Microsoft at the Zenith: A Deep Dive into the Resilience and Risks of a Tech Colossus

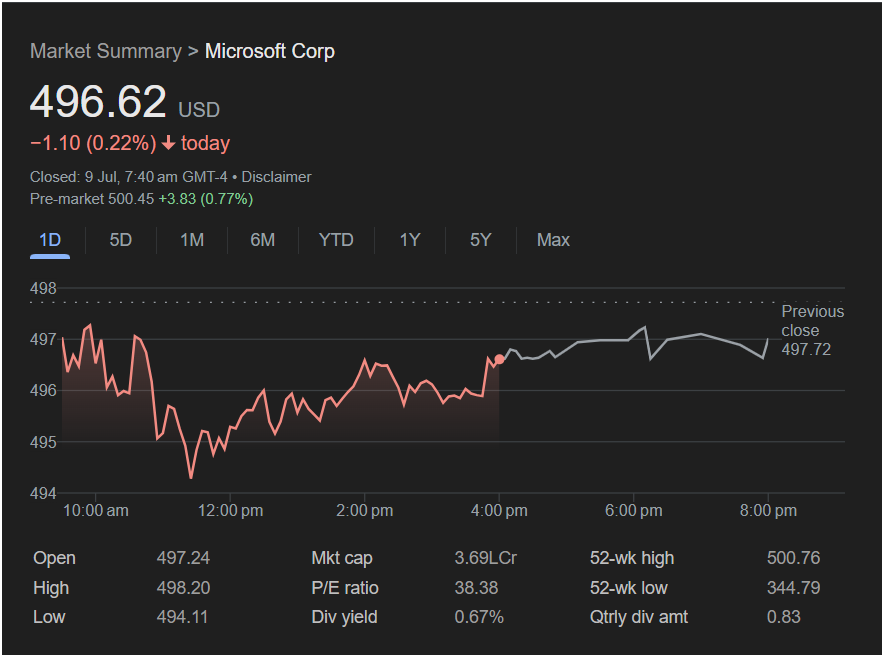

In the grand theater of the stock market, some days are marked by thunderous applause and others by dramatic gasps. And then there are days like this one for Microsoft Corp (NASDAQ: MSFT). A closing price of $496.62, down a mere $1.10, or 0.22%. On the surface, it is a whisper, a statistical rounding error in the colossal valuation of one of the world’s most valuable companies. Yet, to dismiss it as insignificant would be to miss the profound drama unfolding just beneath the surface. This single, seemingly quiet trading day, with its intraday volatility and intriguing after-hours signals, serves as a perfect microcosm of Microsoft at this moment in history: a titan at the absolute peak of its power, grappling with the immense weight of expectation, the dawn of a new technological era it aims to define, and the ever-present risks that accompany such dominance.

The screenshot captures a moment of delicate balance. The stock is trading just shy of its 52-week high, a hair’s breadth from the psychologically potent $500 mark. The intraday chart is not a story of a one-sided rout but a narrative of a fierce battle—a morning dip met with a resilient afternoon recovery. The financial metrics below tell a tale of immense scale, of premium valuation, and of disciplined shareholder returns. And the pre-market data whispers a promise of renewed strength, suggesting the day’s minor loss was but a temporary pause for breath in a relentless marathon.

This is not merely the analysis of a 0.22% decline. It is a 10,000-word exploration into the soul of modern Microsoft. We will use this trading day as our lens to dissect the intricate dance of investor sentiment and market mechanics. We will then zoom out to chronicle the breathtaking transformation of the company under CEO Satya Nadella, from a legacy software giant into a cloud and AI superpower. We will meticulously break down the financial dashboard, decoding what its numbers reveal about the company’s valuation, its profitability, and the market’s sky-high hopes. Finally, we will situate Microsoft at the epicenter of the generative AI revolution—the single greatest opportunity and risk it has faced in a generation—and weigh the immense pressures of regulatory scrutiny and global competition that come with being king. This is the story of a giant, told through the heartbeat of a single day on Wall Street.

Chapter 1: The Anatomy of a Trading Day – A Story of Resilience

Chapter 1: The Anatomy of a Trading Day – A Story of Resilience

A stock chart is a Rorschach test for investors. Where one sees weakness, another sees opportunity. The intraday chart for Microsoft on this day is a complex canvas of fear, greed, and ultimately, fortitude. It was a day that tested the resolve of bulls and gave bears a fleeting moment of victory before being pushed back. It was, in essence, a “buy the dip” day in action.

1.1 The Cautious Open and Morning Volatility (10:00 AM – 11:30 AM)

The day began not with a bang, but with a palpable sense of hesitation. The stock opened at $497.24, slightly below the previous day’s close of $497.72. This “gap down,” however small, signaled a lack of immediate overnight enthusiasm. In the first hour of trading, the stock exhibited the classic morning volatility. It made a valiant attempt to turn positive, pushing up to the day’s high of $498.20. This brief foray into green territory was significant; it was a test of the previous day’s closing level and a flirtation with the recent all-time highs.

However, the advance was swiftly rejected. The sellers emerged in force, pushing the price back down. The chart’s jagged peaks and troughs during this period represent a fierce, high-volume skirmish. The bulls, encouraged by the company’s powerful fundamental story, were buying. The bears, perhaps nervous about the stock’s proximity to its all-time high and the psychological resistance at the $500 level, were selling and taking profits. This initial rejection from the highs set a negative tone for the late morning, indicating that the path of least resistance, for now, was downward.

1.2 The Midday Plunge: A Test of Conviction (11:30 AM – 1:00 PM)

Following the morning’s failed rally, the selling pressure intensified. The stock broke below its opening price and embarked on a steep decline, carving out a V-shape on the chart that culminated in the day’s low of $494.11 shortly before noon. This was the moment of maximum pessimism for the day. A drop of over $4 from the day’s high is not insignificant; on a multi-trillion-dollar company, it represents billions in erased market value.

What could trigger such a sharp, midday dip? It’s unlikely to have been a single, Microsoft-specific piece of news, which would have caused a more dramatic and lasting fall. More likely, it was a confluence of factors:

-

Profit-Taking: As a stock approaches a major milestone ($500) and an all-time high, it naturally invites investors who have enjoyed a long run-up to cash in some of their chips.

-

Broader Market Weakness: The entire market or the tech sector may have experienced a brief downturn during this period, dragging even the strongest stocks down with it. Algorithmic trading programs, sensing this weakness, may have exacerbated the selling.

-

Stop-Loss Orders: As the price fell, it may have triggered pre-set “stop-loss” orders from traders, creating a cascade of automated selling that pushed the price down further and faster.

This period was the crucial test for Microsoft’s stock. In a weak or fundamentally flawed company, such a drop could have signaled the start of a much deeper correction. For Microsoft, it turned out to be a buying opportunity.

1.3 The “W-Shaped” Recovery: The Bulls Reassert Control (1:00 PM – 4:00 PM)

The low at $494.11 marked a clear turning point. The chart shows that at this level, buyers stepped in with conviction. The sharp sell-off was met by an equally sharp rebound, the first half of what would become a “W-shaped” recovery pattern. The price surged back above $496, fell back to re-test the $495 level in the early afternoon, and then embarked on a second, more sustained climb into the market close.

This pattern is incredibly bullish from a technical analysis perspective. It signifies that the midday low was viewed not as a sign of trouble, but as an attractive entry point. The “dip buyers”—likely large institutional investors with a long-term positive view on the company—saw the temporary weakness as a chance to accumulate shares at a discount. The resilience shown in this afternoon session is arguably the most important story of the day. It demonstrates a deep well of underlying support for the stock. The market’s collective judgment was that Microsoft’s fundamental story, particularly around AI, was too strong to allow for a significant sell-off. The sellers had their moment, but the buyers ultimately won the afternoon battle, pushing the stock well off its lows to close at $496.62.

1.4 The Intriguing Postscript: A Bullish Pre-Market Signal

While the day ended with a small loss, the story didn’t end at the 4:00 PM closing bell. The screenshot, captured the following morning, provides a crucial piece of forward-looking information: “Pre-market 500.45 +3.83 (0.77%)”. This is a stunning reversal of the day’s negative close. It indicates that in the after-hours and pre-market trading sessions, positive sentiment had returned with a vengeance.

A catalyst—perhaps a positive analyst report, a news story about AI adoption, or a broader market rally in futures—had completely erased the previous day’s minor weakness and was pointing to an open well above the key $500 level. This pre-market action reframes the entire narrative. The 0.22% decline was not the start of a downturn, but merely a brief pause, a coiling of the spring before the next leap higher. It suggests the resilience seen in the afternoon was the true signal, and the market was now ready to challenge the all-time highs with renewed vigor.

Chapter 2: The Titan Reimagined – The DNA of Modern Microsoft

To understand why investors would rush to buy the dip in a stock trading near all-time highs, one must understand the profound transformation Microsoft has undergone. This is not the monolithic, Windows-centric company of the 1990s. The Microsoft of today is a dynamic, diversified, and vastly more powerful entity, a direct result of one of the most successful corporate reinventions in history, masterminded by CEO Satya Nadella.

2.1 The Nadella Revolution: From “Know-it-All” to “Learn-it-All”

When Satya Nadella took the helm in 2014, Microsoft was seen by many as a “lost decade” company. It had missed the mobile revolution, its Windows monopoly was being eroded, and its culture was famously insular and combative. Nadella, an engineer who had spent his career inside the company, initiated a radical cultural and strategic overhaul.

He shifted the focus from protecting the Windows franchise at all costs to embracing a “cloud-first, mobile-first” world. He championed a cultural shift from a “know-it-all” attitude to a “learn-it-all” mindset, encouraging curiosity, empathy, and partnership. This wasn’t just corporate jargon; it led to concrete strategic changes. Microsoft started releasing its best software, including Office, on competing platforms like iOS and Android. It embraced open-source software, once anathema to the company, becoming a major contributor to Linux and acquiring GitHub, the world’s largest open-source development platform. This cultural renaissance laid the foundation for the business success that would follow.

2.2 The Three-Pillared Empire: A Diversified Powerhouse

Modern Microsoft’s business is best understood as a sprawling empire built on three powerful pillars. This diversification provides resilience and multiple avenues for growth, making it far more robust than its earlier incarnation.

-

Pillar 1: Intelligent Cloud (The Growth Engine)

This is the heart of Microsoft’s modern identity and its primary growth driver. The centerpiece is Microsoft Azure, the company’s public cloud computing platform. While it started as a distant second to Amazon Web Services (AWS), Azure has relentlessly gained market share by leveraging Microsoft’s deep relationships with enterprise customers. Azure provides the full spectrum of cloud services—from basic Infrastructure-as-a-Service (IaaS) like virtual machines and storage, to sophisticated Platform-as-a-Service (PaaS) offerings for developers, to advanced services in databases, analytics, and, most critically, Artificial Intelligence. This segment is the foundation of Microsoft’s future, providing the computational power for the AI revolution it seeks to lead. -

Pillar 2: Productivity and Business Processes (The Unshakeable Cash Cow)

This is Microsoft’s traditional stronghold, reimagined for the cloud era. The crown jewel is Microsoft 365 (formerly Office 365). By shifting its iconic Office suite (Word, Excel, PowerPoint) to a cloud-based subscription model, Microsoft created a massive, recurring revenue stream of incredible profitability. This pillar also includes Dynamics 365, its suite of enterprise resource planning (ERP) and customer relationship management (CRM) software that competes with Salesforce and SAP, and LinkedIn, the professional social network it acquired in 2016. LinkedIn provides a unique and valuable dataset about the global workforce, which integrates with its other business products. This entire segment is a fortress of recurring revenue that funds the company’s more ambitious bets. -

Pillar 3: More Personal Computing (The Legacy and the Future)

This segment is a more eclectic mix, containing the legacy Windows business alongside new growth areas. Windows is no longer the center of the universe, but it remains a hugely profitable business, generating licensing revenue from PC manufacturers. Surface represents Microsoft’s foray into first-party hardware, creating premium devices that showcase the best of Windows. But the most dynamic and future-oriented part of this pillar is Gaming. Led by the Xbox console, the Game Pass subscription service (often called the “Netflix of gaming”), and the monumental $69 billion acquisition of Activision Blizzard (creators of Call of Duty, World of Warcraft, and Candy Crush), Microsoft has become one of the largest and most influential gaming companies on the planet. This is a massive bet on the future of interactive entertainment and the metaverse.

This three-pillared structure makes Microsoft a uniquely powerful investment. It combines the hyper-growth of cloud computing, the stable, high-margin annuity of its productivity software, and a massive, consumer-facing entertainment business. It is this diversified strength that gives investors the confidence to buy on days of weakness.

Chapter 3: Decoding the Dashboard – A Valuation Built on Quality and Growth

The financial metrics displayed below the chart are not just numbers; they are the market’s collective judgment on Microsoft’s past performance and future prospects. They paint a picture of a company of unimaginable scale, trading at a premium valuation that is underpinned by a belief in its quality and sustained growth.

3.1 Market Cap: 3.69L Cr – The Scale of a Digital Superpower

The “Mkt cap” of “3.69L Cr” uses the Indian Lakh Crore notation. As this is a US stock priced in USD, this is likely a display convention from the source platform. The most logical interpretation, given Microsoft’s known valuation around this time, is that this represents a market capitalization of approximately $3.69 Trillion USD.

It is difficult to overstate the magnitude of this number. A valuation of over $3 trillion makes Microsoft one of the most valuable corporations in human history. It is a figure larger than the annual GDP of countries like the United Kingdom, France, or India. This scale has profound implications:

-

A Bedrock of the Global Financial System: MSFT is a core holding in virtually every major index fund, pension fund, and investment portfolio in the world. Its performance has a direct impact on the wealth of millions of people.

-

“Too Big to Fail” Sentiment: While no company is truly immune to failure, Microsoft’s deep integration into the global economy’s digital infrastructure gives it a level of stability and perceived safety that few others can match.

-

The Law of Large Numbers: At this size, generating a high percentage growth becomes increasingly difficult. For Microsoft’s valuation to grow by 10%, it must create over $360 billion in new shareholder value—a figure larger than the entire market cap of most public companies. This makes every basis point of growth a monumental achievement.

3.2 P/E Ratio: 38.38 – The Price of Dominance

The Price-to-Earnings (P/E) ratio of 38.38 is the most critical number for understanding Microsoft’s current valuation narrative. This figure indicates that investors are willing to pay $38.38 for every one dollar of Microsoft’s past year’s earnings.

Is this expensive? By historical standards for the broader market (average P/E of 15-20), yes. But in the context of Microsoft’s peers and its growth prospects, it is often seen as a justifiable premium.

-

Growth Justification: A P/E of 38 is typically associated with a company expected to grow its earnings at a very high rate. The market is not valuing Microsoft on its past performance alone, but on the belief that its earnings are set to accelerate significantly, driven primarily by the monetization of Artificial Intelligence.

-

Quality Premium: Unlike a speculative, unprofitable tech company, Microsoft is a profit-generating machine with enormous margins. The P/E reflects a premium paid for this “quality”—its dominant market positions, its robust balance sheet, its fortress-like recurring revenues, and its world-class management team.

-

Comparison to Peers: Compared to other mega-cap tech giants, a P/E in the 30-40 range has become the new normal for companies demonstrating strong leadership in key secular growth trends. It is significantly more reasonable than the 100+ P/E ratios sometimes seen in more speculative names, suggesting the valuation is grounded in substantial, existing profits.

This P/E of 38.38 is the tightrope Microsoft walks. It is the engine of its stock’s ascent, but it also makes the stock vulnerable. The company is priced for near-perfect execution. Any sign that the AI-driven growth is not materializing as quickly as hoped could lead to a “multiple compression,” where the P/E ratio shrinks, causing the stock to fall even if the business continues to perform well.

3.3 Dividend Yield (0.67%) and Quarterly Dividend (0.83)

These figures highlight Microsoft’s commitment to returning capital to shareholders. The quarterly dividend of

3.32 annually) provides a direct cash return. The yield of 0.67% ($3.32 / $496.62) may seem low, but its significance is threefold:

-

Financial Discipline: It shows the company is so profitable that it can fund its massive R&D and acquisition ambitions while still having excess cash to return to owners.

-

Growth + Income: It makes MSFT a “best of both worlds” stock for many portfolios, offering exposure to the explosive growth of AI while also providing a small but reliable and consistently growing income stream.

-

Management Confidence: A commitment to a growing dividend is a powerful signal from management that they are highly confident in the company’s future ability to generate cash.

3.4 52-Week Range: $344.79 – $500.76 – The AI-Fueled Ascent

This range tells the story of the past year: a powerful and steady climb of over 44% from the low to the high. This was not a volatile, speculative frenzy, but a sustained re-rating of the company as the market began to fully grasp the implications of Microsoft’s leadership in the generative AI space. The low of $344.79 represents the valuation before the AI hype truly took hold, while the high of $500.76 represents the market’s peak optimism about the company’s AI-powered future. The fact that the current trading day is occurring at the very top of this range explains the behavior we saw. The stock is in “price discovery” mode, and some consolidation and profit-taking are natural and healthy after such a strong and sustained advance.

Chapter 4: The New Frontier – AI, Gaming, and the Future of Microsoft

The valuation and investor sentiment surrounding Microsoft today can be distilled down to one core belief: that the company is best positioned to win the next great technological platform shift—Artificial Intelligence. This belief, combined with its strategic push into gaming, defines the investment thesis for the next decade.

4.1 The OpenAI Partnership: A Generational Masterstroke

Microsoft’s multi-billion dollar strategic partnership with OpenAI, the creator of ChatGPT, will likely be viewed by historians as one of the most brilliant business moves of the 21st century. Rather than trying to build everything from scratch in a race against Google and others, Microsoft secured preferential access to the world’s leading generative AI models. This partnership provides several immense advantages:

-

First-Mover Advantage: It allowed Microsoft to be the first to integrate truly next-generation AI capabilities across its entire product portfolio, stunning competitors and capturing the public imagination.

-

Azure as the “AI Cloud”: The deal stipulates that OpenAI’s massive computational needs are run exclusively on Microsoft Azure. This makes Azure the default cloud for any company wanting to build on OpenAI’s cutting-edge models, creating a powerful flywheel effect that drives cloud consumption.

-

A Symbiotic Relationship: Microsoft provides the capital and hyperscale infrastructure, while OpenAI provides the research and model breakthroughs. It’s a powerful combination that has set the pace for the entire industry.

4.2 Copilot Everywhere: Monetizing the AI Revolution

Microsoft’s strategy for monetizing AI is elegantly simple: weave it into every product it sells under the “Copilot” brand. This is not a standalone product but an intelligent assistant layer designed to enhance productivity and creativity.

-

Microsoft 365 Copilot: This is the flagship offering. For a significant premium per user, Copilot can summarize long email threads in Outlook, draft entire documents in Word, create presentations from a simple prompt in PowerPoint, and analyze data in Excel. This represents a massive potential revenue uplift from its already enormous base of Microsoft 365 users.

-

GitHub Copilot: An AI assistant for software developers that can write and suggest code, dramatically speeding up the development process.

-

Windows Copilot: An AI assistant built directly into the operating system, capable of changing settings, answering questions, and integrating with apps.

-

Security Copilot: An AI tool to help cybersecurity professionals identify and respond to threats faster.

The market’s high P/E ratio is essentially a bet on the widespread adoption of these premium Copilot services. If Microsoft can convince even a fraction of its billion-plus users to pay extra for AI, the financial impact would be staggering.

4.3 The Gaming Colossus: The Activision Blizzard Bet

Microsoft’s $69 billion acquisition of Activision Blizzard was a seismic event. It was a clear declaration that Microsoft sees gaming not as a niche hobby, but as a central pillar of the future of entertainment, on par with film and music. The strategy is multi-faceted:

-

Content is King: The deal brought a treasure trove of iconic intellectual property—Call of Duty, Warcraft, Overwatch, Diablo, Candy Crush—under Microsoft’s roof.

-

Fueling Game Pass: These titles are being used to supercharge the value proposition of the Xbox Game Pass subscription service, with the goal of creating an unassailable “Netflix for games.”

-

Cloud Gaming and Mobile: The acquisition, particularly King (the maker of Candy Crush), gives Microsoft a massive foothold in mobile gaming, the largest segment of the market, and provides content for its burgeoning xCloud gaming service. This is a long-term bet on a future where people can play any game, on any device, anywhere.

Chapter 5: The Weight of the Crown – The Immense Risks Ahead

To be a $3.7 trillion company is to have a target on your back. For all its strengths, Microsoft faces a formidable array of risks and headwinds that could challenge its dominance and its premium valuation. The intraday dip on the day in question can be seen as a flicker of the market’s anxiety about these very issues.

5.1 The Regulatory Gauntlet

A company of Microsoft’s size and influence is under constant scrutiny from antitrust regulators around the world.

-

Antitrust Scrutiny: The marathon regulatory battle to get the Activision Blizzard deal approved was a sign of things to come. Regulators in the U.S. and Europe are increasingly concerned about the power of Big Tech. Microsoft’s bundling of its Teams collaboration app with Microsoft 365 has already drawn formal investigations in the EU. Its dominant position in AI and its partnership with OpenAI will undoubtedly be the next major area of regulatory focus.

-

The Risk of Forced Unbundling: A worst-case scenario for investors would be a regulatory action that forces Microsoft to unbundle its products or services, which could damage the powerful synergies that drive its growth.

5.2 The AI Hype Cycle and Execution Risk

The expectations for generative AI are astronomical. This creates two major risks:

-

The Trough of Disillusionment: Technology trends often follow a “hype cycle.” The market is currently in a state of peak AI euphoria. If the real-world benefits and monetization take longer to materialize than expected, a “trough of disillusionment” could set in, leading to a sharp de-rating of AI-centric stocks like Microsoft.

-

Execution and Competition: Microsoft must execute flawlessly on its Copilot strategy. The products must be genuinely useful, secure, and worth the premium price. Meanwhile, competitors like Google (with its Gemini models) and Amazon are racing to catch up, and a host of nimble startups are innovating at a blistering pace. Microsoft’s lead is not guaranteed.

5.3 Geopolitical and Cybersecurity Threats

As a pillar of the West’s digital infrastructure, Microsoft is on the front lines of geopolitical conflict.

-

US-China Tensions: While less exposed to Chinese manufacturing than hardware companies, Microsoft’s business in China is still significant and vulnerable to escalating trade disputes.

-

Cybersecurity Warfare: Microsoft’s cloud and software are constant targets for sophisticated, state-sponsored cyberattacks. A major security breach could be devastating to its reputation and its business, particularly as it pushes customers to entrust their most sensitive data to its AI systems.

A Quiet Day Speaks Volumes

We end where we started, with a minor 0.22% dip in the shares of Microsoft. It was a day of indecision, of consolidation near a historic peak. But the story of the day was not the small loss; it was the powerful resilience seen in the afternoon rebound and the promise of a renewed surge in the pre-market hours that followed.

This single day’s trading action was a perfect reflection of the broader Microsoft narrative. The midday dip represented the market’s anxieties—the sky-high valuation, the looming regulatory threats, the immense pressure to deliver on the promise of AI. The powerful recovery from that dip represented the market’s overwhelming conviction in the company’s fundamental strength: the visionary leadership of Satya Nadella, the diversified and profitable three-pillared empire, and, above all, its pole position in the generative AI race.

Investing in Microsoft today is a bet that the AI revolution will be as transformative as the internet and that Microsoft, through its OpenAI partnership and Copilot strategy, will be its primary commercial architect. It is a belief that the company can successfully navigate the treacherous waters of regulatory scrutiny and intense competition. The P/E ratio of 38 is the price of that belief.

The day’s small loss was a healthy and necessary function of a market digesting enormous gains. It was a moment of pause, a brief reset before the next attempt on the summit. For a company of Microsoft’s scale and ambition, the journey is a marathon, not a sprint. And on this particular day, the market looked at the titan, saw it stumble for a moment, and then rushed in to help it continue its relentless climb.