) below its 52-week high.

-

It is approximately $43 (or 18.7%) above its 52-week low.

This tells us that Salesforce is not a stock currently enjoying breakout momentum. Instead, it is a stock in a prolonged state of recovery and consolidation after a major pullback. This explains the intraday price action: the strong buying interest near the lows reflects a belief that the stock is attractively priced after its correction, while the selling pressure near the session highs reflects the significant “overhead supply” from investors who bought at higher prices and are looking to sell at breakeven.

Valuation Analysis: The Premium for a Market Leader (P/E Ratio)

Salesforce’s P/E ratio is listed at 42.77. This is a premium “growth” valuation, indicating that investors are willing to pay nearly $43 for every $1 of the company’s current annual earnings. While not as stratospheric as some AI-focused names, it is significantly higher than the average P/E of the S&P 500.

This premium is justified in the market’s eyes by several factors:

-

Market Dominance: Salesforce has a commanding share of the Customer Relationship Management (CRM) market, a category it essentially created.

-

Sticky Ecosystem: Its products have extremely high switching costs. Once a company builds its sales and service processes on the Salesforce platform, it is very difficult and expensive to leave.

-

Recurring Revenue Model: The company’s subscription-based model provides a highly predictable and reliable stream of revenue.

-

Future Growth Potential: The market is still pricing in significant future growth, particularly from new initiatives like the Data Cloud and the integration of artificial intelligence across its product suite.

The Dividend: A Sign of a New Era

One of the most important new developments for Salesforce is its dividend. The screenshot shows a Div yield of 0.61%, based on a Qtrly div amt of $0.42 (or $1.68 annually).

For most of its history, Salesforce was a quintessential growth company that reinvested all its profits. The initiation of a dividend in early 2024 marked a historic pivot. It signifies the company’s transition from a “growth-at-all-costs” mindset to a focus on “profitable growth” and a commitment to returning capital to shareholders. This move was spurred in part by pressure from activist investors and reflects a new phase of maturity for the company. While the yield is modest, its very existence changes the investment profile of the stock, making it appealing to a broader set of investors who require capital returns.

Part III: The Salesforce Narrative – Navigating a New Chapter of Profitable Growth

The stock’s performance is deeply intertwined with the evolution of its corporate narrative. Salesforce is currently navigating one of the most significant transformations in its history.

The Pioneer of SaaS: Salesforce, under the visionary leadership of co-founder Marc Benioff, pioneered the Software-as-a-Service (SaaS) business model, fundamentally disrupting the traditional enterprise software industry dominated by the likes of Oracle and SAP. By delivering software over the cloud on a subscription basis, it made powerful CRM tools accessible to all businesses.

The Age of Hyper-Growth and Acquisition: For two decades, the company’s story was defined by relentless top-line growth, often fueled by major acquisitions like MuleSoft, Tableau, and, most controversially, Slack for $27.7 billion. This strategy created a comprehensive “Customer 360” platform but also led to concerns about bloated costs and declining margins.

The Pivot to Profitability: The last two years have been defined by a dramatic shift. Facing a slowing macro environment and pressure from activist investors, Salesforce embarked on a major efficiency drive. This included significant layoffs, a focus on integrating its acquisitions, and a new mantra of profitable growth. The initiation of the dividend and a large stock buyback program are the financial manifestations of this new philosophy. The market is now evaluating whether Salesforce can successfully balance this new discipline with the need to continue innovating and growing.

The AI Opportunity: Data Cloud is Key: Looking forward, Salesforce’s biggest growth opportunity lies in artificial intelligence. The company is positioning its Data Cloud platform as the essential ingredient for enterprises to succeed with AI. The argument is that generative AI models are only as good as the data they are trained on. By unifying all of a company’s customer data within its Data Cloud, Salesforce aims to become the trusted platform for building and deploying enterprise-grade AI applications. The success of this strategy will be critical to re-accelerating growth and justifying its premium valuation.

A Bullish Day in a Broader Recovery Story

The trading session of July 9th for Salesforce was a clear win for the bulls, with the stock posting a strong 1.43% gain and holding onto it into the next day’s pre-market. The explosive morning rally demonstrated a strong underlying bid for the stock, as investors recognize its dominant market position and its successful pivot towards profitability.

However, the fade from the day’s highs is equally telling. It serves as a reminder that the stock is still in a recovery phase, trading significantly below its all-time highs. Investors remain sensitive to valuation, and the path back to its former peaks will likely be a gradual one.

Ultimately, the day’s trading reflects a company at a fascinating inflection point. Salesforce has successfully matured, embracing profitability and shareholder returns. Now, its future trajectory—and the justification for its premium P/E ratio—will depend on its ability to leverage its entrenched customer relationships and its vast data trove to become an indispensable leader in the new era of enterprise AI.

Disclaimer: This article is an analysis of publicly available financial data from a specific point in time and is for informational purposes only. It does not constitute financial or investment advice. All investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.