American Express Stock Plummets Nearly 2% in Sharp Reversal from All-Time Highs, Stoking Fears Over Consumer Health

NEW YORK, NY – July 8 – American Express Company (NYSE: AXP), the financial services giant and a premier bellwether for high-end consumer spending, suffered a jarring and significant setback in Monday’s trading session. Shares of the company were decisively rejected near their all-time highs, tumbling sharply in a move that erased early gains and sent a ripple of concern through a market closely watching for any signs of cracks in the U.S. consumer’s armor.

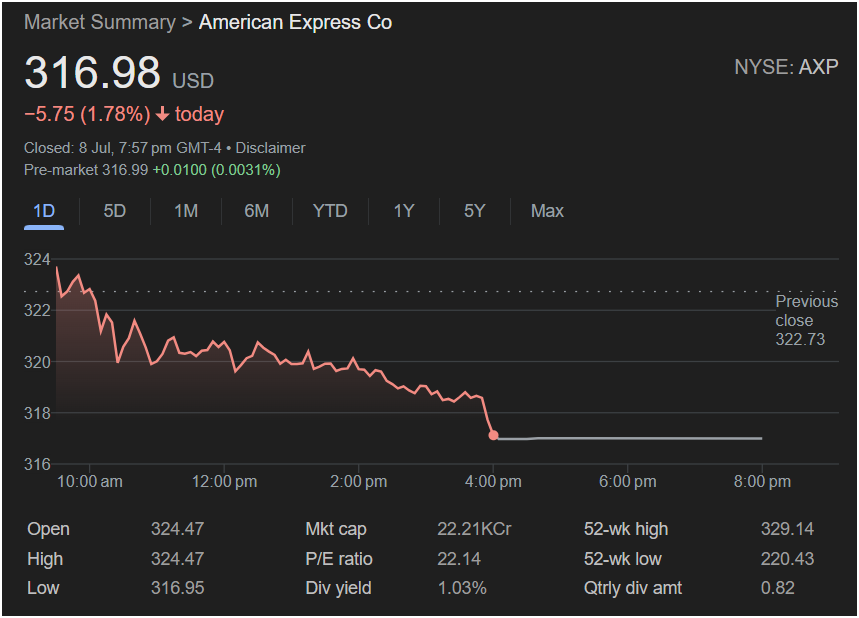

The stock closed the day at a price of

5.75, which translates to a painful 1.78% loss. The sell-off was broad and sustained, marking one of the stock’s worst single-day performances in recent weeks and wiping out billions in shareholder value. The day’s price action represented a stark reversal of sentiment and raised critical questions about the durability of the robust consumer spending that has propelled the stock to record valuations.

In the after-hours and pre-market, the stock showed signs of stabilization, but not recovery. As of 7:57 pm GMT-4, pre-market data indicated a price of

0.01 (0.0031%). This flat trading suggests that while the aggressive selling may have paused, bullish conviction has yet to return, leaving the stock in a precarious position ahead of the next session.

A Bull Trap Springs: Dissecting a Brutal Intraday Reversal

The story of Monday’s trading session for American Express is a textbook example of a “bull trap” and a powerful rejection at a key technical level. The day began not with weakness, but with a surge of optimism.

Building on a previous close of

324.47. This opening price would also serve as the session’s high. This is a profoundly bearish technical signal. The immediate failure to advance past the opening print indicated that sellers were lying in wait, ready to unload their shares into any show of strength.

The intraday chart paints a clear picture of this bearish dominance. From the moment the market opened, the stock began a relentless descent. There were no meaningful bounces or recovery attempts; instead, the chart shows a persistent, grinding sell-off throughout the morning and afternoon. The price methodically broke down through the $324, $322, and $320 levels, with each minor consolidation period resolving to the downside.

The selling pressure culminated in the final hour of trading with another sharp leg down, pushing the stock to its session low of $316.95. The stock ultimately closed just pennies above this low. This pattern, known as “closing on the lows,” is another strong bearish indicator, suggesting that sellers were in complete control until the very end of the session and that the negative momentum could carry over into subsequent days.

What makes this reversal so significant is its context. The stock’s 52-week high is $329.14. The day’s opening price of $324.47 brought it within just 1.5% of that peak. The market’s forceful and immediate rejection of this attempt to challenge the all-time high suggests that investors are growing wary of the stock’s lofty valuation and the economic outlook required to sustain it.

The Canary in the Coal Mine? What Spooked Investors

A 1.78% drop in a blue-chip financial leader like American Express is rarely a random event. It almost always points to deeper-seated fears about the macroeconomic landscape. The sell-off was likely driven by a confluence of factors, all centering on the health of the American consumer.

-

Fears of a High-End Consumer Slowdown: American Express’s business model is uniquely tethered to the spending habits of affluent and super-affluent consumers. While this demographic has been remarkably resilient, there are growing concerns that even these households are beginning to feel the cumulative impact of persistent inflation and a “higher for longer” interest rate environment. Any economic data point—be it a weaker-than-expected retail sales report, a dip in luxury goods sales, or a downward revision in GDP growth—can trigger fears that the spending boom is ending. Monday’s sell-off may reflect a market pre-emptively pricing in a future where travel and entertainment spending, the lifeblood of AXP’s revenue, begins to cool off.

-

Credit Quality Jitters: While AXP is famous for its charge cards, it is also a significant lender through its credit card products. A core concern for any financial institution is the risk of rising loan delinquencies and defaults. Although American Express boasts a best-in-class credit portfolio due to its premium customer base, it is not immune to economic cycles. If the market begins to anticipate a broader economic slowdown or a rise in unemployment, investors will naturally become more risk-averse, selling shares of lenders on the fear of future credit losses.

-

Profit-Taking at a Technical Peak: Psychology plays a massive role in markets. After a spectacular run-up from its 52-week low of $220.43, the stock had gained nearly 50%. As it approached its all-time high, many investors who had enjoyed this rally likely saw it as a natural and prudent time to take profits. The failure to decisively break out to a new high can become a self-fulfilling prophecy, triggering sell orders from technical traders and long-term investors alike.

-

Broader Financial Sector Weakness: The sell-off may have been part of a broader “risk-off” move away from the financial sector. Concerns about net interest margin compression, the potential for increased regulatory scrutiny, or geopolitical uncertainty can cause investors to reduce their exposure to banks and credit card companies, and AXP, as a leader in the space, would be caught in this downdraft.

Beneath the Numbers: A Deep Dive into AXP’s Financials

The screenshot provides several key metrics that offer crucial context to Monday’s price action.

-

Valuation (P/E Ratio of 22.14): American Express has historically commanded a premium valuation relative to traditional banks, and its current P/E of 22.14 reflects this. This premium is justified by its unique “closed-loop” network (where it acts as both the card issuer and the network processor), which provides a wealth of data and allows for higher “discount rates” (the fees charged to merchants). It also reflects its powerful, fee-based revenue streams from high-annual-fee cards. However, this premium valuation also makes the stock more vulnerable. If its growth rate begins to slow, the market may no longer be willing to pay this premium, leading to a “de-rating” of the stock.

-

Market Capitalization: The figure of 22.21KCr (an Indian numbering system notation for 22,210 crore rupees) translates to a market capitalization of approximately $222 billion. This places AXP among the most valuable financial services companies in the world.

-

Dividend Profile (1.03% Yield, $0.82 Quarterly): AXP provides a quarterly dividend of $0.82, resulting in an annual payout of $3.28 per share. At the current price, this gives a dividend yield of 1.03%. This relatively low yield indicates that investors are primarily holding AXP for capital appreciation and growth, not for income. While the dividend provides a small, stable return, it is not substantial enough to provide a strong support floor for the stock during a growth-scare-driven sell-off like Monday’s.

Outlook: A Critical Inflection Point

American Express stock now finds itself at a critical inflection point. The powerful rejection from its all-time high has firmly established a ceiling of resistance, and the market will be watching intently to see what happens next.

The Bear Case: The bears will argue that Monday’s price action was a major warning sign—the “canary in the coal mine” for consumer spending. They believe the stock is priced for a level of economic perfection that is increasingly unlikely. If a recession or even a significant economic slowdown materializes, AXP’s earnings would be hit by both lower spending volumes and higher credit provisions. In this scenario, the stock could see a significant correction as its premium P/E multiple contracts.

The Bull Case: The bulls will contend that this is a healthy, albeit sharp, consolidation after a massive rally. They will argue that AXP’s focus on the most affluent consumers provides a durable moat that can withstand a minor economic wobble. They believe the structural shift in spending towards travel, dining, and experiences—AXP’s core strengths—will continue, driving long-term growth. From this perspective, the dip is a buying opportunity to acquire a best-in-class franchise at a discount before it makes its next assault on all-time highs.

Ultimately, the future direction of American Express stock will be dictated by the incoming economic data. The next Consumer Price Index (CPI) report, jobs report, and, most importantly, AXP’s own quarterly earnings report will be scrutinized with extreme prejudice. Investors will be desperate for clues about spending trends and credit quality. Monday’s brutal session was a stark reminder that in today’s market, even the most powerful brands are at the mercy of macroeconomic sentiment, and for American Express, all eyes are now on the health of its premium consumer.